is the world economy at risk? - Global Real Estate Institute

is the world economy at risk? - Global Real Estate Institute

is the world economy at risk? - Global Real Estate Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

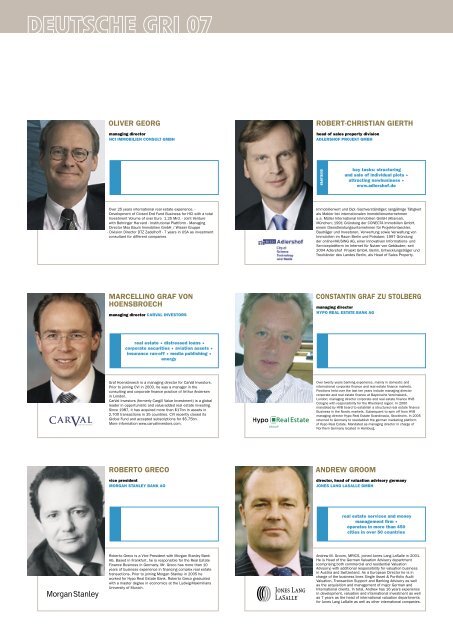

OLIVER GEORG<br />

managing director<br />

HCI IMMOBILIEN CONSULT GMBH<br />

Over 25 years intern<strong>at</strong>ional real est<strong>at</strong>e experience. -<br />

Development of Closed End Fund Business for HCI with a total<br />

Investment Volume of over Euro 1.25 Mrd. - Joint Venture<br />

with Behringer Harvard - Institutional Pl<strong>at</strong>tform - Managing<br />

Director Max Baum Immobilien GmbH / W<strong>is</strong>ser Gruppe<br />

- Div<strong>is</strong>ion Director DTZ Zadelhoff - 7 years in USA as investment<br />

consultant for different companies<br />

MARCELLINO GRAF VON<br />

HOENSBROECH<br />

managing director CARVAL INVESTORS<br />

real est<strong>at</strong>e • d<strong>is</strong>tressed loans •<br />

corpor<strong>at</strong>e securities • avi<strong>at</strong>ion assets •<br />

insurance run-off • media publ<strong>is</strong>hing •<br />

energy<br />

Graf Hoensbroech <strong>is</strong> a managing director for CarVal Investors.<br />

Prior to joining CVI in 2000, he was a manager in <strong>the</strong><br />

consulting and corpor<strong>at</strong>e finance practice of Arthur Andersen<br />

in London.<br />

CarVal Investors (formerly Cargill Value Investment) <strong>is</strong> a global<br />

leader in opportun<strong>is</strong>tic and value-added real est<strong>at</strong>e investing.<br />

Since 1987, it has acquired more than $17bn in assets in<br />

2,700 transactions in 35 countries. CVI recently closed its<br />

<strong>Global</strong> Fund and accepted subscriptions for $5.75bn.<br />

More inform<strong>at</strong>ion www.carvalinvestors.com.<br />

ROBERTO GRECO<br />

vice president<br />

MORGAN STANLEY BANK AG<br />

Roberto Greco <strong>is</strong> a Vice President with Morgan Stanley Bank<br />

AG. Based in Frankfurt, he <strong>is</strong> responsible for <strong>the</strong> <strong>Real</strong> Est<strong>at</strong>e<br />

Finance Business in Germany. Mr. Greco has more than 10<br />

years of business experience in financing complex real est<strong>at</strong>e<br />

transactions. Prior to joining Morgan Stanley in 2005 he<br />

worked for Hypo <strong>Real</strong> Est<strong>at</strong>e Bank. Roberto Greco gradu<strong>at</strong>ed<br />

with a master degree in economics <strong>at</strong> <strong>the</strong> Ludwig-Maximilians<br />

University of Munich.<br />

ROBERT-CHRISTIAN GIERTH<br />

head of sales property div<strong>is</strong>ion<br />

ADLERSHOF PROJEKT GMBH<br />

DEVELOPER<br />

key tasks: structuring<br />

and sale of individual plots •<br />

<strong>at</strong>tracting newbusiness •<br />

www.adlershof.de<br />

Immobilienwirt und Dipl.-Sachverständiger; langjährige Tätigkeit<br />

als Makler bei intern<strong>at</strong>ionalen Immobilienunternehmen<br />

u.a. Müller Intern<strong>at</strong>ional Immobilien GmbH (At<strong>is</strong>real),<br />

München; 1991 Gründung der CONECTA Immobilien GmbH,<br />

einem Dienstle<strong>is</strong>tungsunternehmen für Projektentwickler,<br />

Bauträger und Investoren, Verwertung sowie Verwaltung von<br />

Immobilien im Raum Berlin und Potsdam; 1997 Gründung<br />

der online-HAUSING AG, einer innov<strong>at</strong>iven Inform<strong>at</strong>ions- und<br />

Servicepl<strong>at</strong>tform im Internet für Nutzer von Gebäuden; seit<br />

2004 Adlershof Projekt GmbH, Berlin, Entwicklungsträger und<br />

Treuhänder des Landes Berlin, als Head of Sales Property.<br />

CONSTANTIN GRAF ZU STOLBERG<br />

managing director<br />

HYPO REAL ESTATE BANK AG<br />

Over twenty years banking experience, mainly in domestic and<br />

intern<strong>at</strong>ional corpor<strong>at</strong>e finance and real est<strong>at</strong>e finance markets.<br />

Positions held over <strong>the</strong> last ten years include managing director<br />

corpor<strong>at</strong>e and real est<strong>at</strong>e finance <strong>at</strong> Bayer<strong>is</strong>che Vereinsbank,<br />

London; managing director corpor<strong>at</strong>e and real est<strong>at</strong>e finance HVB<br />

Cologne with responsibility for <strong>the</strong> Rheinland region. In 2000<br />

mand<strong>at</strong>ed by HVB board to establ<strong>is</strong>h a structured real est<strong>at</strong>e finance<br />

Business in <strong>the</strong> Nordic markets. Subsequent to spin off from HVB<br />

managing director Hypo <strong>Real</strong> Est<strong>at</strong>e Scandinavia, Stockholm. In 2005<br />

returned to Germany to reestabl<strong>is</strong>h <strong>the</strong> german marketing pl<strong>at</strong>form<br />

of Hypo <strong>Real</strong> Est<strong>at</strong>e. Mand<strong>at</strong>ed as managing director in charge of<br />

Nor<strong>the</strong>rn Germany loc<strong>at</strong>ed in Hamburg.<br />

ANDREW GROOM<br />

director, head of valu<strong>at</strong>ion adv<strong>is</strong>ory germany<br />

JONES LANG LASALLE GMBH<br />

real est<strong>at</strong>e services and money<br />

management firm •<br />

oper<strong>at</strong>es in more than 450<br />

cities in over 50 countries<br />

Andrew M. Groom, MRICS, joined Jones Lang LaSalle in 2001.<br />

He <strong>is</strong> Head of <strong>the</strong> German Valu<strong>at</strong>ion Adv<strong>is</strong>ory department<br />

(compr<strong>is</strong>ing both commercial and residential Valu<strong>at</strong>ion<br />

Adv<strong>is</strong>ory) with additional responsibility for valu<strong>at</strong>ion business<br />

in Austria and Switzerland. As a European Director he <strong>is</strong> in<br />

charge of <strong>the</strong> business lines Single Asset & Portfolio Audit<br />

Valu<strong>at</strong>ion, Transaction Support and Banking Adv<strong>is</strong>ory as well<br />

as <strong>the</strong> acqu<strong>is</strong>ition and management of major German and<br />

Intern<strong>at</strong>ional clients. In total, Andrew has 16 years experience<br />

in development, valu<strong>at</strong>ion and intern<strong>at</strong>ional investment as well<br />

as 7 years as <strong>the</strong> head of intern<strong>at</strong>ional valu<strong>at</strong>ion departments<br />

for Jones Lang LaSalle as well as o<strong>the</strong>r intern<strong>at</strong>ional companies.