Annual report 2012 - Comrod

Annual report 2012 - Comrod

Annual report 2012 - Comrod

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

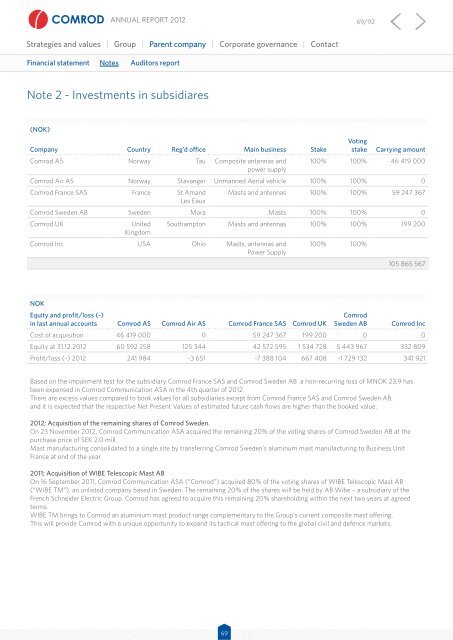

<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 69/92Strategies and values | Group | Parent company | Corporate governance | ContactFinancial statement Notes Auditors <strong>report</strong>Note 2 - Investments in subsidiares(NOK)Company Country Reg’d office Main business Stake<strong>Comrod</strong> AS Norway Tau Composite antennas andpower supplyVotingstakeCarrying amount100% 100% 46 419 000<strong>Comrod</strong> Air AS Norway Stavanger Unmanned Aerial vehicle 100% 100% 0<strong>Comrod</strong> France SAS France St.AmandLes EauxMasts and antennas 100% 100% 59 247 367<strong>Comrod</strong> Sweden AB Sweden Mora Masts 100% 100% 0<strong>Comrod</strong> UKUnitedKingdom<strong>Comrod</strong> Inc USA Ohio Masts, antennas andPower SupplySouthampton Masts and antennas 100% 100% 199 200100% 100%105 865 567NOKEquity and profit/loss (-)in last annual accounts <strong>Comrod</strong> AS <strong>Comrod</strong> Air AS <strong>Comrod</strong> France SAS <strong>Comrod</strong> UK<strong>Comrod</strong>Sweden AB <strong>Comrod</strong> IncCost of acquisition 46 419 000 0 59 247 367 199 200 0 0Equity at 31.12.<strong>2012</strong> 60 592 258 125 344 42 572 595 1 534 728 5 443 967 332 809Profit/loss (-) <strong>2012</strong> 241 984 -3 651 -7 388 104 667 408 -1 729 132 341 921Based on the impairment test for the subsidiary <strong>Comrod</strong> France SAS and <strong>Comrod</strong> Sweden AB a non-recurring loss of MNOK 23,9 hasbeen expensed in <strong>Comrod</strong> Communication ASA in the 4th quarter of <strong>2012</strong>.There are excess values compared to book values for all subsidiaries except from <strong>Comrod</strong> France SAS and <strong>Comrod</strong> Sweden AB,and it is expected that the respective Net Present Values of estimated future cash flows are higher than the booked value.<strong>2012</strong>; Acquisition of the remaining shares of <strong>Comrod</strong> Sweden.On 23 November <strong>2012</strong>, <strong>Comrod</strong> Communication ASA acquired the remaining 20% of the voting shares of <strong>Comrod</strong> Sweden AB at thepurchase price of SEK 2.0 mill.Mast manufacturing consolidated to a single site by transferring <strong>Comrod</strong> Sweden’s aluminum mast manufacturing to Business UnitFrance at end of the year.2011; Acquisition of WIBE Telescopic Mast ABOn 16 September 2011, <strong>Comrod</strong> Communication ASA (“<strong>Comrod</strong>”) acquired 80% of the voting shares of WIBE Telescopic Mast AB(“WIBE TM”), an unlisted company based in Sweden. The remaining 20% of the shares will be held by AB Wibe – a subsidiary of theFrench Schneider Electric Group. <strong>Comrod</strong> has agreed to acquire this remaining 20% shareholding within the next two years at agreedterms.WIBE TM brings to <strong>Comrod</strong> an aluminium mast product range complementary to the Group’s current composite mast offering.This will provide <strong>Comrod</strong> with a unique opportunity to expand its tactical mast offering to the global civil and defence markets.69