Annual report 2012 - Comrod

Annual report 2012 - Comrod

Annual report 2012 - Comrod

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

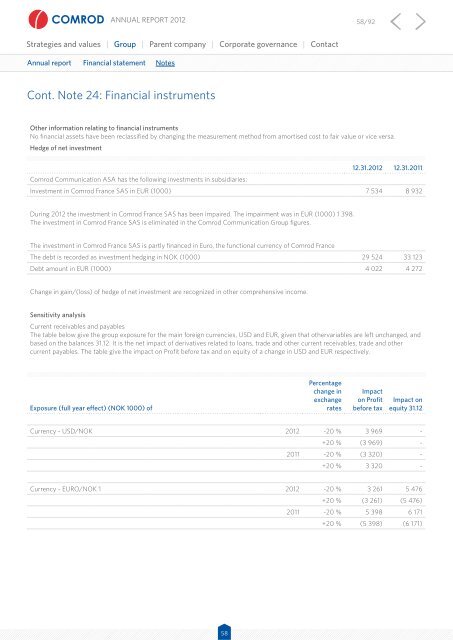

<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 58/92Strategies and values | Group | Parent company | Corporate governance | Contact<strong>Annual</strong> <strong>report</strong> Financial statement NotesCont. Note 24: Financial instrumentsOther information relating to financial instrumentsNo financial assets have been reclassified by changing the measurement method from amortised cost to fair value or vice versa.Hedge of net investment12.31.<strong>2012</strong> 12.31.2011<strong>Comrod</strong> Communication ASA has the following investments in subsidiaries:Investment in <strong>Comrod</strong> France SAS in EUR (1000) 7 534 8 932During <strong>2012</strong> the investment in <strong>Comrod</strong> France SAS has been impaired. The impairment was in EUR (1000) 1 398.The investment in <strong>Comrod</strong> France SAS is eliminated in the <strong>Comrod</strong> Communication Group figures.The investment in <strong>Comrod</strong> France SAS is partly financed in Euro, the functional currency of <strong>Comrod</strong> FranceThe debt is recorded as investment hedging in NOK (1000) 29 524 33 123Debt amount in EUR (1000) 4 022 4 272Change in gain/(loss) of hedge of net investment are recognized in other comprehensive income.Sensitivity analysisCurrent receivables and payablesThe table below give the group exposure for the main foreign currencies, USD and EUR, given that othervariables are left unchanged, andbased on the balances 31.12. It is the net impact of derivatives related to loans, trade and other current receivables, trade and othercurrent payables. The table give the impact on Profit before tax and on equity of a change in USD and EUR respectively.Exposure (full year effect) (NOK 1000) ofPercentagechange inexchangeratesImpacton Profitbefore taxImpact onequity 31.12Currency - USD/NOK <strong>2012</strong> -20 % 3 969 -+20 % (3 969) -2011 -20 % (3 320) -+20 % 3 320 -Currency - EURO/NOK 1 <strong>2012</strong> -20 % 3 261 5 476+20 % (3 261) (5 476)2011 -20 % 5 398 6 171+20 % (5 398) (6 171)58