<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 72/92Strategies and values | Group | Parent company | Corporate governance | ContactFinancial statement Notes Auditors <strong>report</strong>Note 6 - Share capital and shareholder information(NOK)Share capital consists of: Number of shares Nominal value Carrying amountA shares 21 482 345 1,00 21 482 345The Company’s share capital consists of one class of shares. All shares carry equal rights.On 13 September 2010, the company bought 62 200 of its own shares with a purchase price of 0.8 Mnok. On 27 January 2011,the company bought another 1 250 000 of its own shares with a purchase price of 15.6 Mnok. Both transactions were enteredas a deduction against equity. The shares are held as own shares, and the company is entitled to sell them in the future.On December 21, <strong>2012</strong> a capital increase of 1,935,000 shares was issued by a private placing. Cost of NOK 250.000 related to thecapital increase was deducted from the share premium amount.20 Largest shareholders at 31.12.<strong>2012</strong>Number ofshares Share-holding %HABU HOLDING AS 6 223 120 28,97%BRØDRENE NORDBØ AS 3 477 081 16,19%DNB NOR SMB 1 940 511 9,03%MP PENSJON PK 1 565 309 7,29%COMROD COMMUNICATION ASA 1 312 220 6,11%SPILKA INTERNATIONAL AS 1 214 908 5,66%STATOIL PENSJON 723 870 3,37%TANANGER ENTERPRISE AS 390 300 1,82%DAHLE 371 031 1,73%VPF NORDEA SMB 321 750 1,50%TANANGER HOLDING AS 292 200 1,36%TELENOR PENSJONSKASSE 220 025 1,02%LANDKREDITT NORGE 200 000 0,93%NBI HF ICELAND 190 950 0,89%STATOIL FORSIKRING AS 176 130 0,82%AUSTERHEIM 174 410 0,81%THORKILDSEN ALF C. 173 154 0,81%VPF NORDEA KAPITAL 164 800 0,77%VPF NORDEA AVKASTNING 152 500 0,71%FLYDAL 122 332 0,57%Total 20 largest shareholders 19 406 601 90,34%Other shareholders 2 075 744 9,66%TOTAL 21 482 345 100,00%The total number of shareholders at 31.12.<strong>2012</strong> was 1,030 of whom 25 (2.4%) were foreign shareholders.72

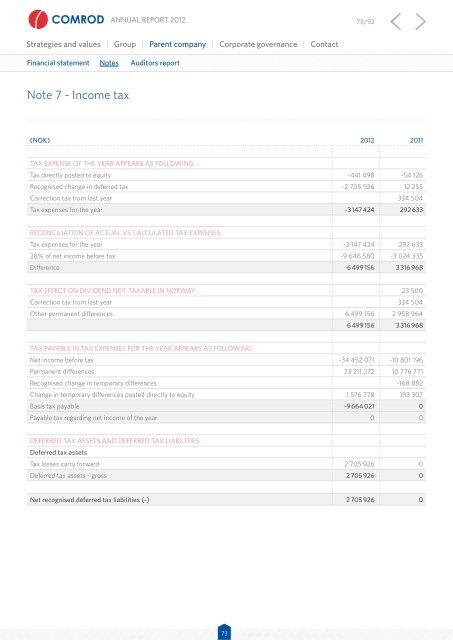

<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 73/92Strategies and values | Group | Parent company | Corporate governance | ContactFinancial statement Notes Auditors <strong>report</strong>note 7 - Income tax(NOK) <strong>2012</strong> 2011Tax expense of the year appears as following:Tax directly posted to equity -441 498 -54 126Recognised change in deferred tax -2 705 926 12 255Correction tax from last year 334 504Tax expenses for the year -3 147 424 292 633Reconciliation of actual vs calculated tax expenses:Tax expenses for the year -3 147 424 292 63328% of net income before tax -9 646 580 -3 024 335Difference 6 499 156 3 316 968Tax effect on dividend not taxable in Norway 23 500Correction tax from last year 334 504Other permanent differences 6 499 156 2 958 9646 499 156 3 316 968Tax payable in tax expenses for the year appears as following:Net income before tax -34 452 071 -10 801 196Permanent differences 23 211 272 10 776 771Recognised change in temporary differences -168 882Change in temporary differences posted directly to equity 1 576 778 193 307Basis tax payable -9 664 021 0Payable tax regarding net income of the year 0 0Deferred tax assets and deferred tax liabilities:Deferred tax assetsTax losses carry forward 2 705 926 0Deferred tax assets - gross 2 705 926 0Net recognised deferred tax liabilities (-) 2 705 926 073