Annual report 2012 - Comrod

Annual report 2012 - Comrod

Annual report 2012 - Comrod

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

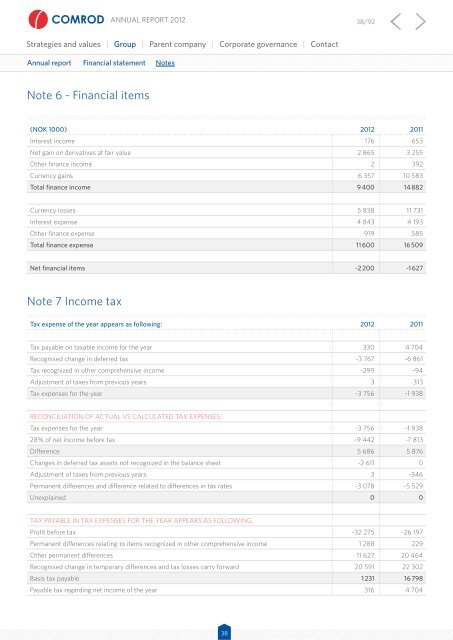

<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 38/92Strategies and values | Group | Parent company | Corporate governance | Contact<strong>Annual</strong> <strong>report</strong> Financial statement NotesNote 6 - Financial items(NOK 1000) <strong>2012</strong> 2011Interest income 176 653Net gain on derivatives at fair value 2 865 3 255Other finance income 2 392Currency gains 6 357 10 583Total finance income 9 400 14 882Currency losses 5 838 11 731Interest expense 4 843 4 193Other finance expense 919 585Total finance expense 11 600 16 509Net financial items -2 200 -1 627note 7 income taxTax expense of the year appears as following: <strong>2012</strong> 2011Tax payable on taxable income for the year 330 4 704Recognised change in deferred tax -3 767 -6 861Tax recognized in other comprehensive income -299 -94Adjustment of taxes from previous years 3 313Tax expenses for the year -3 756 -1 938Reconciliation of actual vs calculated tax expenses:Tax expenses for the year -3 756 -1 93828% of net income before tax -9 442 -7 813Difference 5 686 5 876Changes in deferred tax assets not recognized in the balance sheet -2 611 0Adjustment of taxes from previous years 3 -346Permanent differences and difference related to differences in tax rates -3 078 -5 529Unexplained 0 0Tax payable in tax expenses for the year appears as following:Profit before tax -32 275 -26 197Permanent differences relating to items recognized in other comprehensive income 1 288 229Other permanent differences 11 627 20 464Recognised change in temporary differences and tax losses carry forward 20 591 22 302Basis tax payable 1 231 16 798Payable tax regarding net income of the year 316 4 70438