Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

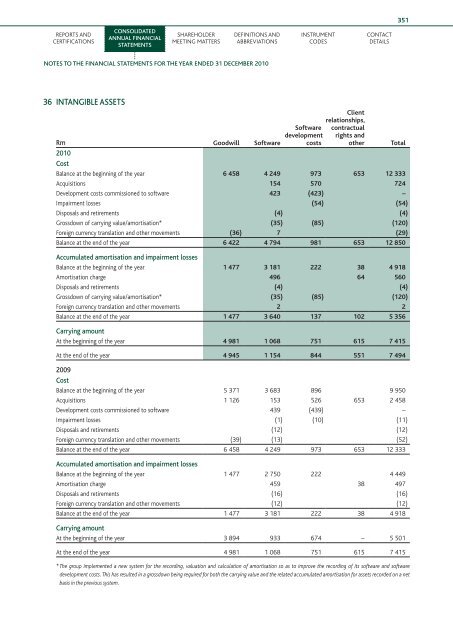

351Reports andcertificationsConsolidatedannual financialstatementsShareholdermeeting mattersDefinitions andabbreviationsInstrumentcodesContactdetailsnotes to <strong>the</strong> financial statements for <strong>the</strong> year ended 31 December 201036 INTANGIBLE ASSETSClientrelationships,Rm Goodwill SoftwareSoftwaredevelopmentcostscontractualrights ando<strong>the</strong>r Total2010CostBalance at <strong>the</strong> beginning of <strong>the</strong> year 6 458 4 249 973 653 12 333Acquisitions 154 570 724Development costs commissioned to software 423 (423) –Impairment losses (54) (54)Disposals and retirements (4) (4)Grossdown of carrying value/amortisation* (35) (85) (120)Foreign currency translation and o<strong>the</strong>r movements (36) 7 (29)Balance at <strong>the</strong> end of <strong>the</strong> year 6 422 4 794 981 653 12 850Accumulated amortisation and impairment lossesBalance at <strong>the</strong> beginning of <strong>the</strong> year 1 477 3 181 222 38 4 918Amortisation charge 496 64 560Disposals and retirements (4) (4)Grossdown of carrying value/amortisation* (35) (85) (120)Foreign currency translation and o<strong>the</strong>r movements 2 2Balance at <strong>the</strong> end of <strong>the</strong> year 1 477 3 640 137 102 5 356Carrying amountAt <strong>the</strong> beginning of <strong>the</strong> year 4 981 1 068 751 615 7 415At <strong>the</strong> end of <strong>the</strong> year 4 945 1 154 844 551 7 4942009CostBalance at <strong>the</strong> beginning of <strong>the</strong> year 5 371 3 683 896 9 950Acquisitions 1 126 153 526 653 2 458Development costs commissioned to software 439 (439) –Impairment losses (1) (10) (11)Disposals and retirements (12) (12)Foreign currency translation and o<strong>the</strong>r movements (39) (13) (52)Balance at <strong>the</strong> end of <strong>the</strong> year 6 458 4 249 973 653 12 333Accumulated amortisation and impairment lossesBalance at <strong>the</strong> beginning of <strong>the</strong> year 1 477 2 750 222 4 449Amortisation charge 459 38 497Disposals and retirements (16) (16)Foreign currency translation and o<strong>the</strong>r movements (12) (12)Balance at <strong>the</strong> end of <strong>the</strong> year 1 477 3 181 222 38 4 918Carrying amountAt <strong>the</strong> beginning of <strong>the</strong> year 3 894 933 674 – 5 501At <strong>the</strong> end of <strong>the</strong> year 4 981 1 068 751 615 7 415* The group implemented a new system for <strong>the</strong> recording, valuation and calculation of amortisation so as to improve <strong>the</strong> recording of its software and softwaredevelopment costs. This has resulted in a grossdown being required for both <strong>the</strong> carrying value and <strong>the</strong> related accumulated amortisation for assets recorded on a netbasis in <strong>the</strong> previous system.