Annual report 2012 - Comrod

Annual report 2012 - Comrod

Annual report 2012 - Comrod

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

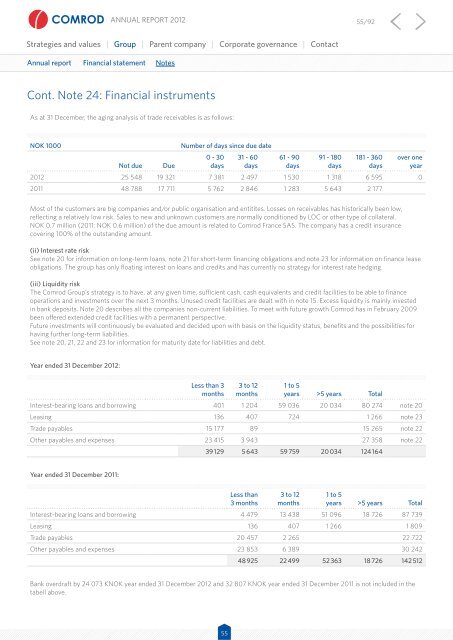

<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 55/92Strategies and values | Group | Parent company | Corporate governance | Contact<strong>Annual</strong> <strong>report</strong> Financial statement NotesCont. Note 24: Financial instrumentsAs at 31 December, the aging analysis of trade receivables is as follows:NOK 1000Not dueDueNumber of days since due date0 - 30days31 - 60days61 - 90days91 - 180days181 - 360daysover oneyear<strong>2012</strong> 25 548 19 321 7 381 2 497 1 530 1 318 6 595 02011 48 788 17 711 5 762 2 846 1 283 5 643 2 177Most of the customers are big companies and/or public organisation and entitites. Losses on receivables has historically been low,reflecting a relatively low risk. Sales to new and unknown customers are normally conditioned by LOC or other type of collateral.NOK 0.7 million (2011: NOK 0.6 million) of the due amount is related to <strong>Comrod</strong> France SAS. The company has a credit insurancecovering 100% of the outstanding amount.(ii) Interest rate riskSee note 20 for information on long-term loans, note 21 for short-term financing obligations and note 23 for information on finance leaseobligations. The group has only floating interest on loans and credits and has currently no strategy for interest rate hedging.(iii) Liquidity riskThe <strong>Comrod</strong> Group’s strategy is to have, at any given time, sufficient cash, cash equivalents and credit facilities to be able to financeoperations and investments over the next 3 months. Unused credit facilities are dealt with in note 15. Excess liquidity is mainly investedin bank deposits. Note 20 describes all the companies non-current liabilities. To meet with future growth <strong>Comrod</strong> has in February 2009been offered extended credit facilities with a permanent perspective.Future investments will continuously be evaluated and decided upon with basis on the liquidity status, benefits and the possibilities forhaving further long-term liabilities.See note 20, 21, 22 and 23 for information for maturity date for liabilities and debt.Year ended 31 December <strong>2012</strong>:Less than 3months3 to 12months1 to 5years >5 years TotalInterest-bearing loans and borrowing 401 1 204 59 036 20 034 80 274 note 20Leasing 136 407 724 1 266 note 23Trade payables 15 177 89 15 265 note 22Other payables and expenses 23 415 3 943 27 358 note 2239 129 5 643 59 759 20 034 124 164Year ended 31 December 2011:Less than3 months3 to 12months1 to 5years >5 years TotalInterest-bearing loans and borrowing 4 479 13 438 51 096 18 726 87 739Leasing 136 407 1 266 1 809Trade payables 20 457 2 265 22 722Other payables and expenses 23 853 6 389 30 24248 925 22 499 52 363 18 726 142 512Bank overdraft by 24 073 KNOK year ended 31 December <strong>2012</strong> and 32 807 KNOK year ended 31 December 2011 is not included in thetabell above.55