<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 56/92Strategies and values | Group | Parent company | Corporate governance | Contact<strong>Annual</strong> <strong>report</strong> Financial statement NotesCont. Note 24: Financial instruments(iv) Currency riskAs the group has production and sales in foreign countries, it is exposed to currency risk. The group seeks to mitigate its currency riskfrom cash inflows.The Group’s strategy is to hedge net cash flow in the foreign currency by using forward exchange contracts.The Group does not use hedge accounting for forward exchange contracts.At 31 Dec. <strong>2012</strong>, the group had the following forward contracts to hedge future forecasted sales to customers. Forward contracts areused to reduce currency risk associated with expected future sales. The terms of the contracts are as follows:Forward exchangecontractsAmount(1000)MaturitydateExchangerateFair value31.12.12Forward contracts to hedge sales contracts USD 900 1.15.2013 6,028 396,09Forward contracts to hedge sales contracts USD 900 2.15.2013 5,857 236,23Forward contracts to hedge sales contracts USD 900 3.15.2013 5,863 236,08Forward contracts to hedge sales contracts USD 900 4.15.2013 5,871 237,13Forward contracts to hedge sales contracts USD 900 5.15.2013 6,010 355,40Forward contracts to hedge sales contracts USD 900 6.17.2013 6,073 404,95Forward contracts to hedge sales contracts USD 900 7.15.2013 6,187 500,90Forward contracts to hedge sales contracts USD 900 8.15.2013 6,192 498,7Total 2 865,5The above currency effects relating to the cash flow hedges have been recorded as financial item in the income statement.At 31 Dec. 2011, the group had the following forward contracts to hedge future forecasted sales to customers. Forward contracts are usedto reduce currency risk associated with expected future sales. The terms of the contracts are as follows:Forward exchangecontractsAmount(1000)MaturitydateExchangerateFair value31.12.11Forward contracts to hedge sales contracts USD 900 1.17.<strong>2012</strong> 5,585 (363,1)Forward contracts to hedge sales contracts USD 900 2.16.<strong>2012</strong> 5,600 (354,0)Forward contracts to hedge sales contracts USD 900 3.15.<strong>2012</strong> 5,690 (278,9)Forward contracts to hedge sales contracts USD 900 4.13.<strong>2012</strong> 5,634 (333,2)Forward contracts to hedge sales contracts USD 900 5.18.<strong>2012</strong> 5,567 (397,9)Forward contracts to hedge sales contracts USD 900 6.18.<strong>2012</strong> 5,575 (394,4)Forward contracts to hedge sales contracts USD 900 7.17.<strong>2012</strong> 5,581 (392,7)Forward contracts to hedge sales contracts USD 900 8.16.<strong>2012</strong> 5,744 (252,0)Forward contracts to hedge sales contracts USD 900 9.18.<strong>2012</strong> 5,750 (251,2)Forward contracts to hedge sales contracts USD 900 10.16.<strong>2012</strong> 5,857 (160,4)Forward contracts to hedge sales contracts USD 900 11.16.<strong>2012</strong> 6,000 (38,4)Forward contracts to hedge sales contracts USD 900 12.17.<strong>2012</strong> 6,004 (38,8)Total (3 255,0)The above currency effects relating to the cash flow hedges have been recorded as financial item in the income statement.(v) Measurement of fair valueSet below is a comparison by class of the carrying amounts and fair value of the Group’s financial instruments that are carried in thefinancial statements.56

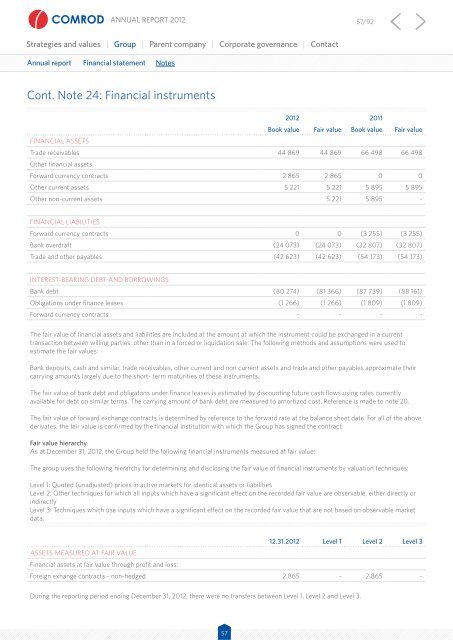

<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 57/92Strategies and values | Group | Parent company | Corporate governance | Contact<strong>Annual</strong> <strong>report</strong> Financial statement NotesCont. Note 24: Financial instruments<strong>2012</strong> 2011Book value Fair value Book value Fair valueFinancial assetsTrade receivables 44 869 44 869 66 498 66 498Other financial assetsForward currency contracts 2 865 2 865 0 0Other current assets 5 221 5 221 5 895 5 895Other non-current assets 5 221 5 895 -Financial liabilitiesForward currency contracts 0 0 (3 255) (3 255)Bank overdraft (24 073) (24 073) (32 807) (32 807)Trade and other payables (42 623) (42 623) (54 173) (54 173)Interest-bearing debt and borrowings:Bank debt (80 274) (81 366) (87 739) (88 161)Obligations under finance leases (1 266) (1 266) (1 809) (1 809)Forward currency contracts - - - -The fair value of financial assets and liabilities are included at the amount at which the instrument could be exchanged in a currenttransaction between willing parties, other than in a forced or liquidation sale. The following methods and assumptions were used toestimate the fair values:Bank deposits, cash and similar, trade receivables, other current and non current assets and trade and other payables approximate theircarrying amounts largely due to the short- term maturities of these instruments.The fair value of bank debt and obligatons under finance leases is estimated by discounting future cash flows using rates currentlyavailable for debt on similar terms. The carrying amount of bank debt are measured to amortized cost. Reference is made to note 20.The fair value of forward exchange contracts is determined by reference to the forward rate at the balance sheet date. For all of the abovederivates, the fair value is confirmed by the financial institution with which the Group has signed the contract.Fair value hierarchyAs at December 31, <strong>2012</strong>, the Group held the following financial instruments measured at fair value:The group uses the following hierarchy for determining and disclosing the fair value of financial instruments by valuation techniques:Level 1: Quoted (unadjusted) prices in active markets for identical assets or liabilitiesLevel 2: Other techniques for which all inputs which have a significant effect on the recorded fair value are observable, either directly orindirectlyLevel 3: Techniques which use inputs which have a significant effect on the recorded fair value that are not based on observable marketdata.12.31.<strong>2012</strong> Level 1 Level 2 Level 3Assets measured at fair valueFinancial assets at fair value through profit and loss:Foreign exhange contracts - non-hedged 2 865 - 2 865 -During the <strong>report</strong>ing period ending December 31, <strong>2012</strong>, there were no transfers between Level 1, Level 2 and Level 3.57