Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

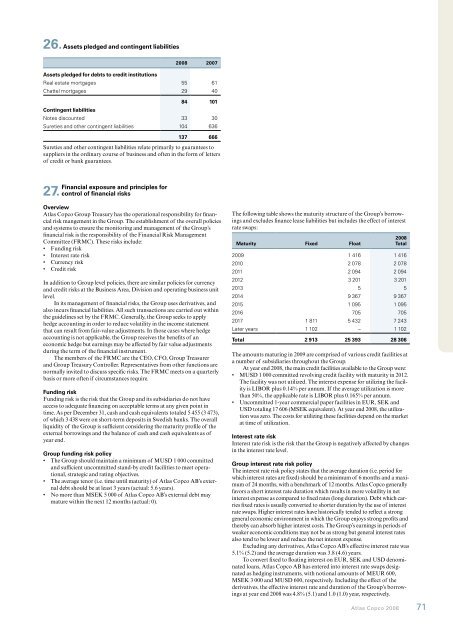

26. Assets pledged and contingent liabilities<strong>2008</strong> 2007Assets pledged for debts <strong>to</strong> credit institutionsReal estate mortgages 55 61Chattel mortgages 29 4084 101Contingent liabilitiesNotes discounted 33 30Sureties and other contingent liabilities 104 636137 666Sureties and other contingent liabilities relate primarily <strong>to</strong> guarantees <strong>to</strong>suppliers in the ordinary course of business and often in the form of lettersof credit or bank guarantees.Financial exposure and principles for27. control of financial risksOverview<strong>Atlas</strong> <strong>Copco</strong> Group Treasury has the operational responsibility for financialrisk mangement in the Group. The establishment of the overall policiesand systems <strong>to</strong> ensure the moni<strong>to</strong>ring and management of the Group’sfinancial risk is the responsibility of the Financial Risk ManagementCommittee (FRMC). These risks include:• Funding risk• Interest rate risk• Currency risk• Credit riskIn addition <strong>to</strong> Group level policies, there are similar policies for currencyand credit risks at the Business Area, Division and operating business unitlevel.In its management of financial risks, the Group uses derivatives, andalso incurs financial liabilities. All such transactions are carried out withinthe guidelines set by the FRMC. Generally, the Group seeks <strong>to</strong> applyhedge accounting in order <strong>to</strong> reduce volatility in the income statementthat can result from fair-value adjustments. In those cases where hedgeaccounting is not applicable, the Group receives the benefits of aneconomic hedge but earnings may be affected by fair value adjustmentsduring the term of the financial instrument.The members of the FRMC are the CEO, CFO, Group Treasurerand Group Treasury Controller. Representatives from other functions arenormally invited <strong>to</strong> discuss specific risks. The FRMC meets on a quarterlybasis or more often if circumstances require.Funding riskFunding risk is the risk that the Group and its subsidiaries do not haveaccess <strong>to</strong> adequate financing on acceptable terms at any given point intime. As per December 31, cash and cash equivalents <strong>to</strong>taled 5 455 (3 473),of which 3 438 were on short-term deposits in Swedish banks. The overallliquidity of the Group is sufficient considering the maturity profile of theexternal borrowings and the balance of cash and cash equivalents as of<strong>year</strong> end.Group funding risk policy• The Group should maintain a minimum of MUSD 1 000 committedand sufficient uncommitted stand-by credit facilities <strong>to</strong> meet operational,strategic and rating objectives.• The average tenor (i.e. time until maturity) of <strong>Atlas</strong> <strong>Copco</strong> AB’s externaldebt should be at least 3 <strong>year</strong>s (actual: 5.6 <strong>year</strong>s).• No more than MSEK 5 000 of <strong>Atlas</strong> <strong>Copco</strong> AB’s external debt maymature within the next 12 months (actual: 0).The following table shows the maturity structure of the Group’s borrowingsand excludes finance lease liabilities but includes the effect of interestrate swaps:Maturity Fixed Float<strong>2008</strong>Total2009 1 416 1 4162010 2 078 2 0782011 2 094 2 0942012 3 201 3 2012013 5 52014 9 367 9 3672015 1 095 1 0952016 705 7052017 1 811 5 432 7 243Later <strong>year</strong>s 1 102 – 1 102Total 2 913 25 393 28 306The amounts maturing in 2009 are comprised of various credit facilities ata number of subsidiaries throughout the Group.At <strong>year</strong> end <strong>2008</strong>, the main credit facilities available <strong>to</strong> the Group were:• MUSD 1 000 committed revolving credit facility with maturity in 2012.The facility was not utilized. The interest expense for utilizing the facilityis LIBOR plus 0.14% per annum. If the average utilization is morethan 50%, the applicable rate is LIBOR plus 0.165% per annum.• Uncommitted 1-<strong>year</strong> commercial paper facilities in EUR, SEK andUSD <strong>to</strong>taling 17 606 (MSEK equivalent). At <strong>year</strong> end <strong>2008</strong>, the utilizationwas zero. The costs for utilizing these facilities depend on the marketat time of utilization.Interest rate riskInterest rate risk is the risk that the Group is negatively affected by changesin the interest rate level.Group interest rate risk policyThe interest rate risk policy states that the average duration (i.e. period forwhich interest rates are fixed) should be a minimum of 6 months and a maximumof 24 months, with a benchmark of 12 months. <strong>Atlas</strong> <strong>Copco</strong> generallyfavors a short interest rate duration which results in more volatility in netinterest expense as compared <strong>to</strong> fixed rates (long duration). Debt which carriesfixed rates is usually converted <strong>to</strong> shorter duration by the use of interestrate swaps. Higher interest rates have his<strong>to</strong>rically tended <strong>to</strong> reflect a stronggeneral economic environment in which the Group enjoys strong profits andthereby can absorb higher interest costs. The Group’s earnings in periods ofweaker economic conditions may not be as strong but general interest ratesalso tend <strong>to</strong> be lower and reduce the net interest expense.Excluding any derivatives, <strong>Atlas</strong> <strong>Copco</strong> AB’s effective interest rate was5.1% (5.2) and the average duration was 3.8 (4.6) <strong>year</strong>s.To convert fixed <strong>to</strong> floating interest on EUR, SEK and USD denominatedloans, <strong>Atlas</strong> <strong>Copco</strong> AB has entered in<strong>to</strong> interest rate swaps designatedas hedging instruments, with notional amounts of MEUR 600,MSEK 3 000 and MUSD 600, respectively. Including the effect of thederivatives, the effective interest rate and duration of the Group’s borrowingsat <strong>year</strong> end <strong>2008</strong> was 4.8% (5.1) and 1.0 (1.0) <strong>year</strong>, respectively.<strong>Atlas</strong> <strong>Copco</strong> <strong>2008</strong> 71