Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

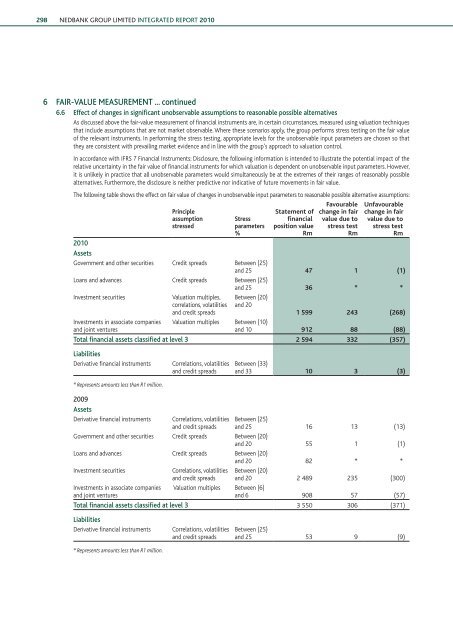

298 NEDBANK GROUP <strong>Limited</strong> INTEGRATED REPORT 20106 FAIR-VALUE MEASUREMENT ... continued6.6 Effect of changes in significant unobservable assumptions to reasonable possible alternativesAs discussed above <strong>the</strong> fair-value measurement of financial instruments are, in certain circumstances, measured using valuation techniquesthat include assumptions that are not market observable. Where <strong>the</strong>se scenarios apply, <strong>the</strong> group performs stress testing on <strong>the</strong> fair valueof <strong>the</strong> relevant instruments. In performing <strong>the</strong> stress testing, appropriate levels for <strong>the</strong> unobservable input parameters are chosen so that<strong>the</strong>y are consistent with prevailing market evidence and in line with <strong>the</strong> group’s approach to valuation control.In accordance with IFRS 7 Financial Instruments: Disclosure, <strong>the</strong> following information is intended to illustrate <strong>the</strong> potential impact of <strong>the</strong>relative uncertainty in <strong>the</strong> fair value of financial instruments for which valuation is dependent on unobservable input parameters. However,it is unlikely in practice that all unobservable parameters would simultaneously be at <strong>the</strong> extremes of <strong>the</strong>ir ranges of reasonably possiblealternatives. Fur<strong>the</strong>rmore, <strong>the</strong> disclosure is nei<strong>the</strong>r predictive nor indicative of future movements in fair value.The following table shows <strong>the</strong> effect on fair value of changes in unobservable input parameters to reasonable possible alternative assumptions:PrincipleassumptionstressedStressparameters%Statement offinancialposition valueRmFavourablechange in fairvalue due tostress testRmUnfavourablechange in fairvalue due tostress testRm2010AssetsGovernment and o<strong>the</strong>r securities Credit spreads Between (25)and 25 47 1 (1)Loans and advances Credit spreads Between (25)and 25 36 * *Investment securitiesValuation multiples,correlations, volatilitiesand credit spreadsBetween (20)and 201 599 243 (268)Investments in associate companies Valuation multiples Between (10)and joint venturesand 10 912 88 (88)Total financial assets classified at level 3 2 594 332 (357)LiabilitiesDerivative financial instruments* Represents amounts less than R1 million.2009AssetsDerivative financial instrumentsCorrelations, volatilitiesand credit spreadsBetween (33)and 33 10 3 (3)Correlations, volatilitiesand credit spreadsGovernment and o<strong>the</strong>r securities Credit spreads Between (20)and 20 55 1 (1)Loans and advances Credit spreads Between (20)and 20 82 * *Between (25)and 25 16 13 (13)Investment securitiesCorrelations, volatilities Between (20)and credit spreads and 20 2 489 235 (300)Investments in associate companies Valuation multiples Between (6)and joint venturesand 6 908 57 (57)Total financial assets classified at level 3 3 550 306 (371)LiabilitiesDerivative financial instruments* Represents amounts less than R1 million.Correlations, volatilitiesand credit spreadsBetween (25)and 25 53 9 (9)