Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

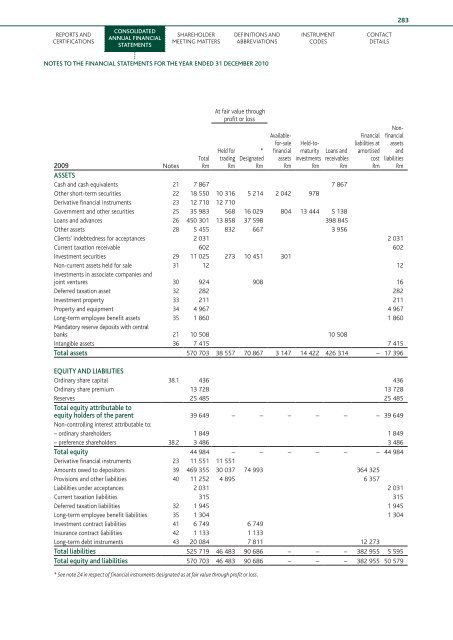

283Reports andcertificationsConsolidatedannual financialstatementsShareholdermeeting mattersDefinitions andabbreviationsInstrumentcodesContactdetailsnotes to <strong>the</strong> financial statements for <strong>the</strong> year ended 31 December 2010TotalRmAt fair value throughprofit or lossHeld fortradingRm*DesignatedRmAvailablefor-salefinancialassetsRmHeld-tomaturityinvestmentsRmLoans andreceivablesRmFinancialliabilities atamortisedcostRmNonfinancialassetsandliabilitiesRm2009 NotesAssetsCash and cash equivalents 21 7 867 7 867O<strong>the</strong>r short-term securities 22 18 550 10 316 5 214 2 042 978Derivative financial instruments 23 12 710 12 710Government and o<strong>the</strong>r securities 25 35 983 568 16 029 804 13 444 5 138Loans and advances 26 450 301 13 858 37 598 398 845O<strong>the</strong>r assets 28 5 455 832 667 3 956Clients’ indebtedness for acceptances 2 031 2 031Current taxation receivable 602 602Investment securities 29 11 025 273 10 451 301Non-current assets held for sale 31 12 12Investments in associate companies andjoint ventures 30 924 908 16Deferred taxation asset 32 282 282Investment property 33 211 211Property and equipment 34 4 967 4 967Long-term employee benefit assets 35 1 860 1 860Mandatory reserve deposits with centralbanks 21 10 508 10 508Intangible assets 36 7 415 7 415Total assets 570 703 38 557 70 867 3 147 14 422 426 314 – 17 396Equity and liabilitiesOrdinary share capital 38.1 436 436Ordinary share premium 13 728 13 728Reserves 25 485 25 485Total equity attributable toequity holders of <strong>the</strong> parent 39 649 – – – – – – 39 649Non-controlling interest attributable to:– ordinary shareholders 1 849 1 849– preference shareholders 38.2 3 486 3 486Total equity 44 984 – – – – – – 44 984Derivative financial instruments 23 11 551 11 551Amounts owed to depositors 39 469 355 30 037 74 993 364 325Provisions and o<strong>the</strong>r liabilities 40 11 252 4 895 6 357Liabilities under acceptances 2 031 2 031Current taxation liabilities 315 315Deferred taxation liabilities 32 1 945 1 945Long-term employee benefit liabilities 35 1 304 1 304Investment contract liabilities 41 6 749 6 749Insurance contract liabilities 42 1 133 1 133Long-term debt instruments 43 20 084 7 811 12 273Total liabilities 525 719 46 483 90 686 – – – 382 955 5 595Total equity and liabilities 570 703 46 483 90 686 – – – 382 955 50 579* See note 24 in respect of financial instruments designated as at fair value through profit or loss.