Annual report 2012 - Comrod

Annual report 2012 - Comrod

Annual report 2012 - Comrod

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

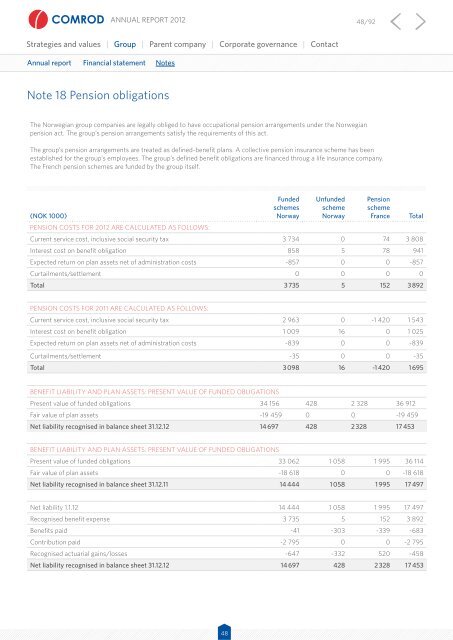

<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 48/92Strategies and values | Group | Parent company | Corporate governance | Contact<strong>Annual</strong> <strong>report</strong> Financial statement Notesnote 18 Pension obligationsThe Norwegian group companies are legally obliged to have occupational pension arrangements under the Norwegianpension act. The group’s pension arrangements satisfy the requirements of this act.The group’s pension arrangements are treated as defined-benefit plans. A collective pension insurance scheme has beenestablished for the group’s employees. The group’s defined benefit obligations are financed throug a life insurance company.The French pension schemes are funded by the group itself.(NOK 1000)Pension costs for <strong>2012</strong> are calculated as follows:FundedschemesNorwayUnfundedschemeNorwayPensionschemeFranceCurrent service cost, inclusive social security tax 3 734 0 74 3 808Interest cost on benefit obligation 858 5 78 941Expected return on plan assets net of administration costs -857 0 0 -857Curtailments/settlement 0 0 0 0Total 3 735 5 152 3 892TotalPension costs for 2011 are calculated as follows:Current service cost, inclusive social security tax 2 963 0 -1 420 1 543Interest cost on benefit obligation 1 009 16 0 1 025Expected return on plan assets net of administration costs -839 0 0 -839Curtailments/settlement -35 0 0 -35Total 3 098 16 -1 420 1 695Benefit liability and plan assets: present value of funded obligationsPresent value of funded obligations 34 156 428 2 328 36 912Fair value of plan assets -19 459 0 0 -19 459Net liability recognised in balance sheet 31.12.12 14 697 428 2 328 17 453Benefit liability and plan assets: present value of funded obligationsPresent value of funded obligations 33 062 1 058 1 995 36 114Fair value of plan assets -18 618 0 0 -18 618Net liability recognised in balance sheet 31.12.11 14 444 1 058 1 995 17 497Net liability 1.1.12 14 444 1 058 1 995 17 497Recognised benefit expense 3 735 5 152 3 892Benefits paid -41 -303 -339 -683Contribution paid -2 795 0 0 -2 795Recognised actuarial gains/losses -647 -332 520 -458Net liability recognised in balance sheet 31.12.12 14 697 428 2 328 17 45348