is the world economy at risk? - Global Real Estate Institute

is the world economy at risk? - Global Real Estate Institute

is the world economy at risk? - Global Real Estate Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

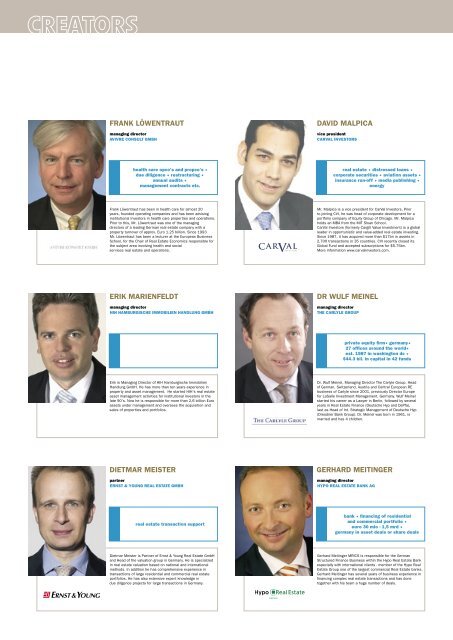

FRANK LÖWENTRAUT<br />

managing director<br />

AVIVRE CONSULT GMBH<br />

health care opco’s and propco’s •<br />

due diligence • restructuring •<br />

annual audits •<br />

management contracts etc.<br />

Frank Löwentraut has been in health care for almost 20<br />

years, founded oper<strong>at</strong>ing companies and has been adv<strong>is</strong>ing<br />

institutional investors in health care properties and oper<strong>at</strong>ions.<br />

Prior to th<strong>is</strong>, Mr. Löwentraut was one of <strong>the</strong> managing<br />

directors of a leading German real est<strong>at</strong>e company with a<br />

property turnover of approx. Euro 1.25 billion. Since 1993<br />

Mr. Löwentraut has been a lecturer <strong>at</strong> <strong>the</strong> European Business<br />

School, for <strong>the</strong> Chair of <strong>Real</strong> Est<strong>at</strong>e Economics responsible for<br />

<strong>the</strong> subject area involving health and social<br />

services real est<strong>at</strong>e and oper<strong>at</strong>ions.<br />

ERIK MARIENFELDT<br />

managing director<br />

HIH HAMBURGISCHE IMMOBILIEN HANDLUNG GMBH<br />

Erik <strong>is</strong> Managing Director of HIH Hamburg<strong>is</strong>che Immobilien<br />

Handlung GmbH. He has more than ten years experience in<br />

property and asset management. He started HIH’s real est<strong>at</strong>e<br />

asset management activities for institutional investors in <strong>the</strong><br />

l<strong>at</strong>e 90’s. Now he <strong>is</strong> responsible for more than 2,6 billion Euro<br />

assets under management and oversees <strong>the</strong> acqu<strong>is</strong>ition and<br />

sales of properties and portfolios.<br />

DIETMAR MEISTER<br />

partner<br />

ERNST & YOUNG REAL ESTATE GMBH<br />

real est<strong>at</strong>e transaction support<br />

Dietmar Me<strong>is</strong>ter <strong>is</strong> Partner of Ernst & Young <strong>Real</strong> Est<strong>at</strong>e GmbH<br />

and Head of <strong>the</strong> valu<strong>at</strong>ion group in Germany. He <strong>is</strong> specialized<br />

in real est<strong>at</strong>e valu<strong>at</strong>ion based on n<strong>at</strong>ional and intern<strong>at</strong>ional<br />

methods. In addition he has comprehensive experience in<br />

transactions of large residential and commercial real est<strong>at</strong>e<br />

portfolios. He has also extensive expert knowledge in<br />

due diligence projects for large transactions in Germany.<br />

DAVID MALPICA<br />

vice president<br />

CARVAL INVESTORS<br />

real est<strong>at</strong>e • d<strong>is</strong>tressed loans •<br />

corpor<strong>at</strong>e securities • avi<strong>at</strong>ion assets •<br />

insurance run-off • media publ<strong>is</strong>hing •<br />

energy<br />

Mr. Malpica <strong>is</strong> a vice president for CarVal Investors. Prior<br />

to joining CVI, he was head of corpor<strong>at</strong>e development for a<br />

portfolio company of Equity Group of Chicago. Mr. Malpica<br />

holds an MBA from <strong>the</strong> MIT Sloan School.<br />

CarVal Investors (formerly Cargill Value Investment) <strong>is</strong> a global<br />

leader in opportun<strong>is</strong>tic and value-added real est<strong>at</strong>e investing.<br />

Since 1987, it has acquired more than $17bn in assets in<br />

2,700 transactions in 35 countries. CVI recently closed its<br />

<strong>Global</strong> Fund and accepted subscriptions for $5.75bn.<br />

More inform<strong>at</strong>ion www.carvalinvestors.com.<br />

DR WULF MEINEL<br />

managing director<br />

THE CARLYLE GROUP<br />

priv<strong>at</strong>e equity firm• germany•<br />

27 offices around <strong>the</strong> <strong>world</strong>•<br />

est. 1987 in washington dc •<br />

$44.3 bil. in capital in 42 funds<br />

Dr. Wulf Meinel, Managing Director The Carlyle Group. Head<br />

of German, Switzerland, Austria and Central European RE<br />

business of Carlyle since 2001, previously Director Europe<br />

for LaSalle Investment Management, Germany. Wulf Meinel<br />

started h<strong>is</strong> career as a Lawyer in Berlin, followed by several<br />

years in <strong>Real</strong> Est<strong>at</strong>e Finance (Deutsche Hyp and DePfa),<br />

last as Head of Int. Str<strong>at</strong>egic Management of Deutsche Hyp<br />

(Dresdner Bank Group). Dr. Meinel was born in 1961, <strong>is</strong><br />

married and has 4 children.<br />

GERHARD MEITINGER<br />

managing director<br />

HYPO REAL ESTATE BANK AG<br />

bank • financing of residential<br />

and commercial portfolio •<br />

euro 30 mio - 1,5 mrd •<br />

germany in asset deals or share deals<br />

Gerhard Meitinger MRICS <strong>is</strong> responsible for <strong>the</strong> German<br />

Structured Finance Business within <strong>the</strong> Hypo <strong>Real</strong> Est<strong>at</strong>e Bank<br />

especially with intern<strong>at</strong>ional clients - member of <strong>the</strong> Hypo <strong>Real</strong><br />

Est<strong>at</strong>e Group one of <strong>the</strong> largest commercial <strong>Real</strong> Est<strong>at</strong>e banks.<br />

Gerhard Meitinger has several years of business experience in<br />

financing complex real est<strong>at</strong>e transactions and has done<br />

toge<strong>the</strong>r with h<strong>is</strong> team a huge number of deals.