Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

Atlas Copco 2008 â tough ending to a record year Annual Report ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

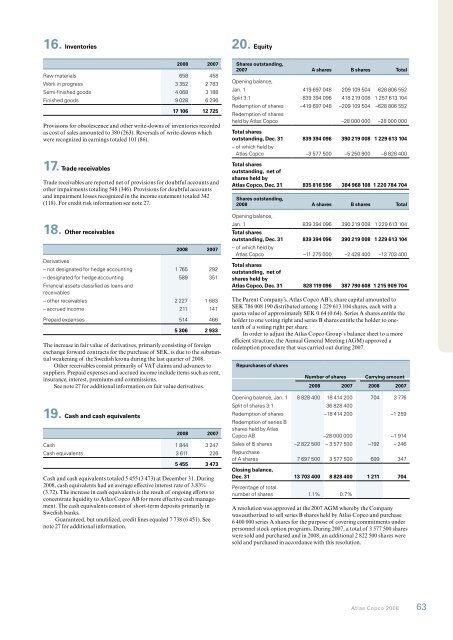

16. Inven<strong>to</strong>ries20. Equity<strong>2008</strong> 2007Raw materials 658 458Work in progress 3 352 2 783Semi-finished goods 4 068 3 188Finished goods 9 028 6 29617 106 12 725Provisions for obsolescence and other write-downs of inven<strong>to</strong>ries <strong>record</strong>edas cost of sales amounted <strong>to</strong> 380 (263). Reversals of write-downs whichwere recognized in earnings <strong>to</strong>taled 101 (86).17. Trade receivablesTrade receivables are reported net of provisions for doubtful accounts andother impairments <strong>to</strong>taling 548 (346). Provisions for doubtful accountsand impairment losses recognized in the income statement <strong>to</strong>taled 342(118). For credit risk information see note 27.18. Other receivables<strong>2008</strong> 2007Derivatives– not designated for hedge accounting 1 765 292– designated for hedge accounting 589 351Financial assets classified as loans andreceivables– other receivables 2 227 1 683– accrued income 211 141Prepaid expenses 514 4665 306 2 933The increase in fair value of derivatives, primarily consisting of foreignexchange forward contracts for the purchase of SEK, is due <strong>to</strong> the substantialweakening of the Swedish krona during the last quarter of <strong>2008</strong>.Other receivables consist primarily of VAT claims and advances <strong>to</strong>suppliers. Prepaid expenses and accrued income include items such as rent,insurance, interest, premiums and commissions.See note 27 for additional information on fair value derivatives.19. Cash and cash equivalents<strong>2008</strong> 2007Cash 1 844 3 247Cash equivalents 3 611 2265 455 3 473Cash and cash equivalents <strong>to</strong>taled 5 455 (3 473) at December 31. During<strong>2008</strong>, cash equivalents had an average effective interest rate of 3.83%(3.72). The increase in cash equivalents is the result of ongoing efforts <strong>to</strong>concentrate liquidity <strong>to</strong> <strong>Atlas</strong> <strong>Copco</strong> AB for more effective cash management.The cash equivalents consist of short-term deposits primarily inSwedish banks.Guaranteed, but unutilized, credit lines equaled 7 738 (6 451). Seenote 27 for additional information.Shares outstanding,2007 A shares B shares TotalOpening balance,Jan. 1 419 697 048 209 109 504 628 806 552Split 3:1 839 394 096 418 219 008 1 257 613 104Redemption of shares –419 697 048 –209 109 504 –628 806 552Redemption of sharesheld by <strong>Atlas</strong> <strong>Copco</strong> –28 000 000 –28 000 000Total sharesoutstanding, Dec. 31 839 394 096 390 219 008 1 229 613 104– of which held by<strong>Atlas</strong> <strong>Copco</strong> –3 577 500 –5 250 900 –8 828 400Total sharesoutstanding, net ofshares held by<strong>Atlas</strong> <strong>Copco</strong>, Dec. 31 835 816 596 384 968 108 1 220 784 704Shares outstanding,<strong>2008</strong> A shares B shares TotalOpening balance,Jan. 1 839 394 096 390 219 008 1 229 613 104Total sharesoutstanding, Dec. 31 839 394 096 390 219 008 1 229 613 104– of which held by<strong>Atlas</strong> <strong>Copco</strong> –11 275 000 –2 428 400 –13 703 400Total sharesoutstanding, net ofshares held by<strong>Atlas</strong> <strong>Copco</strong>, Dec. 31 828 119 096 387 790 608 1 215 909 704The Parent Company’s, <strong>Atlas</strong> <strong>Copco</strong> AB’s, share capital amounted <strong>to</strong>SEK 786 008 190 distributed among 1 229 613 104 shares, each with aquota value of approximately SEK 0.64 (0.64). Series A shares entitle theholder <strong>to</strong> one voting right and series B shares entitle the holder <strong>to</strong> onetenthof a voting right per share.In order <strong>to</strong> adjust the <strong>Atlas</strong> <strong>Copco</strong> Group´s balance sheet <strong>to</strong> a moreefficient structure, the <strong>Annual</strong> General Meeting (AGM) approved aredemption procedure that was carried out during 2007.Repurchases of sharesNumber of sharesCarrying amount<strong>2008</strong> 2007 <strong>2008</strong> 2007Opening balance, Jan. 1 8 828 400 18 414 200 704 3 776Split of shares 3:1 36 828 400Redemption of shares –18 414 200 –1 259Redemption of series Bshares held by <strong>Atlas</strong><strong>Copco</strong> AB –28 000 000 –1 914Sales of B shares –2 822 500 – 3 577 500 –192 – 246Repurchaseof A shares 7 697 500 3 577 500 699 347Closing balance,Dec. 31 13 703 400 8 828 400 1 211 704Percentage of <strong>to</strong>talnumber of shares 1.1% 0.7%A resolution was approved at the 2007 AGM whereby the Companywas authorized <strong>to</strong> sell series B shares held by <strong>Atlas</strong> <strong>Copco</strong> and purchase6 400 000 series A shares for the purpose of covering commitments underpersonnel s<strong>to</strong>ck option programs. During 2007, a <strong>to</strong>tal of 3 577 500 shareswere sold and purchased and in <strong>2008</strong>, an additional 2 822 500 shares weresold and purchased in accordance with this resolution.<strong>Atlas</strong> <strong>Copco</strong> <strong>2008</strong> 63