Annual report 2012 - Comrod

Annual report 2012 - Comrod

Annual report 2012 - Comrod

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

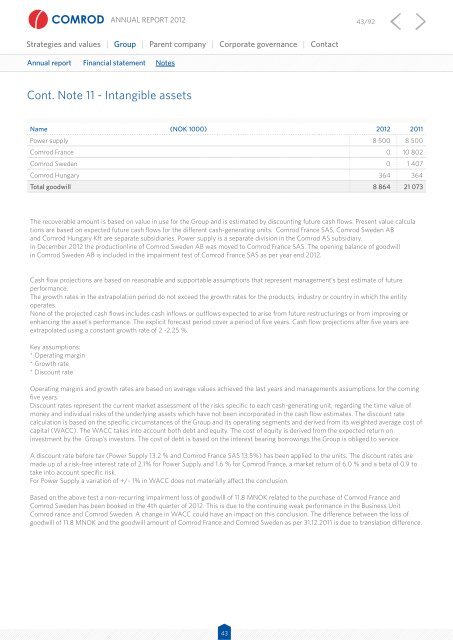

<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 43/92Strategies and values | Group | Parent company | Corporate governance | Contact<strong>Annual</strong> <strong>report</strong> Financial statement NotesCont. Note 11 - Intangible assetsName (NOK 1000) <strong>2012</strong> 2011Power supply 8 500 8 500<strong>Comrod</strong> France 0 10 802<strong>Comrod</strong> Sweden 0 1 407<strong>Comrod</strong> Hungary 364 364Total goodwill 8 864 21 073The recoverable amount is based on value in use for the Group and is estimated by discounting future cash flows. Present value calculations are based on expected future cash flows for the different cash-generating units. <strong>Comrod</strong> France SAS, <strong>Comrod</strong> Sweden ABand <strong>Comrod</strong> Hungary Kft are separate subsidiaries. Power supply is a separate division in the <strong>Comrod</strong> AS subsidiary.In December <strong>2012</strong> the productionline of <strong>Comrod</strong> Sweden AB was moved to <strong>Comrod</strong> France SAS. The opening balance of goodwillin <strong>Comrod</strong> Sweden AB is included in the impairment test of <strong>Comrod</strong> France SAS as per year end <strong>2012</strong>.Cash flow projections are based on reasonable and supportable assumptions that represent management’s best estimate of futureperformance.The growth rates in the extrapolation period do not exceed the growth rates for the products, industry or country in which the entityoperates.None of the projected cash flows includes cash inflows or outflows expected to arise from future restructurings or from improving orenhancing the asset’s performance. The explicit forecast period cover a period of five years. Cash flow projections after five years areextrapolated using a constant growth rate of 2 -2,25 %.Key assumptions:* Operating margin* Growth rate* Discount rateOperating margins and growth rates are based on average values achieved the last years and managements assumptions for the comingfive years.Discount rates represent the current market assessment of the risks specific to each cash-generating unit, regarding the time value ofmoney and individual risks of the underlying assets which have not been incorporated in the cash flow estimates. The discount ratecalculation is based on the specific circumstances of the Group and its operating segments and derived from its weighted average cost ofcapital (WACC). The WACC takes into account both debt and equity. The cost of equity is derived from the expected return oninvestment by the Group’s investors. The cost of debt is based on the interest bearing borrowings the Group is obliged to service.A discount rate before tax (Power Supply 13.2 % and <strong>Comrod</strong> France SAS 13.5%) has been applied to the units. The discount rates aremade up of a risk-free interest rate of 2.1% for Power Supply and 1.6 % for <strong>Comrod</strong> France, a market return of 6.0 % and a beta of 0.9 totake into account specific risk.For Power Supply a variation of +/- 1% in WACC does not materially affect the conclusion.Based on the above test a non-recurring impairment loss of goodwill of 11.8 MNOK related to the purchase of <strong>Comrod</strong> France and<strong>Comrod</strong> Sweden has been booked in the 4th quarter of <strong>2012</strong>. This is due to the continuing weak performance in the Business Unit<strong>Comrod</strong> rance and <strong>Comrod</strong> Sweden. A change in WACC could have an impact on this conclusion. The difference between the loss ofgoodwill of 11.8 MNOK and the goodwill amount of <strong>Comrod</strong> France and <strong>Comrod</strong> Sweden as per 31.12.2011 is due to translation difference.43