Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

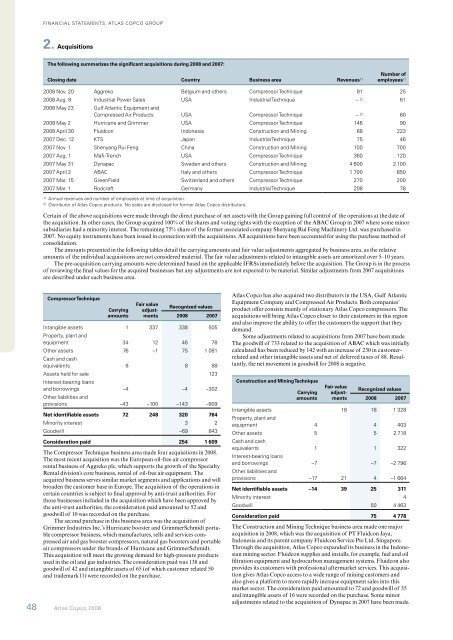

Financial statements, atlas copco group2. AcquisitionsThe following summarizes the significant acquisitions during <strong>2008</strong> and 2007:Closing date Country Business area Revenues 1)Number ofemployees 1)<strong>2008</strong> Nov. 20 Aggreko Belgium and others Compressor Technique 91 25<strong>2008</strong> Aug. 8 Industrial Power Sales USA Industrial Technique – 2) 61<strong>2008</strong> May 23 Gulf Atlantic Equipment andCompressed Air Products USA Compressor Technique – 2) 60<strong>2008</strong> May 2 Hurricane and Grimmer USA Compressor Technique 146 90<strong>2008</strong> April 30 Fluidcon Indonesia Construction and Mining 68 2232007 Dec. 12 KTS Japan Industrial Technique 75 462007 Nov. 1 Shenyang Rui Feng China Construction and Mining 100 7002007 Aug. 1 Mafi-Trench USA Compressor Technique 360 1202007 May 31 Dynapac Sweden and others Construction and Mining 4 600 2 1002007 April 2 ABAC Italy and others Compressor Technique 1 700 6502007 Mar. 15 GreenField Switzerland and others Compressor Technique 270 2002007 Mar. 1 Rodcraft Germany Industrial Technique 208 781) <strong>Annual</strong> revenues and number of employees at time of acquisition.2) Distribu<strong>to</strong>r of <strong>Atlas</strong> <strong>Copco</strong> products. No sales are disclosed for former <strong>Atlas</strong> <strong>Copco</strong> distribu<strong>to</strong>rs.Certain of the above acquisitions were made through the direct purchase of net assets with the Group gaining full control of the operations at the date ofthe acquisition. In other cases, the Group acquired 100% of the shares and voting rights with the exception of the ABAC Group in 2007 where some minorsubsidiaries had a minority interest. The remaining 75% share of the former associated company Shenyang Rui Feng Machinery Ltd. was purchased in2007. No equity instruments have been issued in connection with the acquisitions. All acquisitions have been accounted for using the purchase method ofconsolidation.The amounts presented in the following tables detail the carrying amounts and fair value adjustments aggregated by business area, as the relativeamounts of the individual acquisitions are not considered material. The fair value adjustments related <strong>to</strong> intangible assets are amortized over 5–10 <strong>year</strong>s.The pre-acquisition carrying amounts were determined based on the applicable IFRSs immediately before the acquisition. The Group is in the processof reviewing the final values for the acquired businesses but any adjustments are not expected <strong>to</strong> be material. Similar adjustments from 2007 acquisitionsare described under each business area.Compressor Technique48 <strong>Atlas</strong> <strong>Copco</strong> <strong>2008</strong>CarryingamountsFair valueadjustmentsRecognized values<strong>2008</strong> 2007Intangible assets 1 337 338 505Property, plant andequipment 34 12 46 78Other assets 76 –1 75 1 081Cash and cashequivalents 8 8 88Assets held for sale 123Interest-bearing loansand borrowings –4 –4 –302Other liabilities andprovisions –43 –100 –143 –809Net identifiable assets 72 248 320 764Minority interest 3 2Goodwill –69 843Consideration paid 254 1 609The Compressor Technique business area made four acquisitions in <strong>2008</strong>.The most recent acquisition was the European oil-free air compressorrental business of Aggreko plc, which supports the growth of the SpecialtyRental division’s core business, rental of oil-free air equipment. Theacquired business serves similar market segments and applications and willbroaden the cus<strong>to</strong>mer base in Europe. The acquisition of the operations incertain countries is subject <strong>to</strong> final approval by anti-trust authorities. Forthose businesses included in the acquisition which have been approved bythe anti-trust authorities, the consideration paid amounted <strong>to</strong> 52 andgoodwill of 10 was <strong>record</strong>ed on the purchase.The second purchase in this business area was the acquisition ofGrimmer Industries Inc.’s Hurricane booster and GrimmerSchmidt portablecompressor business, which manufactures, sells and services compressedair and gas booster compressors, natural gas boosters and portableair compressors under the brands of Hurricane and GrimmerSchmidt.This acquisition will meet the growing demand for high-pressure productsused in the oil and gas industries. The consideration paid was 138 andgoodwill of 42 and intangible assets of 65 (of which cus<strong>to</strong>mer related 50and trademark11) were <strong>record</strong>ed on the purchase.<strong>Atlas</strong> <strong>Copco</strong> has also acquired two distribu<strong>to</strong>rs in the USA, Gulf AtlanticEquipment Company and Compressed Air Products. Both companies’product offer consists mainly of stationary <strong>Atlas</strong> <strong>Copco</strong> compressors. Theacquisitions will bring <strong>Atlas</strong> <strong>Copco</strong> closer <strong>to</strong> their cus<strong>to</strong>mers in this regionand also improve the ability <strong>to</strong> offer the cus<strong>to</strong>mers the support that theydemand.Some adjustments related <strong>to</strong> acquisitions from 2007 have been made.The goodwill of 733 related <strong>to</strong> the acquisition of ABAC which was initiallycalculated has been reduced by 142 with an increase of 230 in cus<strong>to</strong>merrelatedand other intangible assets and net of deferred taxes of 88. Resultantly,the net movement in goodwill for <strong>2008</strong> is negative.Construction and Mining TechniqueCarryingamountsFair valueadjustmentsRecognized values<strong>2008</strong> 2007Intangible assets 18 18 1 328Property, plant andequipment 4 4 403Other assets 5 5 2 718Cash and cashequivalents 1 1 322Interest-bearing loansand borrowings –7 –7 –2 796Other liabilities andprovisions –17 21 4 –1 664Net identifiable assets –14 39 25 311Minority interest 4Goodwill 50 4 463Consideration paid 75 4 778The Construction and Mining Technique business area made one majoracquisition in <strong>2008</strong>, which was the acquisition of PT Fluidcon Jaya,Indonesia and its parent company Fluidcon Service Pte Ltd, Singapore.Through the acquisition, <strong>Atlas</strong> <strong>Copco</strong> expanded its business in the Indonesianmining sec<strong>to</strong>r. Fluidcon supplies and installs, for example, fuel and oilfiltration equipment and hydrocarbon management systems. Fluidcon alsoprovides its cus<strong>to</strong>mers with professional aftermarket services. This acquisitiongives <strong>Atlas</strong> <strong>Copco</strong> access <strong>to</strong> a wide range of mining cus<strong>to</strong>mers andalso gives a platform <strong>to</strong> more rapidly increase equipment sales in<strong>to</strong> thismarket sec<strong>to</strong>r. The consideration paid amounted <strong>to</strong> 72 and goodwill of 35and intangible assets of 16 were <strong>record</strong>ed on the purchase. Some minoradjustments related <strong>to</strong> the acquisition of Dynapac in 2007 have been made.