Annual report 2012 - Comrod

Annual report 2012 - Comrod

Annual report 2012 - Comrod

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

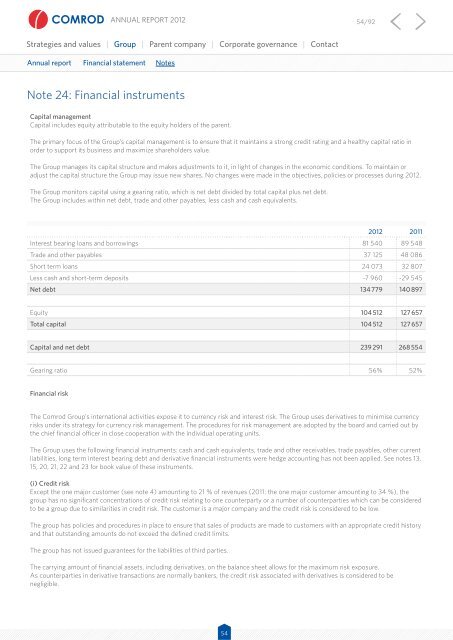

<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 54/92Strategies and values | Group | Parent company | Corporate governance | Contact<strong>Annual</strong> <strong>report</strong> Financial statement NotesNote 24: Financial instrumentsCapital managementCapital includes equity attributable to the equity holders of the parent.The primary focus of the Group’s capital management is to ensure that it maintains a strong credit rating and a healthy capital ratio inorder to support its business and maximize shareholders value.The Group manages its capital structure and makes adjustments to it, in light of changes in the economic conditions. To maintain oradjust the capital structure the Group may issue new shares. No changes were made in the objectives, policies or processes during <strong>2012</strong>.The Group monitors capital using a gearing ratio, which is net debt divided by total capital plus net debt.The Group includes within net debt, trade and other payables, less cash and cash equivalents.<strong>2012</strong> 2011Interest bearing loans and borrowings 81 540 89 548Trade and other payables 37 125 48 086Short term loans 24 073 32 807Less cash and short-term deposits -7 960 -29 545Net debt 134 779 140 897Equity 104 512 127 657Total capital 104 512 127 657Capital and net debt 239 291 268 554Gearing ratio 56% 52%Financial riskThe <strong>Comrod</strong> Group’s international activities expose it to currency risk and interest risk. The Group uses derivatives to minimise currencyrisks under its strategy for currency risk management. The procedures for risk management are adopted by the board and carried out bythe chief financial officer in close cooperation with the individual operating units.The Group uses the following financial instruments: cash and cash equivalents, trade and other receivables, trade payables, other currentliabilities, long term interest bearing debt and derivative financial instruments were hedge accounting has not been applied. See notes 13,15, 20, 21, 22 and 23 for book value of these instruments.(i) Credit riskExcept the one major customer (see note 4) amounting to 21 % of revenues (2011: the one major customer amounting to 34 %), thegroup has no significant concentrations of credit risk relating to one counterparty or a number of counterparties which can be consideredto be a group due to similarities in credit risk. The customer is a major company and the credit risk is considered to be low.The group has policies and procedures in place to ensure that sales of products are made to customers with an appropriate credit historyand that outstanding amounts do not exceed the defined credit limits.The group has not issued guarantees for the liabilities of third parties.The carrying amount of financial assets, including derivatives, on the balance sheet allows for the maximum risk exposure.As counterparties in derivative transactions are normally bankers, the credit risk associated with derivatives is considered to benegligible.54