OTAGO MUSEUM

OtagoMuseum-1415-Annual-Report

OtagoMuseum-1415-Annual-Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>OTAGO</strong> <strong>MUSEUM</strong> TRUST BOARD<br />

NOTES TO THE FINANCIAL STATEMENTS (Cont.)<br />

For the Financial Year Ended 30 June, 2015<br />

22 FINANCIAL INSTRUMENTS cont.<br />

(g)<br />

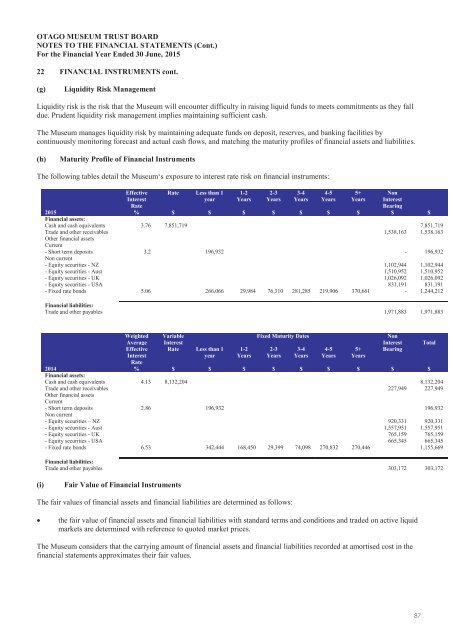

Liquidity Risk Management<br />

Liquidity risk is the risk that the Museum will encounter difficulty in raising liquid funds to meets commitments as they fall<br />

due. Prudent liquidity risk management implies maintaining sufficient cash.<br />

The Museum manages liquidity risk by maintaining adequate funds on deposit, reserves, and banking facilities by<br />

continuously monitoring forecast and actual cash flows, and matching the maturity profiles of financial assets and liabilities.<br />

(h)<br />

Maturity Profile of Financial Instruments<br />

The following tables detail the Museum‘s exposure to interest rate risk on financial instruments:<br />

Effective<br />

Interest<br />

Rate<br />

%<br />

Rate<br />

Less than 1<br />

year<br />

1-2<br />

Years<br />

2-3<br />

Years<br />

3-4<br />

Years<br />

4-5<br />

Years<br />

5+<br />

Years<br />

Non<br />

Interest<br />

Bearing<br />

$ $<br />

2015<br />

$<br />

$<br />

$ $ $ $ $<br />

Financial assets:<br />

Cash and cash equivalents 3.76 7,851,719 7,851,719<br />

Trade and other receivables 1,538,163 1,538,163<br />

Other financial assets<br />

Current<br />

- Short term deposits 3.2 196,932 - 196,932<br />

Non current<br />

- Equity securities - NZ 1,102,944 1,102,944<br />

- Equity securities - Aust 1,510,952 1,510,952<br />

- Equity securities - UK 1,026,092 1,026,092<br />

- Equity securities - USA 831,191 831,191<br />

- Fixed rate bonds 5.06 266,066 29,984 76,310 281,285 219,906 370,661 - 1,244,212<br />

Financial liabilities:<br />

Trade and other payables 1,971,883 1,971,883<br />

Weighted<br />

Average<br />

Effective<br />

Interest<br />

Rate<br />

%<br />

Variable<br />

Interest<br />

Rate<br />

Less than 1<br />

year<br />

1-2<br />

Years<br />

Fixed Maturity Dates<br />

2-3<br />

Years<br />

3-4<br />

Years<br />

4-5<br />

Years<br />

5+<br />

Years<br />

Non<br />

Interest<br />

Bearing<br />

2014<br />

$<br />

$<br />

$ $ $ $ $<br />

$ $<br />

Financial assets:<br />

Cash and cash equivalents 4.13 8,132,204 8,132,204<br />

Trade and other receivables 227,949 227,949<br />

Other financial assets<br />

Current<br />

- Short term deposits 2.86 196,932 196,932<br />

Non current<br />

- Equity securities – NZ 920,331 920,331<br />

- Equity securities - Aust 1,557,951 1,557,951<br />

- Equity securities - UK 765,159 765,159<br />

- Equity securities - USA 665,345 665,345<br />

- Fixed rate bonds 6.53 342,444 168,450 29,399 74,098 270,832 270,446 1,155,669<br />

Financial liabilities:<br />

Trade and other payables 303,172 303,172<br />

Total<br />

(i)<br />

Fair Value of Financial Instruments<br />

The fair values of financial assets and financial liabilities are determined as follows:<br />

<br />

the fair value of financial assets and financial liabilities with standard terms and conditions and traded on active liquid<br />

markets are determined with reference to quoted market prices.<br />

The Museum considers that the carrying amount of financial assets and financial liabilities recorded at amortised cost in the<br />

financial statements approximates their fair values.<br />

87