Contents

Registration document PDF - Sequana

Registration document PDF - Sequana

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

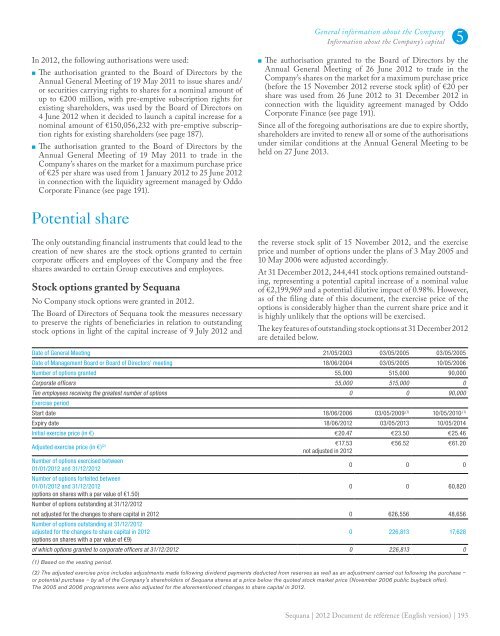

General information about the CompanyInformation about the Company’s capital 5In 2012, the following authorisations were used:■■The authorisation granted to the Board of Directors by theAnnual General Meeting of 19 May 2011 to issue shares and/or securities carrying rights to shares for a nominal amount ofup to €200 million, with pre-emptive subscription rights forexisting shareholders, was used by the Board of Directors on4 June 2012 when it decided to launch a capital increase for anominal amount of €150,056,232 with pre-emptive subscriptionrights for existing shareholders (see page 187).■■The authorisation granted to the Board of Directors by theAnnual General Meeting of 19 May 2011 to trade in theCompany’s shares on the market for a maximum purchase priceof €25 per share was used from 1 January 2012 to 25 June 2012in connection with the liquidity agreement managed by OddoCorporate Finance (see page 191).■■The authorisation granted to the Board of Directors by theAnnual General Meeting of 26 June 2012 to trade in theCompany’s shares on the market for a maximum purchase price(before the 15 November 2012 reverse stock split) of €20 pershare was used from 26 June 2012 to 31 December 2012 inconnection with the liquidity agreement managed by OddoCorporate Finance (see page 191).Since all of the foregoing authorisations are due to expire shortly,shareholders are invited to renew all or some of the authorisationsunder similar conditions at the Annual General Meeting to beheld on 27 June 2013.Potential shareThe only outstanding financial instruments that could lead to thecreation of new shares are the stock options granted to certaincorporate officers and employees of the Company and the freeshares awarded to certain Group executives and employees.Stock options granted by SequanaNo Company stock options were granted in 2012.The Board of Directors of Sequana took the measures necessaryto preserve the rights of beneficiaries in relation to outstandingstock options in light of the capital increase of 9 July 2012 andthe reverse stock split of 15 November 2012, and the exerciseprice and number of options under the plans of 3 May 2005 and10 May 2006 were adjusted accordingly.At 31 December 2012, 244,441 stock options remained outstanding,representing a potential capital increase of a nominal valueof €2,199,969 and a potential dilutive impact of 0.98%. However,as of the filing date of this document, the exercise price of theoptions is considerably higher than the current share price and itis highly unlikely that the options will be exercised.The key features of outstanding stock options at 31 December 2012are detailed below.Date of General Meeting 21/05/2003 03/05/2005 03/05/2005Date of Management Board or Board of Directors’ meeting 18/06/2004 03/05/2005 10/05/2006Number of options granted 55,000 515,000 90,000Corporate officers 55,000 515,000 0Ten employees receiving the greatest number of options 0 0 90,000Exercise periodStart date 18/06/2006 03/05/2009 ,(1) 10/05/2010 ,(1)Expiry date 18/06/2012 03/05/2013 10/05/2014Initial exercise price (in €) v20.47 v23.50 v25.46Adjusted exercise price (in €) (2) v17.53not adjusted in 2012Number of options exercised between01/01/2012 and 31/12/2012Number of options forfeited between01/01/2012 and 31/12/2012(options on shares with a par value of €1.50)Number of options outstanding at 31/12/2012v56.52 v61.200 0 00 0 60,820not adjusted for the changes to share capital in 2012 0 626,556 48,656Number of options outstanding at 31/12/2012adjusted for the changes to share capital in 2012(options on shares with a par value of €9)0 226,813 17,628of which options granted to corporate officers at 31/12/2012 0 226,813 0(1) Based on the vesting period.(2) The adjusted exercise price includes adjustments made following dividend payments deducted from reserves as well as an adjustment carried out following the purchase –or potential purchase – by all of the Company’s shareholders of Sequana shares at a price below the quoted stock market price (November 2006 public buyback offer).The 2005 and 2006 programmes were also adjusted for the aforementioned changes to share capital in 2012.Sequana | 2012 Document de référence (English version) | 193