Contents

Registration document PDF - Sequana

Registration document PDF - Sequana

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

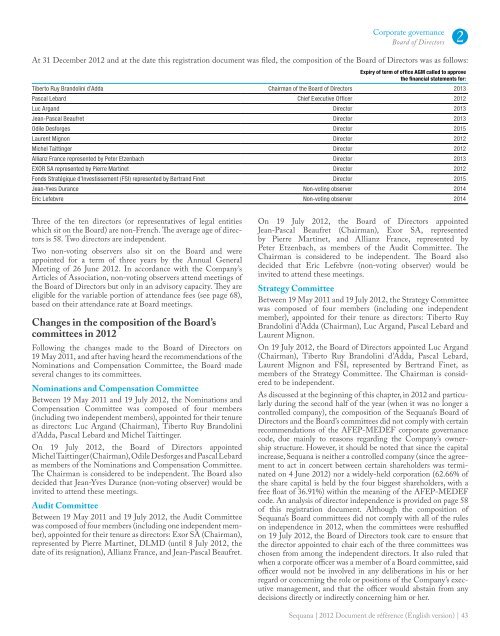

Corporate governanceBoard of Directors 2At 31 December 2012 and at the date this registration document was filed, the composition of the Board of Directors was as follows:Expiry of term of office AGM called to approvethe financial statements for:Tiberto Ruy Brandolini d’Adda Chairman of the Board of Directors 2013Pascal Lebard Chief Executive Officer 2012Luc Argand Director 2013Jean-Pascal Beaufret Director 2013Odile Desforges Director 2015Laurent Mignon Director 2012Michel Taittinger Director 2012Allianz France represented by Peter Etzenbach Director 2013EXOR SA represented by Pierre Martinet Director 2012Fonds Stratégique d’Investissement (FSI) represented by Bertrand Finet Director 2015Jean-Yves Durance Non-voting observer 2014Eric Lefebvre Non-voting observer 2014Three of the ten directors (or representatives of legal entitieswhich sit on the Board) are non-French. The average age of directorsis 58. Two directors are independent.Two non-voting observers also sit on the Board and wereappointed for a term of three years by the Annual GeneralMeeting of 26 June 2012. In accordance with the Company’sArticles of Association, non-voting observers attend meetings ofthe Board of Directors but only in an advisory capacity. They areeligible for the variable portion of attendance fees (see page 68),based on their attendance rate at Board meetings.Changes in the composition of the Board’scommittees in 2012Following the changes made to the Board of Directors on19 May 2011, and after having heard the recommendations of theNominations and Compensation Committee, the Board madeseveral changes to its committees.Nominations and Compensation CommitteeBetween 19 May 2011 and 19 July 2012, the Nominations andCompensation Committee was composed of four members(including two independent members), appointed for their tenureas directors: Luc Argand (Chairman), Tiberto Ruy Brandolinid’Adda, Pascal Lebard and Michel Taittinger.On 19 July 2012, the Board of Directors appointedMichel Taittinger (Chairman), Odile Desforges and Pascal Lebardas members of the Nominations and Compensation Committee.The Chairman is considered to be independent. The Board alsodecided that Jean-Yves Durance (non-voting observer) would beinvited to attend these meetings.Audit CommitteeBetween 19 May 2011 and 19 July 2012, the Audit Committeewas composed of four members (including one independent member),appointed for their tenure as directors: Exor SA (Chairman),represented by Pierre Martinet, DLMD (until 8 July 2012, thedate of its resignation), Allianz France, and Jean-Pascal Beaufret.On 19 July 2012, the Board of Directors appointedJean‐Pascal Beaufret (Chairman), Exor SA, representedby Pierre Martinet, and Allianz France, represented byPeter Etzenbach, as members of the Audit Committee. TheChairman is considered to be independent. The Board alsodecided that Eric Lefebvre (non-voting observer) would beinvited to attend these meetings.Strategy CommitteeBetween 19 May 2011 and 19 July 2012, the Strategy Committeewas composed of four members (including one independentmember), appointed for their tenure as directors: Tiberto RuyBrandolini d’Adda (Chairman), Luc Argand, Pascal Lebard andLaurent Mignon.On 19 July 2012, the Board of Directors appointed Luc Argand(Chairman), Tiberto Ruy Brandolini d’Adda, Pascal Lebard,Laurent Mignon and FSI, represented by Bertrand Finet, asmembers of the Strategy Committee. The Chairman is consideredto be independent.As discussed at the beginning of this chapter, in 2012 and particularlyduring the second half of the year (when it was no longer acontrolled company), the composition of the Sequana’s Board ofDirectors and the Board’s committees did not comply with certainrecommendations of the AFEP-MEDEF corporate governancecode, due mainly to reasons regarding the Company’s ownershipstructure. However, it should be noted that since the capitalincrease, Sequana is neither a controlled company (since the agreementto act in concert between certain shareholders was terminatedon 4 June 2012) nor a widely-held corporation (62.66% ofthe share capital is held by the four biggest shareholders, with afree float of 36.91%) within the meaning of the AFEP‐MEDEFcode. An analysis of director independence is provided on page 58of this registration document. Although the composition ofSequana’s Board committees did not comply with all of the ruleson independence in 2012, when the committees were reshuffledon 19 July 2012, the Board of Directors took care to ensure thatthe director appointed to chair each of the three committees waschosen from among the independent directors. It also ruled thatwhen a corporate officer was a member of a Board committee, saidofficer would not be involved in any deliberations in his or herregard or concerning the role or positions of the Company’s executivemanagement, and that the officer would abstain from anydecisions directly or indirectly concerning him or her.Sequana | 2012 Document de référence (English version) | 43