Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EU 28 Country Reports<br />

was stronger in the two major urban centres (Athens: -42.9% and Thessaloniki:<br />

-44.6%), compared with other cities (-38.0%) and other areas (-35.0%), as well<br />

as larger properties in relatively higher cost areas in Greece. During the crisis,<br />

household demand shifted towards smaller, older and more affordable properties<br />

in medium-cost areas which became more marked in 2014, according to the<br />

surveys of real estate agencies conducted in 2014. These kinds of properties are<br />

considered as a safe alternative to households’ savings and have been developed<br />

into an investment option. This is also attributable to the substantial decline in<br />

property transfers tax (to 3% since 2014), while recent legislation on real estate<br />

taxation has curbed the uncertainty of the tax regime on real estate property.<br />

With the continuous fall in house prices in the past few years, the Greek real estate<br />

market does not currently show signs of significant overpricing. This takes into<br />

account the fact that a strong decline was observed in the past five years in the<br />

price-to-rent ratio. House prices then stabilised for two years before continuing<br />

to decline further in the second quarter of <strong>2015</strong>. House prices are now (Q2 <strong>2015</strong>)<br />

33.6 percentage points lower from its peak in the 4 th quarter of 2006.<br />

As a result of financing constraints, rising uncertainty and deterioration of the<br />

economic climate, all activity in the real estate market has come to a halt since<br />

the first months of <strong>2015</strong>. The downward trend of house prices is likely to persist<br />

in the following quarters, but at relatively more moderate rates. The reduced risk<br />

of abrupt change in house prices is, inter alia, attributed to the prohibition (until<br />

the end of <strong>2015</strong>) of auctioning households’ main residences (with an objective<br />

value of up to €200,000) and the reluctance of commercial banks to auction off<br />

properties that secure bad loans at this stage of severe recession. The recovery<br />

prospects in the real estate market depend, inter alia, on improving businesses’<br />

and households’ expectations, improving bank financing conditions, reducing<br />

uncertainty and boosting the recovery prospects of the Greek economy.<br />

The volume of credit to the private sector has contracted at relatively stable rates<br />

in the last four years. This decrease can be partly attributed to reduced demand<br />

for credit as a result of the weakness of economic activity, commercial banks’<br />

shortage of liquidity, the loss of confidence and the significant losses experienced<br />

by banks as a result of sovereign debt restructuring measures. Credit expansion<br />

remains negative and both supply and demand side developments point to a<br />

further negative path, in view of deteriorating conditions in all funding markets.<br />

The outstanding balances of loans from domestic MFIs to households (end of<br />

period amounts, including loans and securitised loans) declined at an annual rate<br />

of 1.2% in 2010, 3.9% in 2011, 3.8% in 2012, 3.5% in 2013 and 2.9% in 2014.<br />

The respective annual rates of decline for housing loans were 0.3%, 2.9%, 3.4%,<br />

3.3% and 3.0%. The annual growth rate for both corporate and households lending<br />

bottomed-out by mid-2012 and has been gradually improving since, although<br />

it remains negative. The rate of contraction of bank credit to households has<br />

stabilised in the last few months, after decelerating gradually since end-2012;<br />

the rate of contraction of bank credit to non-financial corporations has been<br />

decelerating since the beginning of 2014. The bank lending rate for mortgages<br />

and non-financial corporations has been declining, in contrast to the consumer<br />

credit rate which has been rising. Despite this, as credit risks are increasing, bank<br />

lending rates are expected to rise.<br />

Mortgage Funding<br />

Housing loans continue to record negative y-o-y growth rates, with the latest<br />

figure (June <strong>2015</strong>) standing at -3.4%, virtually unchanged compared to previous<br />

months (May <strong>2015</strong>: -3.5%, April <strong>2015</strong>: -3.4%. Developments in credit to the<br />

domestic private sector are expected to remain negative for the rest of <strong>2015</strong>,<br />

driven by uncertainty related to economic activity, as well as the lack of internal<br />

funds and generally the liquidity squeeze experienced by commercial banks. Note<br />

that between October 2014 and June <strong>2015</strong>, private sector deposits reduced by<br />

EUR 42 billion. Since the eruption of the Greek crisis in October 2009, deposits<br />

are down by EUR 113 billion in total. Credit standards, terms and conditions<br />

remained unchanged for loans to households and this development is expected<br />

to continue in Q3 <strong>2015</strong>. The proportion of rejected loan applications to housing<br />

loans shifted slightly, although the proportion of rejected applications for consumer<br />

loans remained unchanged. As far as demand is concerned, it remains unchanged<br />

for housing loans, in contrast to demand for consumer loans and non-financial<br />

corporations that declined due to the effect of consumer confidence, shrinking<br />

production and declining investment expenditures.<br />

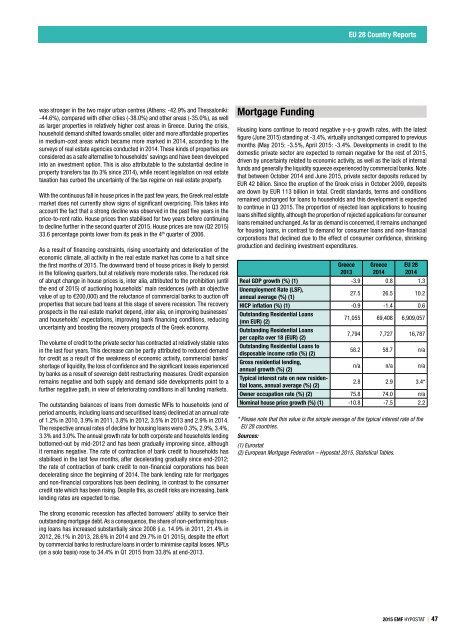

Greece<br />

2013<br />

Greece<br />

2014<br />

EU 28<br />

2014<br />

Real GDP growth (%) (1) -3.9 0.8 1.3<br />

Unemployment Rate (LSF),<br />

annual average (%) (1)<br />

27.5 26.5 10.2<br />

HICP inflation (%) (1) -0.9 -1.4 0.6<br />

Outstanding Residential Loans<br />

(mn EUR) (2)<br />

71,055 69,408 6,909,057<br />

Outstanding Residential Loans<br />

per capita over 18 (EUR) (2)<br />

7,794 7,727 16,787<br />

Outstanding Residential Loans to<br />

disposable income ratio (%) (2)<br />

58.2 58.7 n/a<br />

Gross residential lending,<br />

annual growth (%) (2)<br />

n/a n/a n/a<br />

Typical interest rate on new residential<br />

loans, annual average (%) (2)<br />

2.8 2.9 3.4*<br />

Owner occupation rate (%) (2) 75.8 74.0 n/a<br />

Nominal house price growth (%) (1) -10.8 -7.5 2.2<br />

* Please note that this value is the simple average of the typical interest rate of the<br />

EU 28 countries.<br />

Sources:<br />

(1) Eurostat<br />

(2) European Mortgage Federation – <strong>Hypostat</strong> <strong>2015</strong>, Statistical Tables.<br />

The strong economic recession has affected borrowers’ ability to service their<br />

outstanding mortgage debt. As a consequence, the share of non-performing housing<br />

loans has increased substantially since 2008 (i.e. 14.9% in 2011, 21.4% in<br />

2012, 26.1% in 2013, 28.6% in 2014 and 29.7% in Q1 <strong>2015</strong>), despite the effort<br />

by commercial banks to restructure loans in order to minimise capital losses. NPLs<br />

(on a solo basis) rose to 34.4% in Q1 <strong>2015</strong> from 33.8% at end-2013.<br />

<strong>2015</strong> EMF HYPOSTAT | 47