Contents

Registration document PDF - Sequana

Registration document PDF - Sequana

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

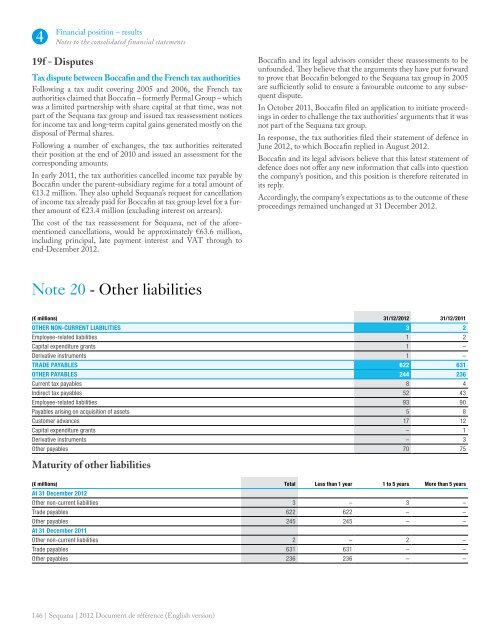

4Financial position – resultsNotes to the consolidated financial statements19f - DisputesTax dispute between Boccafin and the French tax authoritiesFollowing a tax audit covering 2005 and 2006, the French taxauthorities claimed that Boccafin – formerly Permal Group – whichwas a limited partnership with share capital at that time, was notpart of the Sequana tax group and issued tax reassessment noticesfor income tax and long-term capital gains generated mostly on thedisposal of Permal shares.Following a number of exchanges, the tax authorities reiteratedtheir position at the end of 2010 and issued an assessment for thecorresponding amounts.In early 2011, the tax authorities cancelled income tax payable byBoccafin under the parent-subsidiary regime for a total amount of€13.2 million. They also upheld Sequana’s request for cancellationof income tax already paid for Boccafin at tax group level for a furtheramount of €23.4 million (excluding interest on arrears).The cost of the tax reassessment for Sequana, net of the aforementionedcancellations, would be approximately €63.6 million,including principal, late payment interest and VAT through toend-December 2012.Boccafin and its legal advisors consider these reassessments to beunfounded. They believe that the arguments they have put forwardto prove that Boccafin belonged to the Sequana tax group in 2005are sufficiently solid to ensure a favourable outcome to any subsequentdispute.In October 2011, Boccafin filed an application to initiate proceedingsin order to challenge the tax authorities’ arguments that it wasnot part of the Sequana tax group.In response, the tax authorities filed their statement of defence inJune 2012, to which Boccafin replied in August 2012.Boccafin and its legal advisors believe that this latest statement ofdefence does not offer any new information that calls into questionthe company’s position, and this position is therefore reiterated inits reply.Accordingly, the company’s expectations as to the outcome of theseproceedings remained unchanged at 31 December 2012.Note 20 - Other liabilities(€ millions) 31/12/2012 31/12/2011OTHER NON-CURRENT LIABILITIES 3 2Employee-related liabilities 1 2Capital expenditure grants 1 –Derivative instruments 1 –TRADE PAYABLES 622 631OTHER PAYABLES 244 236Current tax payables 8 4Indirect tax payables 52 43Employee-related liabilities 93 90Payables arising on acquisition of assets 5 8Customer advances 17 12Capital expenditure grants – 1Derivative instruments – 3Other payables 70 75Maturity of other liabilities(€ millions) Total Less than 1 year 1 to 5 years More than 5 yearsAt 31 December 2012Other non-current liabilities 3 – 3 –Trade payables 622 622 – –Other payables 245 245 – –At 31 December 2011Other non-current liabilities 2 – 2 –Trade payables 631 631 – –Other payables 236 236 – –146 | Sequana | 2012 Document de référence (English version)