Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

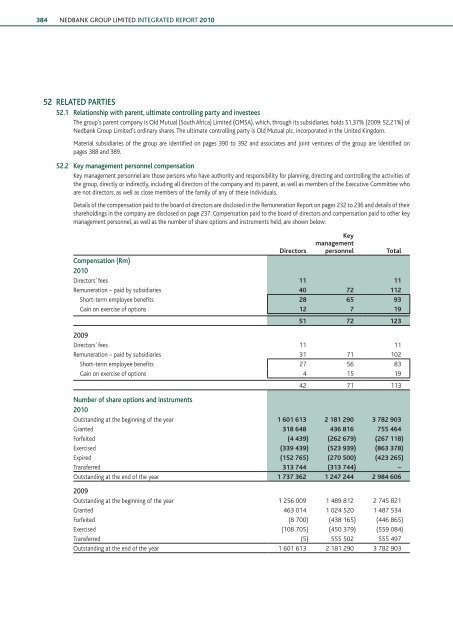

384 NEDBANK GROUP <strong>Limited</strong> INTEGRATED REPORT 201052 RELATED PARTIES52.1 Relationship with parent, ultimate controlling party and investeesThe group’s parent company is Old Mutual (South Africa) <strong>Limited</strong> (OMSA), which, through its subsidiaries, holds 51,37% (2009: 52,21%) of<strong>Nedbank</strong> <strong>Group</strong> <strong>Limited</strong>’s ordinary shares. The ultimate controlling party is Old Mutual plc, incorporated in <strong>the</strong> United Kingdom.Material subsidiaries of <strong>the</strong> group are identified on pages 390 to 392 and associates and joint ventures of <strong>the</strong> group are identified onpages 388 and 389.52.2 Key management personnel compensationKey management personnel are those persons who have authority and responsibility for planning, directing and controlling <strong>the</strong> activities of<strong>the</strong> group, directly or indirectly, including all directors of <strong>the</strong> company and its parent, as well as members of <strong>the</strong> Executive Committee whoare not directors, as well as close members of <strong>the</strong> family of any of <strong>the</strong>se individuals.Details of <strong>the</strong> compensation paid to <strong>the</strong> board of directors are disclosed in <strong>the</strong> Remuneration Report on pages 232 to 236 and details of <strong>the</strong>irshareholdings in <strong>the</strong> company are disclosed on page 237. Compensation paid to <strong>the</strong> board of directors and compensation paid to o<strong>the</strong>r keymanagement personnel, as well as <strong>the</strong> number of share options and instruments held, are shown below:DirectorsKeymanagementpersonnelTotalCompensation (Rm)2010Directors’ fees 11 11Remuneration – paid by subsidiaries 40 72 112Short-term employee benefits 28 65 93Gain on exercise of options 12 7 1951 72 1232009Directors’ fees 11 11Remuneration – paid by subsidiaries 31 71 102Short-term employee benefits 27 56 83Gain on exercise of options 4 15 1942 71 113Number of share options and instruments2010Outstanding at <strong>the</strong> beginning of <strong>the</strong> year 1 601 613 2 181 290 3 782 903Granted 318 648 436 816 755 464Forfeited (4 439) (262 679) (267 118)Exercised (339 439) (523 939) (863 378)Expired (152 765) (270 500) (423 265)Transferred 313 744 (313 744) –Outstanding at <strong>the</strong> end of <strong>the</strong> year 1 737 362 1 247 244 2 984 6062009Outstanding at <strong>the</strong> beginning of <strong>the</strong> year 1 256 009 1 489 812 2 745 821Granted 463 014 1 024 520 1 487 534Forfeited (8 700) (438 165) (446 865)Exercised (108 705) (450 379) (559 084)Transferred (5) 555 502 555 497Outstanding at <strong>the</strong> end of <strong>the</strong> year 1 601 613 2 181 290 3 782 903