Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

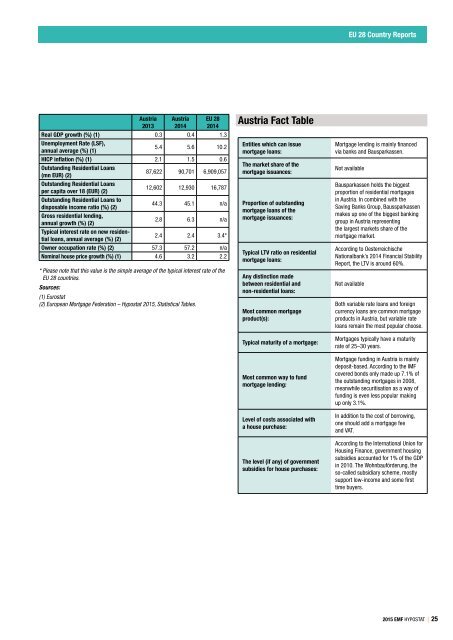

EU 28 Country Reports<br />

Austria<br />

2013<br />

Austria<br />

2014<br />

EU 28<br />

2014<br />

Real GDP growth (%) (1) 0.3 0.4 1.3<br />

Unemployment Rate (LSF),<br />

annual average (%) (1)<br />

5.4 5.6 10.2<br />

HICP inflation (%) (1) 2.1 1.5 0.6<br />

Outstanding Residential Loans<br />

(mn EUR) (2)<br />

87,622 90,701 6,909,057<br />

Outstanding Residential Loans<br />

per capita over 18 (EUR) (2)<br />

12,602 12,930 16,787<br />

Outstanding Residential Loans to<br />

disposable income ratio (%) (2)<br />

44.3 45.1 n/a<br />

Gross residential lending,<br />

annual growth (%) (2)<br />

2.8 6.3 n/a<br />

Typical interest rate on new residential<br />

loans, annual average (%) (2)<br />

2.4 2.4 3.4*<br />

Owner occupation rate (%) (2) 57.3 57.2 n/a<br />

Nominal house price growth (%) (1) 4.6 3.2 2.2<br />

* Please note that this value is the simple average of the typical interest rate of the<br />

EU 28 countries.<br />

Sources:<br />

(1) Eurostat<br />

(2) European Mortgage Federation – <strong>Hypostat</strong> <strong>2015</strong>, Statistical Tables.<br />

Austria Fact Table<br />

Entities which can issue<br />

mortgage loans:<br />

The market share of the<br />

mortgage issuances:<br />

Proportion of outstanding<br />

mortgage loans of the<br />

mortgage issuances:<br />

Typical LTV ratio on residential<br />

mortgage loans:<br />

Any distinction made<br />

between residential and<br />

non‐residential loans:<br />

Most common mortgage<br />

product(s):<br />

Typical maturity of a mortgage:<br />

Most common way to fund<br />

mortgage lending:<br />

Level of costs associated with<br />

a house purchase:<br />

The level (if any) of government<br />

subsidies for house purchases:<br />

Mortgage lending is mainly financed<br />

via banks and Bausparkassen.<br />

Not available<br />

Bausparkassen holds the biggest<br />

proportion of residential mortgages<br />

in Austria. In combined with the<br />

Saving Banks Group, Baussparkassen<br />

makes up one of the biggest banking<br />

group in Austria representing<br />

the largest markets share of the<br />

mortgage market.<br />

According to Oesterreichische<br />

Nationalbank’s 2014 Financial Stability<br />

Report, the LTV is around 60%.<br />

Not available<br />

Both variable rate loans and foreign<br />

currency loans are common mortgage<br />

products in Austria, but variable rate<br />

loans remain the most popular choose.<br />

Mortgages typically have a maturity<br />

rate of 25–30 years.<br />

Mortgage funding in Austria is mainly<br />

deposit-based. According to the IMF<br />

covered bonds only made up 7.1% of<br />

the outstanding mortgages in 2008,<br />

meanwhile securitisation as a way of<br />

funding is even less popular making<br />

up only 3.1%.<br />

In addition to the cost of borrowing,<br />

one should add a mortgage fee<br />

and VAT.<br />

According to the International Union for<br />

Housing Finance, government housing<br />

subsidies accounted for 1% of the GDP<br />

in 2010. The Wohnbauförderung, the<br />

so-called subsidiary scheme, mostly<br />

support low-income and some first<br />

time buyers.<br />

<strong>2015</strong> EMF HYPOSTAT | 25