Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

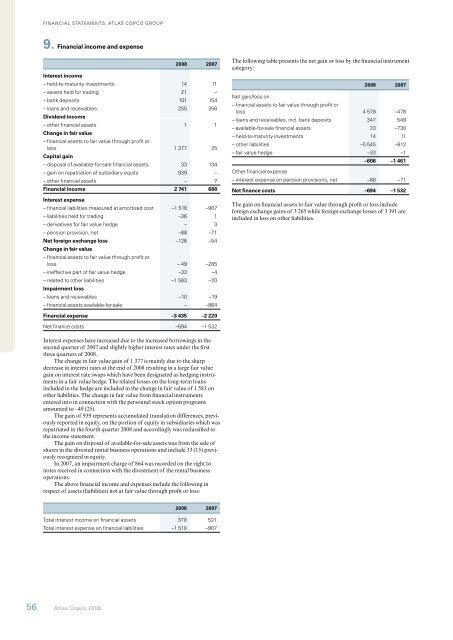

Financial statements, atlas copco group9. Financial income and expense<strong>2008</strong> 2007Interest income– held-<strong>to</strong>-maturity investments 14 11– assets held for trading 21 –– bank deposits 101 154– loans and receivables 255 356Dividend income– other financial assets 1 1Change in fair value– financial assets <strong>to</strong> fair value through profit orloss 1 377 25Capital gain– disposal of available-for-sale financial assets 33 134– gain on repatriation of subsidiary equity 939 –– other financial assets – 7Financial income 2 741 688Interest expense– financial liabilities measured at amortized cost –1 510 –907– liabilities held for trading –36 1– derivatives for fair value hedge – 3– pension provision, net –88 –71Net foreign exchange loss –126 –54Change in fair value– financial assets <strong>to</strong> fair value through profit orloss – 49 –285– ineffective part of fair value hedge –33 –4– related <strong>to</strong> other liabilities –1 583 –20Impairment loss– loans and receivables –10 –19– financial assets available-for-sale – –864The following table presents the net gain or loss by the financial instrumentcategory:<strong>2008</strong> 2007Net gain/loss on– financial assets <strong>to</strong> fair value through profit orloss 4 578 –478– loans and receivables, incl. bank deposits 347 549– available-for-sale financial assets 33 –730– held-<strong>to</strong>-maturity investments 14 11– other liabilities –5 545 –812– fair value hedge –33 –1Other financial expense–606 –1 461– interest expense on pension provisions, net –88 –71Net finance costs –694 –1 532The gain on financial assets <strong>to</strong> fair value through profit or loss includeforeign exchange gains of 3 265 while foreign exchange losses of 3 391 areincluded in loss on other liabilities.Financial expense –3 435 –2 220Net finance costs –694 –1 532Interest expenses have increased due <strong>to</strong> the increased borrowings in thesecond quarter of 2007 and slightly higher interest rates under the firstthree quarters of <strong>2008</strong>.The change in fair value gain of 1 377 is mainly due <strong>to</strong> the sharpdecrease in interest rates at the end of <strong>2008</strong> resulting in a large fair valuegain on interest rate swaps which have been designated as hedging instrumentsin a fair value hedge. The related losses on the long-term loansincluded in the hedge are included in the change in fair value of 1 583 onother liabilities. The change in fair value from financial instrumentsentered in<strong>to</strong> in connection with the personnel s<strong>to</strong>ck option programsamounted <strong>to</strong> –49 (25).The gain of 939 represents accumulated translation differences, previouslyreported in equity, on the portion of equity in subsidiaries which wasrepatriated in the fourth quarter <strong>2008</strong> and accordingly was reclassified <strong>to</strong>the income statement.The gain on disposal of available-for-sale assets was from the sale ofshares in the divested rental business operations and include 33 (15) previouslyrecognized in equity.In 2007, an impairment charge of 864 was <strong>record</strong>ed on the right <strong>to</strong>notes received in connection with the divestment of the rental businessoperations.The above financial income and expenses include the following inrespect of assets (liabilities) not at fair value through profit or loss:<strong>2008</strong> 2007Total interest income on financial assets 370 521Total interest expense on financial liabilities –1 510 –90756 <strong>Atlas</strong> <strong>Copco</strong> <strong>2008</strong>