OTAGO MUSEUM

OtagoMuseum-1415-Annual-Report

OtagoMuseum-1415-Annual-Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>OTAGO</strong> <strong>MUSEUM</strong> TRUST BOARD<br />

NOTES TO THE FINANCIAL STATEMENTS (Cont.)<br />

For the Financial Year Ended 30 June, 2015<br />

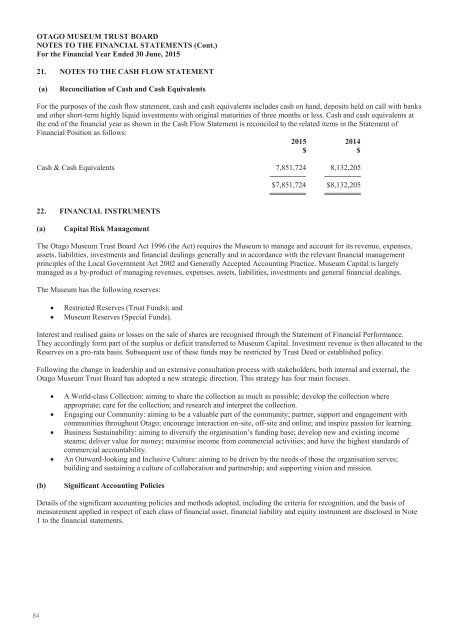

21. NOTES TO THE CASH FLOW STATEMENT<br />

(a)<br />

Reconciliation of Cash and Cash Equivalents<br />

For the purposes of the cash flow statement, cash and cash equivalents includes cash on hand, deposits held on call with banks<br />

and other short-term highly liquid investments with original maturities of three months or less. Cash and cash equivalents at<br />

the end of the financial year as shown in the Cash Flow Statement is reconciled to the related items in the Statement of<br />

Financial Position as follows:<br />

2015 2014<br />

$ $<br />

Cash & Cash Equivalents 7,851,724 8,132,205<br />

──────── ────────<br />

$7,851,724 $8,132,205<br />

════════ ════════<br />

22. FINANCIAL INSTRUMENTS<br />

(a)<br />

Capital Risk Management<br />

The Otago Museum Trust Board Act 1996 (the Act) requires the Museum to manage and account for its revenue, expenses,<br />

assets, liabilities, investments and financial dealings generally and in accordance with the relevant financial management<br />

principles of the Local Government Act 2002 and Generally Accepted Accounting Practice. Museum Capital is largely<br />

managed as a by-product of managing revenues, expenses, assets, liabilities, investments and general financial dealings.<br />

The Museum has the following reserves:<br />

<br />

<br />

Restricted Reserves (Trust Funds); and<br />

Museum Reserves (Special Funds).<br />

Interest and realised gains or losses on the sale of shares are recognised through the Statement of Financial Performance.<br />

They accordingly form part of the surplus or deficit transferred to Museum Capital. Investment revenue is then allocated to the<br />

Reserves on a pro-rata basis. Subsequent use of these funds may be restricted by Trust Deed or established policy.<br />

Following the change in leadership and an extensive consultation process with stakeholders, both internal and external, the<br />

Otago Museum Trust Board has adopted a new strategic direction. This strategy has four main focuses.<br />

<br />

<br />

<br />

<br />

A World-class Collection: aiming to share the collection as much as possible; develop the collection where<br />

appropriate; care for the collection; and research and interpret the collection.<br />

Engaging our Community: aiming to be a valuable part of the community; partner, support and engagement with<br />

communities throughout Otago; encourage interaction on-site, off-site and online; and inspire passion for learning.<br />

Business Sustainability: aiming to diversify the organisation’s funding base; develop new and existing income<br />

steams; deliver value for money; maximise income from commercial activities; and have the highest standards of<br />

commercial accountability.<br />

An Outward-looking and Inclusive Culture: aiming to be driven by the needs of those the organisation serves;<br />

building and sustaining a culture of collaboration and partnership; and supporting vision and mission.<br />

(b)<br />

Significant Accounting Policies<br />

Details of the significant accounting policies and methods adopted, including the criteria for recognition, and the basis of<br />

measurement applied in respect of each class of financial asset, financial liability and equity instrument are disclosed in Note<br />

1 to the financial statements.<br />

84