Annual report 2012 - Comrod

Annual report 2012 - Comrod

Annual report 2012 - Comrod

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

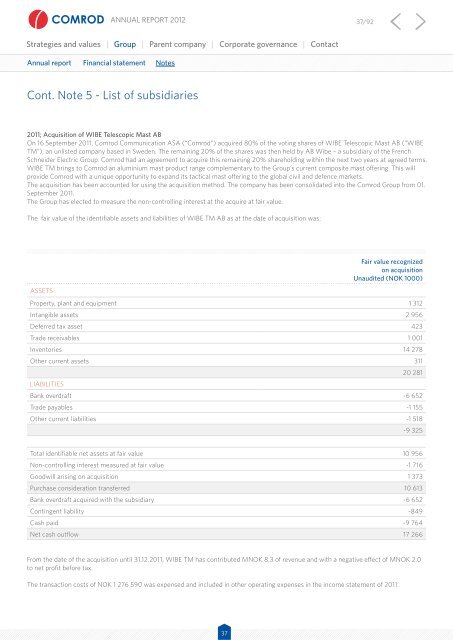

<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 37/92Strategies and values | Group | Parent company | Corporate governance | Contact<strong>Annual</strong> <strong>report</strong> Financial statement NotesCont. Note 5 - List of subsidiaries2011; Acquisition of WIBE Telescopic Mast ABOn 16 September 2011, <strong>Comrod</strong> Communication ASA (“<strong>Comrod</strong>”) acquired 80% of the voting shares of WIBE Telescopic Mast AB (“WIBETM”), an unlisted company based in Sweden. The remaining 20% of the shares was then held by AB Wibe – a subsidiary of the FrenchSchneider Electric Group. <strong>Comrod</strong> had an agreement to acquire this remaining 20% shareholding within the next two years at agreed terms.WIBE TM brings to <strong>Comrod</strong> an aluminium mast product range complementary to the Group’s current composite mast offering. This willprovide <strong>Comrod</strong> with a unique opportunity to expand its tactical mast offering to the global civil and defence markets.The acquisition has been accounted for using the acquisition method. The company has been consolidated into the <strong>Comrod</strong> Group from 01.September 2011.The Group has elected to measure the non-controlling interest at the acquire at fair value.The fair value of the identifiable assets and liabilities of WIBE TM AB as at the date of acquisition was:ASSETSFair value recognizedon acquisitionUnaudited (NOK 1000)Property, plant and equipment 1 312Intangible assets 2 956Deferred tax asset 423Trade receivables 1 001Inventories 14 278Other current assets 31120 281LIABILITIESBank overdraft -6 652Trade payables -1 155Other current liabilities -1 518-9 325Total identifiable net assets at fair value 10 956Non-controlling interest measured at fair value -1 716Goodwill arising on acquisition 1 373Purchase consideration transferred 10 613Bank overdraft acquired with the subsidiary -6 652Contingent liability -849Cash paid -9 764Net cash outflow 17 266From the date of the acquisition until 31.12.2011, WIBE TM has contributed MNOK 8.3 of revenue and with a negative effect of MNOK 2.0to net profit before tax.The transaction costs of NOK 1 276 590 was expensed and included in other operating expenses in the income statement of 2011.37