Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

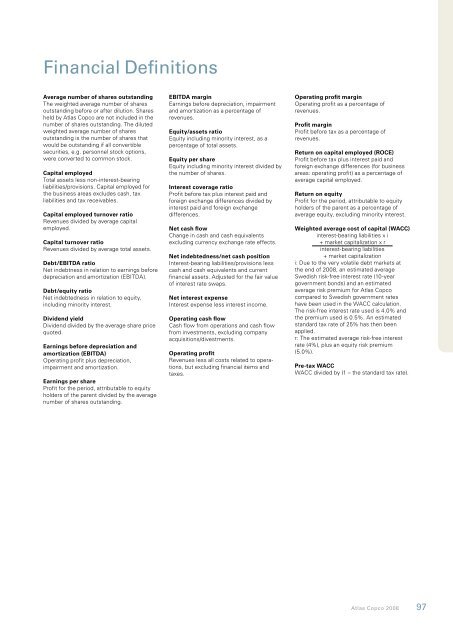

Financial DefinitionsAverage number of shares outstandingThe weighted average number of sharesoutstanding before or after dilution. Sharesheld by <strong>Atlas</strong> <strong>Copco</strong> are not included in thenumber of shares outstanding. The dilutedweighted average number of sharesoutstanding is the number of shares thatwould be outstanding if all convertiblesecurities, e.g. personnel s<strong>to</strong>ck options,were converted <strong>to</strong> common s<strong>to</strong>ck.Capital employedTotal assets less non-interest-bearingliabilities/provisions. Capital employed forthe business areas excludes cash, taxliabilities and tax receivables.Capital employed turnover ratioRevenues divided by average capitalemployed.Capital turnover ratioRevenues divided by average <strong>to</strong>tal assets.Debt/EBITDA ratioNet indebtness in relation <strong>to</strong> earnings beforedepreciation and amortization (EBITDA).Debt/equity ratioNet indebtedness in relation <strong>to</strong> equity,including minority interest.Dividend yieldDividend divided by the average share pricequoted.Earnings before depreciation andamortization (EBITDA)Operating profit plus depreciation,impairment and amortization.Earnings per shareProfit for the period, attributable <strong>to</strong> equityholders of the parent divided by the averagenumber of shares outstanding.EBITDA marginEarnings before depreciation, impairmentand amortization as a percentage ofrevenues.Equity/assets ratioEquity including minority interest, as apercentage of <strong>to</strong>tal assets.Equity per shareEquity including minority interest divided bythe number of shares.Interest coverage ratioProfit before tax plus interest paid andforeign exchange differences divided byinterest paid and foreign exchangedifferences.Net cash flowChange in cash and cash equivalentsexcluding currency exchange rate effects.Net indebtedness/net cash positionInterest-bearing liabilities/provisions lesscash and cash equivalents and currentfinancial assets. Adjusted for the fair valueof interest rate swaps.Net interest expenseInterest expense less interest income.Operating cash flowCash flow from operations and cash flowfrom investments, excluding companyacquisitions/divestments.Operating profitRevenues less all costs related <strong>to</strong> operations,but excluding financial items andtaxes.Operating profit marginOperating profit as a percentage ofrevenues.Profit marginProfit before tax as a percentage ofrevenues.Return on capital employed (ROCE)Profit before tax plus interest paid andforeign exchange differences (for businessareas: operating profit) as a percentage ofaverage capital employed.Return on equityProfit for the period, attributable <strong>to</strong> equityholders of the parent as a percentage ofaverage equity, excluding minority interest.Weighted average cost of capital (WACC)interest-bearing liabilities x i+ market capitalization x rinterest-bearing liabilities+ market capitalizationi: Due <strong>to</strong> the very volatile debt markets atthe end of <strong>2008</strong>, an estimated averageSwedish risk-free interest rate (10-<strong>year</strong>government bonds) and an estimatedaverage risk premium for <strong>Atlas</strong> <strong>Copco</strong>compared <strong>to</strong> Swedish government rateshave been used in the WACC calculation.The risk-free interest rate used is 4.0% andthe premium used is 0.5%. An estimatedstandard tax rate of 25% has then beenapplied.r: The estimated average risk-free interestrate (4%), plus an equity risk premium(5.0%).Pre-tax WACCWACC divided by (1 – the standard tax rate).<strong>Atlas</strong> <strong>Copco</strong> <strong>2008</strong> 97