Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

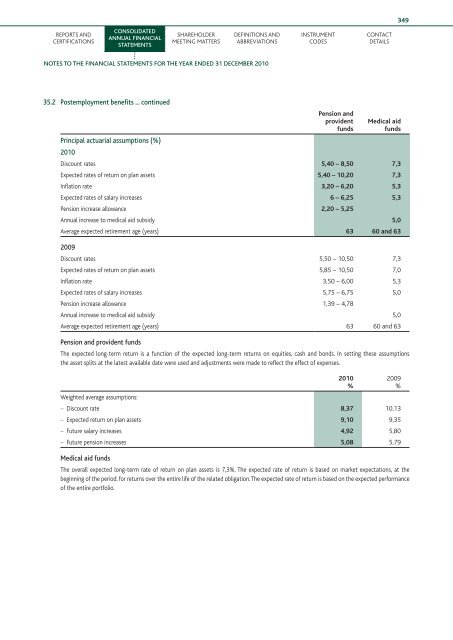

349Reports andcertificationsConsolidatedannual financialstatementsShareholdermeeting mattersDefinitions andabbreviationsInstrumentcodesContactdetailsnotes to <strong>the</strong> financial statements for <strong>the</strong> year ended 31 December 201035.2 Postemployment benefits ... continuedPension andprovidentfundsMedical aidfundsPrincipal actuarial assumptions (%)2010Discount rates 5,40 – 8,50 7,3Expected rates of return on plan assets 5,40 – 10,20 7,3Inflation rate 3,20 – 6,20 5,3Expected rates of salary increases 6 – 6,25 5,3Pension increase allowance 2,20 – 5,25Annual increase to medical aid subsidy 5,0Average expected retirement age (years) 63 60 and 632009Discount rates 5,50 – 10,50 7,3Expected rates of return on plan assets 5,85 – 10,50 7,0Inflation rate 3,50 – 6,00 5,3Expected rates of salary increases 5,75 – 6,75 5,0Pension increase allowance 1,39 – 4,78Annual increase to medical aid subsidy 5,0Average expected retirement age (years) 63 60 and 63Pension and provident fundsThe expected long-term return is a function of <strong>the</strong> expected long-term returns on equities, cash and bonds. In setting <strong>the</strong>se assumptions<strong>the</strong> asset splits at <strong>the</strong> latest available date were used and adjustments were made to reflect <strong>the</strong> effect of expenses.Weighted average assumptions:– Discount rate 8,37 10,13– Expected return on plan assets 9,10 9,35– Future salary increases 4,92 5,80– Future pension increases 5,08 5,79Medical aid fundsThe overall expected long-term rate of return on plan assets is 7,3%. The expected rate of return is based on market expectations, at <strong>the</strong>beginning of <strong>the</strong> period, for returns over <strong>the</strong> entire life of <strong>the</strong> related obligation. The expected rate of return is based on <strong>the</strong> expected performanceof <strong>the</strong> entire portfolio.2010%2009%