Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EU 28 Country Reports<br />

Luxembourg<br />

By Daniele Westig, European Mortgage Federation – European Covered Bond Council<br />

Macroeconomic Overview 1<br />

Luxembourg continued its strong GDP performance in 2014 with an average growth<br />

of 5.6%, thus considerably accelerating from the 4.4% of 2013. This growth was<br />

based on a balanced contribution from domestic demand and net export. The former<br />

may be explained by the boost of private consumption and investment in the<br />

second half of 2014 due to the planned increase by 2 pp of VAT from <strong>2015</strong>. The<br />

financial sector, the country’s main growth engine, has completed the transition to<br />

the new regulatory financial standards and the investment fund industry is gaining<br />

momentum, which is also improved by the ECB’s non-conventional monetary<br />

policy measures. Moreover, the government is promoting investment in high quality<br />

infrastructure, however capacity utilisation remains low and the gradually improving<br />

external environment and the Investment Plan for Europe only will mildly improve the<br />

investment figures of <strong>2015</strong>. Although remaining markedly one of the lowest figures<br />

in the EU, unemployment is expected to peak in <strong>2015</strong> and then decline as a result of<br />

the increased dynamism of the economy. HICP inflation continued to fall to 0.7% in<br />

2014 and went below 0 in December 2014 for the first time. In spite of the increase<br />

of VAT, inflation is expected to remain low in line with the sustained weakening of oil<br />

prices and a negative output gap. Inflation, however, is expected to bounce back to<br />

more than 2% due to sustained demand and to the boost by the QE of the ECB. The<br />

public finance figures continued to be robust, but they displayed a slight deterioration,<br />

reaching a 0.6% surplus in 2014 from the 0.9% in 2013. The balance is expected to<br />

further weaken mostly due to a change in EU legislation on e-commerce services,<br />

which will result in a drop of VAT revenues to around 1.5% of GDP.<br />

Housing and Mortgage Markets 2<br />

Outstanding mortgage loans in Luxembourg rose by just over 7% year-on-year, which<br />

reflects the improving economic situation and a well-performing housing market.<br />

Gross residential lending increased by more than 9% on a y-o-y basis in 2014<br />

overcoming the slight decrease in 2013 and reaching a new all-time high, with<br />

nearly EUR 6.4 billion.<br />

Mortgage interest rates continued to fall (in line with the general trend) for the<br />

fourth consecutive year, reaching 2.03% p.a. remaining among the lowest in Europe.<br />

As the Luxembourgish market for mortgage loans is dominated by variable<br />

rate loans, borrowers are very sensitive to interest rate changes and therefore<br />

cuts in reference interest rates have large impacts on borrowing volumes, and<br />

ultimately house prices.<br />

With this in mind, it is unsurprising that house prices in Luxembourg continued<br />

to rise for the fifth consecutive year. The year-on-year rise in house prices was<br />

nearly 4.1% which continues to be one of the highest rates of increase in Europe<br />

also in 2014 and represents an increase of the house price level of roughly 25%<br />

compared to 2009. However, this rise in 2014 was slightly less than 2013. This can<br />

be explained by the interaction between an ever increasing demand of housing in<br />

Luxembourg and large residential building activity. On the demand side, over the<br />

last year the price of new dwellings increased by more than 14%, while the price<br />

of second hand apartments increased by ca 4%. On the housing supply side, there<br />

was an increase of almost 70% in building permits in 2014, principally due to a<br />

more than doubling of permits for two or more dwelling residential units, while<br />

single residential units increased by more than 17%. This in part eased out the<br />

upwards trend of house prices in Luxembourg.<br />

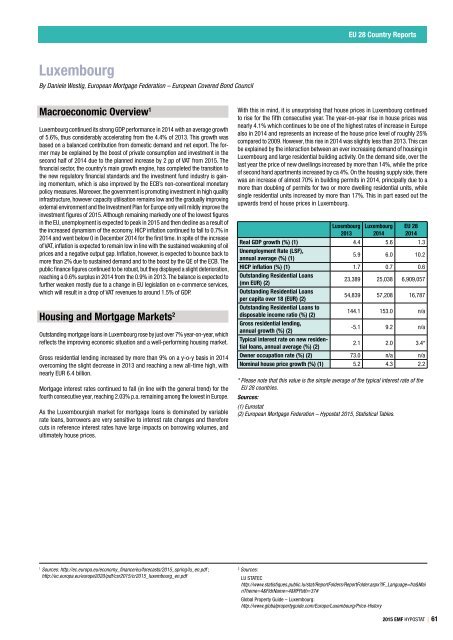

Luxembourg<br />

2013<br />

Luxembourg<br />

2014<br />

EU 28<br />

2014<br />

Real GDP growth (%) (1) 4.4 5.6 1.3<br />

Unemployment Rate (LSF),<br />

annual average (%) (1)<br />

5.9 6.0 10.2<br />

HICP inflation (%) (1) 1.7 0.7 0.6<br />

Outstanding Residential Loans<br />

(mn EUR) (2)<br />

23,389 25,038 6,909,057<br />

Outstanding Residential Loans<br />

per capita over 18 (EUR) (2)<br />

54,839 57,208 16,787<br />

Outstanding Residential Loans to<br />

disposable income ratio (%) (2)<br />

144.1 153.0 n/a<br />

Gross residential lending,<br />

annual growth (%) (2)<br />

-5.1 9.2 n/a<br />

Typical interest rate on new residential<br />

loans, annual average (%) (2)<br />

2.1 2.0 3.4*<br />

Owner occupation rate (%) (2) 73.0 n/a n/a<br />

Nominal house price growth (%) (1) 5.2 4.3 2.2<br />

* Please note that this value is the simple average of the typical interest rate of the<br />

EU 28 countries.<br />

Sources:<br />

(1) Eurostat<br />

(2) European Mortgage Federation – <strong>Hypostat</strong> <strong>2015</strong>, Statistical Tables.<br />

1<br />

Sources: http://ec.europa.eu/economy_finance/eu/forecasts/<strong>2015</strong>_spring/lu_en.pdf ;<br />

http://ec.europa.eu/europe2020/pdf/csr<strong>2015</strong>/cr<strong>2015</strong>_luxembourg_en.pdf<br />

2<br />

Sources:<br />

LU STATEC<br />

http://www.statistiques.public.lu/stat/ReportFolders/ReportFolder.aspx?IF_Language=fra&Mai<br />

nTheme=4&FldrName=4&RFPath=37#<br />

Global Property Guide – Luxembourg:<br />

http://www.globalpropertyguide.com/Europe/Luxembourg/Price-History<br />

<strong>2015</strong> EMF HYPOSTAT | 61