Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

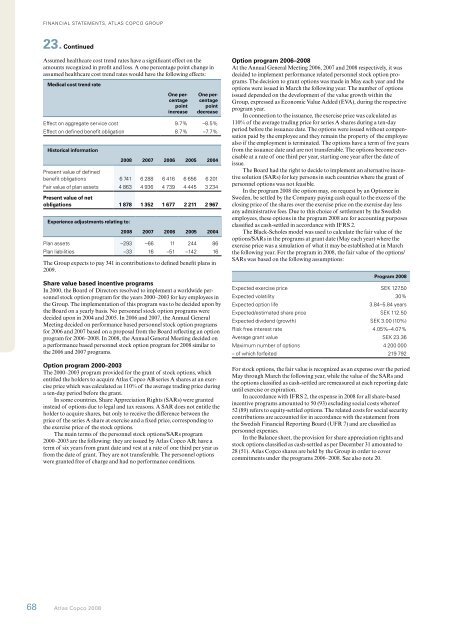

Financial statements, atlas copco group23. ContinuedAssumed healthcare cost trend rates have a significant effect on theamounts recognized in profit and loss. A one percentage point change inassumed healthcare cost trend rates would have the following effects:Medical cost trend rateOne percentagepointincreaseOne percentagepointdecreaseEffect on aggregate service cost 9.7% –8.5%Effect on defined benefit obligation 8.7% –7.7%His<strong>to</strong>rical information<strong>2008</strong> 2007 2006 2005 2004Present value of definedbenefit obligations 6 741 6 288 6 416 6 656 6 201Fair value of plan assets 4 863 4 936 4 739 4 445 3 234Present value of ne<strong>to</strong>bligations 1 878 1 352 1 677 2 211 2 967Experience adjustments relating <strong>to</strong>:<strong>2008</strong> 2007 2006 2005 2004Plan assets –293 –66 11 244 86Plan liabilities –33 16 –51 –142 16The Group expects <strong>to</strong> pay 341 in contributions <strong>to</strong> defined benefit plans in2009.Share value based incentive programsIn 2000, the Board of Direc<strong>to</strong>rs resolved <strong>to</strong> implement a worldwide personnels<strong>to</strong>ck option program for the <strong>year</strong>s 2000–2003 for key employees inthe Group. The implementation of this program was <strong>to</strong> be decided upon bythe Board on a <strong>year</strong>ly basis. No personnel s<strong>to</strong>ck option programs weredecided upon in 2004 and 2005. In 2006 and 2007, the <strong>Annual</strong> GeneralMeeting decided on performance based personnel s<strong>to</strong>ck option programsfor 2006 and 2007 based on a proposal from the Board reflecting an optionprogram for 2006–<strong>2008</strong>. In <strong>2008</strong>, the <strong>Annual</strong> General Meeting decided ona performance based personnel s<strong>to</strong>ck option program for <strong>2008</strong> similar <strong>to</strong>the 2006 and 2007 programs.Option program 2000–2003The 2000–2003 program provided for the grant of s<strong>to</strong>ck options, whichentitled the holders <strong>to</strong> acquire <strong>Atlas</strong> <strong>Copco</strong> AB series A shares at an exerciseprice which was calculated as 110% of the average trading price duringa ten-day period before the grant.In some countries, Share Appreciation Rights (SARs) were grantedinstead of options due <strong>to</strong> legal and tax reasons. A SAR does not entitle theholder <strong>to</strong> acquire shares, but only <strong>to</strong> receive the difference between theprice of the series A share at exercise and a fixed price, corresponding <strong>to</strong>the exercise price of the s<strong>to</strong>ck options.The main terms of the personnel s<strong>to</strong>ck options/SARs program2000–2003 are the following: they are issued by <strong>Atlas</strong> <strong>Copco</strong> AB; have aterm of six <strong>year</strong>s from grant date and vest at a rate of one third per <strong>year</strong> asfrom the date of grant. They are not transferable. The personnel optionswere granted free of charge and had no performance conditions.Option program 2006–<strong>2008</strong>At the <strong>Annual</strong> General Meeting 2006, 2007 and <strong>2008</strong> respectively, it wasdecided <strong>to</strong> implement performance related personnel s<strong>to</strong>ck option programs.The decision <strong>to</strong> grant options was made in May each <strong>year</strong> and theoptions were issued in March the following <strong>year</strong>. The number of optionsissued depended on the development of the value growth within theGroup, expressed as Economic Value Added (EVA), during the respectiveprogram <strong>year</strong>.In connection <strong>to</strong> the issuance, the exercise price was calculated as110% of the average trading price for series A shares during a ten-dayperiod before the issuance date. The options were issued without compensationpaid by the employee and they remain the property of the employeealso if the employment is terminated. The options have a term of five <strong>year</strong>sfrom the issuance date and are not transferable. The options become exercisableat a rate of one third per <strong>year</strong>, starting one <strong>year</strong> after the date ofissue.The Board had the right <strong>to</strong> decide <strong>to</strong> implement an alternative incentivesolution (SARs) for key persons in such countries where the grant ofpersonnel options was not feasible.In the program <strong>2008</strong> the option may, on request by an Optionee inSweden, be settled by the Company paying cash equal <strong>to</strong> the excess of theclosing price of the shares over the exercise price on the exercise day lessany administrative fees. Due <strong>to</strong> this choice of settlement by the Swedishemployees, these options in the program <strong>2008</strong> are for accounting purposesclassified as cash-settled in accordance with IFRS 2.The Black-Scholes model was used <strong>to</strong> calculate the fair value of theoptions/SARs in the programs at grant date (May each <strong>year</strong>) where theexercise price was a simulation of what it may be established at in Marchthe following <strong>year</strong>. For the program in <strong>2008</strong>, the fair value of the options/SARs was based on the following assumptions:Program <strong>2008</strong>Expected exercise price SEK 127.50Expected volatility 30%Expected option life3.84–5.84 <strong>year</strong>sExpected/estimated share price SEK 112.50Expected dividend (growth) SEK 3.00 (10%)Risk free interest rate 4.05%–4.07%Average grant value SEK 23.36Maximum number of options 4 200 000– of which forfeited 219 792For s<strong>to</strong>ck options, the fair value is recognized as an expense over the periodMay through March the following <strong>year</strong>, while the value of the SARs andthe options classified as cash-settled are remeasured at each reporting dateuntil exercise or expiration.In accordance with IFRS 2, the expense in <strong>2008</strong> for all share-basedincentive programs amounted <strong>to</strong> 50 (93) excluding social costs whereof52 (89) refers <strong>to</strong> equity-settled options. The related costs for social securitycontributions are accounted for in accordance with the statement fromthe Swedish Financial <strong>Report</strong>ing Board (UFR 7) and are classified aspersonnel expenses.In the Balance sheet, the provision for share appreciation rights ands<strong>to</strong>ck options classified as cash-settled as per December 31 amounted <strong>to</strong>28 (51). <strong>Atlas</strong> <strong>Copco</strong> shares are held by the Group in order <strong>to</strong> covercommitments under the programs 2006–<strong>2008</strong>. See also note 20.68 <strong>Atlas</strong> <strong>Copco</strong> <strong>2008</strong>