Annual report 2012 - Comrod

Annual report 2012 - Comrod

Annual report 2012 - Comrod

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

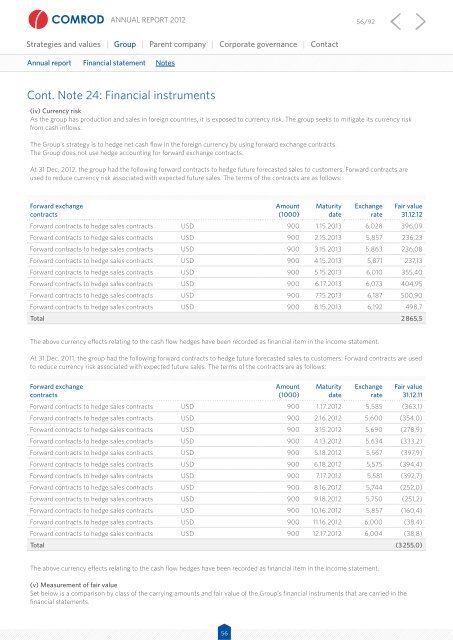

<strong>Annual</strong> <strong>report</strong> <strong>2012</strong> 56/92Strategies and values | Group | Parent company | Corporate governance | Contact<strong>Annual</strong> <strong>report</strong> Financial statement NotesCont. Note 24: Financial instruments(iv) Currency riskAs the group has production and sales in foreign countries, it is exposed to currency risk. The group seeks to mitigate its currency riskfrom cash inflows.The Group’s strategy is to hedge net cash flow in the foreign currency by using forward exchange contracts.The Group does not use hedge accounting for forward exchange contracts.At 31 Dec. <strong>2012</strong>, the group had the following forward contracts to hedge future forecasted sales to customers. Forward contracts areused to reduce currency risk associated with expected future sales. The terms of the contracts are as follows:Forward exchangecontractsAmount(1000)MaturitydateExchangerateFair value31.12.12Forward contracts to hedge sales contracts USD 900 1.15.2013 6,028 396,09Forward contracts to hedge sales contracts USD 900 2.15.2013 5,857 236,23Forward contracts to hedge sales contracts USD 900 3.15.2013 5,863 236,08Forward contracts to hedge sales contracts USD 900 4.15.2013 5,871 237,13Forward contracts to hedge sales contracts USD 900 5.15.2013 6,010 355,40Forward contracts to hedge sales contracts USD 900 6.17.2013 6,073 404,95Forward contracts to hedge sales contracts USD 900 7.15.2013 6,187 500,90Forward contracts to hedge sales contracts USD 900 8.15.2013 6,192 498,7Total 2 865,5The above currency effects relating to the cash flow hedges have been recorded as financial item in the income statement.At 31 Dec. 2011, the group had the following forward contracts to hedge future forecasted sales to customers. Forward contracts are usedto reduce currency risk associated with expected future sales. The terms of the contracts are as follows:Forward exchangecontractsAmount(1000)MaturitydateExchangerateFair value31.12.11Forward contracts to hedge sales contracts USD 900 1.17.<strong>2012</strong> 5,585 (363,1)Forward contracts to hedge sales contracts USD 900 2.16.<strong>2012</strong> 5,600 (354,0)Forward contracts to hedge sales contracts USD 900 3.15.<strong>2012</strong> 5,690 (278,9)Forward contracts to hedge sales contracts USD 900 4.13.<strong>2012</strong> 5,634 (333,2)Forward contracts to hedge sales contracts USD 900 5.18.<strong>2012</strong> 5,567 (397,9)Forward contracts to hedge sales contracts USD 900 6.18.<strong>2012</strong> 5,575 (394,4)Forward contracts to hedge sales contracts USD 900 7.17.<strong>2012</strong> 5,581 (392,7)Forward contracts to hedge sales contracts USD 900 8.16.<strong>2012</strong> 5,744 (252,0)Forward contracts to hedge sales contracts USD 900 9.18.<strong>2012</strong> 5,750 (251,2)Forward contracts to hedge sales contracts USD 900 10.16.<strong>2012</strong> 5,857 (160,4)Forward contracts to hedge sales contracts USD 900 11.16.<strong>2012</strong> 6,000 (38,4)Forward contracts to hedge sales contracts USD 900 12.17.<strong>2012</strong> 6,004 (38,8)Total (3 255,0)The above currency effects relating to the cash flow hedges have been recorded as financial item in the income statement.(v) Measurement of fair valueSet below is a comparison by class of the carrying amounts and fair value of the Group’s financial instruments that are carried in thefinancial statements.56