Contents

Registration document PDF - Sequana

Registration document PDF - Sequana

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

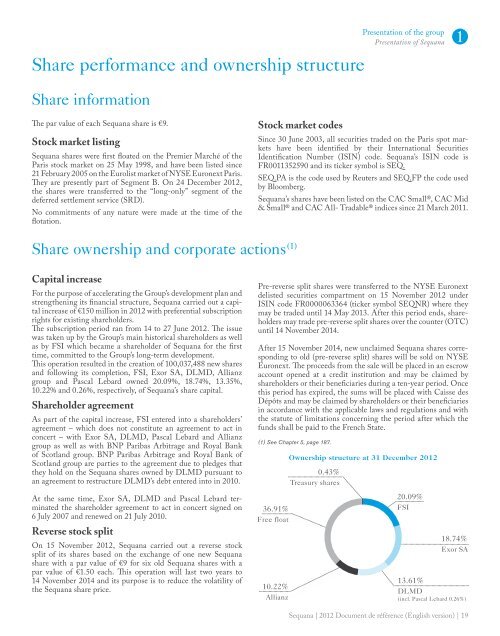

Share performance and ownership structurePresentation of the groupPresentation of Sequana 1Share informationThe par value of each Sequana share is €9.Stock market listingSequana shares were first floated on the Premier Marché of theParis stock market on 25 May 1998, and have been listed since21 February 2005 on the Eurolist market of NYSE Euronext Paris.They are presently part of Segment B. On 24 December 2012,the shares were transferred to the “long-only” segment of thedeferred settlement service (SRD).No commitments of any nature were made at the time of theflotation.Stock market codesSince 30 June 2003, all securities traded on the Paris spot marketshave been identified by their International SecuritiesIdentification Number (ISIN) code. Sequana’s ISIN code isFR0011352590 and its ticker symbol is SEQ.SEQ.PA is the code used by Reuters and SEQ.FP the code usedby Bloomberg.Sequana’s shares have been listed on the CAC Small®, CAC Mid& Small® and CAC All- Tradable® indices since 21 March 2011.Share ownership and corporate actions (1)Capital increaseFor the purpose of accelerating the Group’s development plan andstrengthening its financial structure, Sequana carried out a capitalincrease of €150 million in 2012 with preferential subscriptionrights for existing shareholders.The subscription period ran from 14 to 27 June 2012. The issuewas taken up by the Group’s main historical shareholders as wellas by FSI which became a shareholder of Sequana for the firsttime, committed to the Group’s long-term development.This operation resulted in the creation of 100,037,488 new sharesand following its completion, FSI, Exor SA, DLMD, Allianzgroup and Pascal Lebard owned 20.09%, 18.74%, 13.35%,10.22% and 0.26%, respectively, of Sequana’s share capital.Shareholder agreementAs part of the capital increase, FSI entered into a shareholders’agreement – which does not constitute an agreement to act inconcert – with Exor SA, DLMD, Pascal Lebard and Allianzgroup as well as with BNP Paribas Arbitrage and Royal Bankof Scotland group. BNP Paribas Arbitrage and Royal Bank ofScotland group are parties to the agreement due to pledges thatthey hold on the Sequana shares owned by DLMD pursuant toan agreement to restructure DLMD’s debt entered into in 2010.At the same time, Exor SA, DLMD and Pascal Lebard terminatedthe shareholder agreement to act in concert signed on6 July 2007 and renewed on 21 July 2010.Reverse stock splitOn 15 November 2012, Sequana carried out a reverse stocksplit of its shares based on the exchange of one new Sequanashare with a par value of €9 for six old Sequana shares with apar value of €1.50 each. This operation will last two years to14 November 2014 and its purpose is to reduce the volatility ofthe Sequana share price.Pre-reverse split shares were transferred to the NYSE Euronextdelisted securities compartment on 15 November 2012 underISIN code FR0000063364 (ticker symbol SEQNR) where theymay be traded until 14 May 2013. After this period ends, shareholdersmay trade pre-reverse split shares over the counter (OTC)until 14 November 2014.After 15 November 2014, new unclaimed Sequana shares correspondingto old (pre-reverse split) shares will be sold on NYSEEuronext. The proceeds from the sale will be placed in an escrowaccount opened at a credit institution and may be claimed byshareholders or their beneficiaries during a ten-year period. Oncethis period has expired, the sums will be placed with Caisse desDépôts and may be claimed by shareholders or their beneficiariesin accordance with the applicable laws and regulations and withthe statute of limitations concerning the period after which thefunds shall be paid to the French State.(1) See Chapter 5, page 187.36.91%Free float10.22%AllianzOwnership structure at 31 December 20120.43%Treasury shares20.09%FSI18.74%Exor SA13.61%DLMD(incl. Pascal Lebard 0.26%)Sequana | 2012 Document de référence (English version) | 19