Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EU 28 Country Reports<br />

Slovakia<br />

By Paolo Colonna, European Mortgage Federation – European Covered Bond Council<br />

Macroeconomic Overview<br />

Slovakia’s recovery has been swift and solid, bar domestic demand, which continued<br />

to linger below 2008 levels. This holds true for both private consumption<br />

and investment. In 2014, domestic demand recovered and growth gathered more<br />

pace. Real GDP grew by 2.4% in 2014, versus 1.4% in 2013.<br />

Despite the fact that in 2014 export growth weakened, chiefly due to lower demand<br />

from partners, Slovakia is quite competitive from a trade standpoint. In 2014, it<br />

continued to capitalise on this advantage, consolidating current account surpluses.<br />

However on the investments side, the country’s negative net investment position<br />

deteriorated and gross external debt rose.<br />

Long-term unemployment is endemic in the country. Joblessness is not only<br />

wide-spread but also, unfortunately, long-term. As a matter of fact, more than<br />

60% of the unemployed have been jobless for more than a year, while over 50%<br />

have not had a job in two years.<br />

Headline inflation has declined sharply, reflecting both internal weak demand<br />

and imported deflation from disappointing raw materials prices. Moreover, the<br />

appreciation of the euro has compressed import prices, thus exacerbating the<br />

deflationary pressures.<br />

Fiscal consolidation continued but debt brakes started to bite. The general government<br />

deficit declined to 2.8% of GDP in 2013. Deficit reduction, while substantial,<br />

was achieved partly through one-offs and low-quality measures such as underspending<br />

EU development funds.<br />

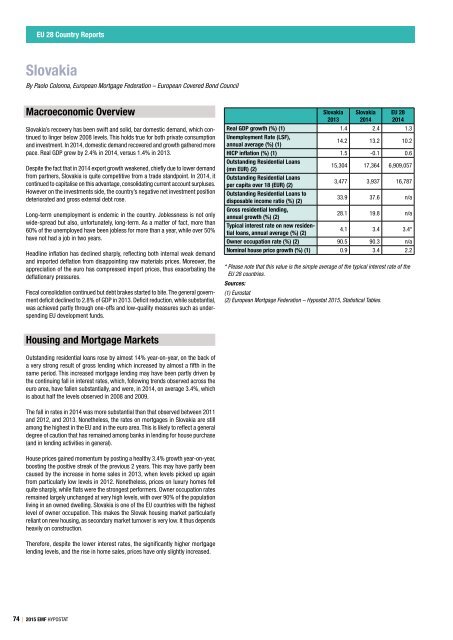

Slovakia<br />

2013<br />

Slovakia<br />

2014<br />

EU 28<br />

2014<br />

Real GDP growth (%) (1) 1.4 2.4 1.3<br />

Unemployment Rate (LSF),<br />

annual average (%) (1)<br />

14.2 13.2 10.2<br />

HICP inflation (%) (1) 1.5 -0.1 0.6<br />

Outstanding Residential Loans<br />

(mn EUR) (2)<br />

15,304 17,364 6,909,057<br />

Outstanding Residential Loans<br />

per capita over 18 (EUR) (2)<br />

3,477 3,937 16,787<br />

Outstanding Residential Loans to<br />

disposable income ratio (%) (2)<br />

33.9 37.6 n/a<br />

Gross residential lending,<br />

annual growth (%) (2)<br />

28.1 19.8 n/a<br />

Typical interest rate on new residential<br />

loans, annual average (%) (2)<br />

4.1 3.4 3.4*<br />

Owner occupation rate (%) (2) 90.5 90.3 n/a<br />

Nominal house price growth (%) (1) 0.9 3.4 2.2<br />

* Please note that this value is the simple average of the typical interest rate of the<br />

EU 28 countries.<br />

Sources:<br />

(1) Eurostat<br />

(2) European Mortgage Federation – <strong>Hypostat</strong> <strong>2015</strong>, Statistical Tables.<br />

Housing and Mortgage Markets<br />

Outstanding residential loans rose by almost 14% year-on-year, on the back of<br />

a very strong result of gross lending which increased by almost a fifth in the<br />

same period. This increased mortgage lending may have been partly driven by<br />

the continuing fall in interest rates, which, following trends observed across the<br />

euro area, have fallen substantially, and were, in 2014, on average 3.4%, which<br />

is about half the levels observed in 2008 and 2009.<br />

The fall in rates in 2014 was more substantial than that observed between 2011<br />

and 2012, and 2013. Nonetheless, the rates on mortgages in Slovakia are still<br />

among the highest in the EU and in the euro area. This is likely to reflect a general<br />

degree of caution that has remained among banks in lending for house purchase<br />

(and in lending activities in general).<br />

House prices gained momentum by posting a healthy 3.4% growth year-on-year,<br />

boosting the positive streak of the previous 2 years. This may have partly been<br />

caused by the increase in home sales in 2013, when levels picked up again<br />

from particularly low levels in 2012. Nonetheless, prices on luxury homes fell<br />

quite sharply, while flats were the strongest performers. Owner occupation rates<br />

remained largely unchanged at very high levels, with over 90% of the population<br />

living in an owned dwelling. Slovakia is one of the EU countries with the highest<br />

level of owner occupation. This makes the Slovak housing market particularly<br />

reliant on new housing, as secondary market turnover is very low. It thus depends<br />

heavily on construction.<br />

Therefore, despite the lower interest rates, the significantly higher mortgage<br />

lending levels, and the rise in home sales, prices have only slightly increased.<br />

74 | <strong>2015</strong> EMF HYPOSTAT