Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

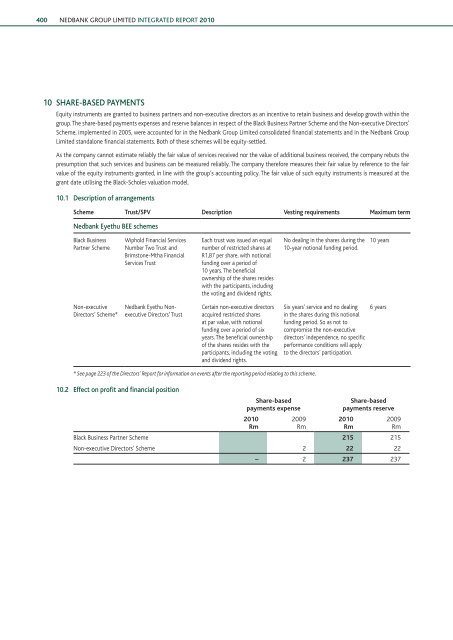

400 NEDBANK GROUP <strong>Limited</strong> INTEGRATED REPORT 201010 SHARE-BASED PAYMENTSEquity instruments are granted to business partners and non-executive directors as an incentive to retain business and develop growth within <strong>the</strong>group. The share-based payments expenses and reserve balances in respect of <strong>the</strong> Black Business Partner Scheme and <strong>the</strong> Non-executive Directors’Scheme, implemented in 2005, were accounted for in <strong>the</strong> <strong>Nedbank</strong> <strong>Group</strong> <strong>Limited</strong> consolidated financial statements and in <strong>the</strong> <strong>Nedbank</strong> <strong>Group</strong><strong>Limited</strong> standalone financial statements. Both of <strong>the</strong>se schemes will be equity-settled.As <strong>the</strong> company cannot estimate reliably <strong>the</strong> fair value of services received nor <strong>the</strong> value of additional business received, <strong>the</strong> company rebuts <strong>the</strong>presumption that such services and business can be measured reliably. The company <strong>the</strong>refore measures <strong>the</strong>ir fair value by reference to <strong>the</strong> fairvalue of <strong>the</strong> equity instruments granted, in line with <strong>the</strong> group’s accounting policy. The fair value of such equity instruments is measured at <strong>the</strong>grant date utilising <strong>the</strong> Black-Scholes valuation model.10.1 Description of arrangementsScheme Trust/SPV Description Vesting requirements Maximum term<strong>Nedbank</strong> Eyethu BEE schemesBlack BusinessPartner SchemeWiphold Financial ServicesNumber Two Trust andBrimstone-Mtha FinancialServices TrustEach trust was issued an equalnumber of restricted shares atR1,87 per share, with notionalfunding over a period of10 years. The beneficialownership of <strong>the</strong> shares resideswith <strong>the</strong> participants, including<strong>the</strong> voting and dividend rights.No dealing in <strong>the</strong> shares during <strong>the</strong>10-year notional funding period.10 yearsNon-executiveDirectors’ Scheme*<strong>Nedbank</strong> Eyethu NonexecutiveDirectors’ TrustCertain non-executive directorsacquired restricted sharesat par value, with notionalfunding over a period of sixyears. The beneficial ownershipof <strong>the</strong> shares resides with <strong>the</strong>participants, including <strong>the</strong> votingand dividend rights.Six years’ service and no dealingin <strong>the</strong> shares during this notionalfunding period. So as not tocompromise <strong>the</strong> non-executivedirectors’ independence, no specificperformance conditions will applyto <strong>the</strong> directors’ participation.6 years* See page 223 of <strong>the</strong> Directors’ Report for information on events after <strong>the</strong> reporting period relating to this scheme.10.2 Effect on profit and financial positionShare-basedpayments expense2010Rm2009RmShare-basedpayments reserveBlack Business Partner Scheme 215 215Non-executive Directors’ Scheme 2 22 22– 2 237 2372010Rm2009Rm