Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Housing and Mortgage Markets in 2014<br />

lower house prices. It is also true, in fact, that lower house prices take a toll on<br />

the economy as homeowners start to see their investment (the house) lose value,<br />

potentially compelling them to cut consumption and investments, thus fostering a<br />

vicious circle. The correlation is visible in a number of countries. See for instance<br />

Spain, chart 7. The European Central Bank in a paper of 2013 estimated that in Spain<br />

an increase of unemployment “has a negative and significant impact, -0.012 , while<br />

a contemporaneous change in the interest rates has no effect on house prices” 3 .<br />

CHART 8<br />

3,000,000<br />

2,500,000<br />

2,000,000<br />

Evolution of construction indicators in the EU 4 , residential units<br />

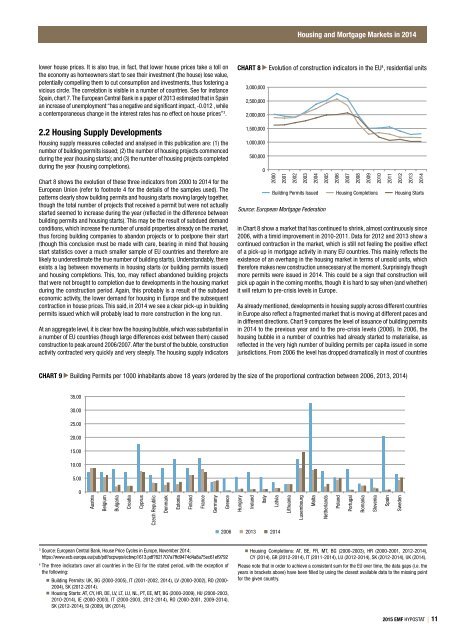

2.2 Housing Supply Developments<br />

Housing supply measures collected and analysed in this publication are: (1) the<br />

number of building permits issued; (2) the number of housing projects commenced<br />

during the year (housing starts); and (3) the number of housing projects completed<br />

during the year (housing completions).<br />

Chart 8 shows the evolution of these three indicators from 2000 to 2014 for the<br />

European Union (refer to footnote 4 for the details of the samples used). The<br />

patterns clearly show building permits and housing starts moving largely together,<br />

though the total number of projects that received a permit but were not actually<br />

started seemed to increase during the year (reflected in the difference between<br />

building permits and housing starts). This may be the result of subdued demand<br />

conditions, which increase the number of unsold properties already on the market,<br />

thus forcing building companies to abandon projects or to postpone their start<br />

(though this conclusion must be made with care, bearing in mind that housing<br />

start statistics cover a much smaller sample of EU countries and therefore are<br />

likely to underestimate the true number of building starts). Understandably, there<br />

exists a lag between movements in housing starts (or building permits issued)<br />

and housing completions. This, too, may reflect abandoned building projects<br />

that were not brought to completion due to developments in the housing market<br />

during the construction period. Again, this probably is a result of the subdued<br />

economic activity, the lower demand for housing in Europe and the subsequent<br />

contraction in house prices. This said, in 2014 we see a clear pick-up in building<br />

permits issued which will probably lead to more construction in the long run.<br />

At an aggregate level, it is clear how the housing bubble, which was substantial in<br />

a number of EU countries (though large differences exist between them) caused<br />

construction to peak around 2006/2007. After the burst of the bubble, construction<br />

activity contracted very quickly and very steeply. The housing supply indicators<br />

1,500,000<br />

1,000,000<br />

500,000<br />

0<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

Building Permits Issued<br />

Source: European Mortgage Federation<br />

Housing Completions<br />

Housing Starts<br />

in Chart 8 show a market that has continued to shrink, almost continuously since<br />

2006, with a timid improvement in 2010-2011. Data for 2012 and 2013 show a<br />

continued contraction in the market, which is still not feeling the positive effect<br />

of a pick-up in mortgage activity in many EU countries. This mainly reflects the<br />

existence of an overhang in the housing market in terms of unsold units, which<br />

therefore makes new construction unnecessary at the moment. Surprisingly though<br />

more permits were issued in 2014. This could be a sign that construction will<br />

pick up again in the coming months, though it is hard to say when (and whether)<br />

it will return to pre-crisis levels in Europe.<br />

As already mentioned, developments in housing supply across different countries<br />

in Europe also reflect a fragmented market that is moving at different paces and<br />

in different directions. Chart 9 compares the level of issuance of building permits<br />

in 2014 to the previous year and to the pre-crisis levels (2006). In 2006, the<br />

housing bubble in a number of countries had already started to materialise, as<br />

reflected in the very high number of building permits per capita issued in some<br />

jurisdictions. From 2006 the level has dropped dramatically in most of countries<br />

CHART 9 Building Permits per 1000 inhabitants above 18 years (ordered by the size of the proportional contraction between 2006, 2013, 2014)<br />

35.00<br />

30.00<br />

25.00<br />

20.00<br />

15.00<br />

10.00<br />

5.00<br />

0<br />

Austria<br />

Belgium<br />

Bulgaria<br />

Croatia<br />

Cyprus<br />

Czech Republic<br />

Denmark<br />

Estonia<br />

Finland<br />

France<br />

Germany<br />

Greece<br />

Hungary<br />

Ireland<br />

Italy<br />

Latvia<br />

Lithuania<br />

Luxembourg<br />

Malta<br />

Netherlands<br />

Poland<br />

Portugal<br />

Romania<br />

Slovenia<br />

Spain<br />

Sweden<br />

2006 2013 2014<br />

3<br />

Source: European Central Bank, House Price Cycles in Europe, November 2014;<br />

https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1613.pdf?821707a7ffd9474d4a8a75ec61ef9792<br />

4<br />

The three indicators cover all countries in the EU for the stated period, with the exception of<br />

the following:<br />

Building Permits: UK, BG (2000-2005), IT (2001-2002, 2014), LV (2000-2002), RO (2000-<br />

2004), SK (2012-2014).<br />

Housing Starts: AT, CY, HR, DE, LV, LT, LU, NL, PT, EE, MT, BG (2000-2009), HU (2000-2003,<br />

2010-2014), IE (2000-2003), IT (2000-2003, 2012-2014), RO (2000-2001, 2009-2014),<br />

SK (2012-2014), SI (2009), UK (2014).<br />

Housing Completions: AT, BE, FR, MT, BG (2000-2003), HR (2000-2001, 2012-2014),<br />

CY (2014), GR (2012-2014), IT (2011-2014), LU (2012-2014), SK (2012-2014), UK (2014).<br />

Please note that in order to achieve a consistent sum for the EU over time, the data gaps (i.e. the<br />

years in brackets above) have been filled by using the closest available data to the missing point<br />

for the given country.<br />

<strong>2015</strong> EMF HYPOSTAT | 11