Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

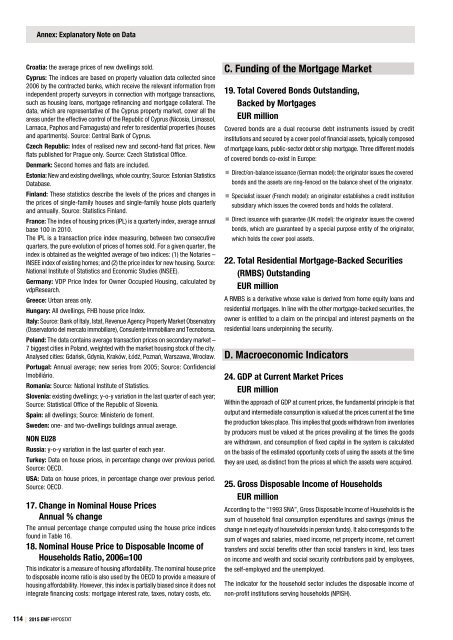

Annex: Explanatory Note on Data<br />

Croatia: the average prices of new dwellings sold.<br />

Cyprus: The indices are based on property valuation data collected since<br />

2006 by the contracted banks, which receive the relevant information from<br />

independent property surveyors in connection with mortgage transactions,<br />

such as housing loans, mortgage refinancing and mortgage collateral. The<br />

data, which are representative of the Cyprus property market, cover all the<br />

areas under the effective control of the Republic of Cyprus (Nicosia, Limassol,<br />

Larnaca, Paphos and Famagusta) and refer to residential properties (houses<br />

and apartments). Source: Central Bank of Cyprus.<br />

Czech Republic: Index of realised new and second-hand flat prices. New<br />

flats published for Prague only. Source: Czech Statistical Office.<br />

Denmark: Second homes and flats are included.<br />

Estonia: New and existing dwellings, whole country; Source: Estonian Statistics<br />

Database.<br />

Finland: These statistics describe the levels of the prices and changes in<br />

the prices of single-family houses and single-family house plots quarterly<br />

and annually. Source: Statistics Finland.<br />

France: The index of housing prices (IPL) is a quarterly index, average annual<br />

base 100 in 2010.<br />

The IPL is a transaction price index measuring, between two consecutive<br />

quarters, the pure evolution of prices of homes sold. For a given quarter, the<br />

index is obtained as the weighted average of two indices: (1) the Notaries –<br />

INSEE index of existing homes; and (2) the price index for new housing. Source:<br />

National Institute of Statistics and Economic Studies (INSEE).<br />

Germany: VDP Price Index for Owner Occupied Housing, calculated by<br />

vdpResearch.<br />

Greece: Urban areas only.<br />

Hungary: All dwellings, FHB house price Index.<br />

Italy: Source: Bank of Italy, Istat, Revenue Agency Property Market Observatory<br />

(Osservatorio del mercato immobiliare), Consulente Immobiliare and Tecnoborsa.<br />

Poland: The data contains average transaction prices on secondary market –<br />

7 biggest cities in Poland, weighted with the market housing stock of the city.<br />

Analysed cities: Gdańsk, Gdynia, Kraków, Łódź, Poznań, Warszawa, Wrocław.<br />

Portugal: Annual average; new series from 2005; Source: Confidencial<br />

Imobiliário.<br />

Romania: Source: National Institute of Statistics.<br />

Slovenia: existing dwellings; y-o-y variation in the last quarter of each year;<br />

Source: Statistical Office of the Republic of Slovenia.<br />

Spain: all dwellings; Source: Ministerio de foment.<br />

Sweden: one- and two-dwellings buildings annual average.<br />

NON EU28<br />

Russia: y-o-y variation in the last quarter of each year.<br />

Turkey: Data on house prices, in percentage change over previous period.<br />

Source: OECD.<br />

USA: Data on house prices, in percentage change over previous period.<br />

Source: OECD.<br />

17. Change in Nominal House Prices<br />

Annual % change<br />

The annual percentage change computed using the house price indices<br />

found in Table 16.<br />

18. Nominal House Price to Disposable Income of<br />

Households Ratio, 2006=100<br />

This indicator is a measure of housing affordability. The nominal house price<br />

to disposable income ratio is also used by the OECD to provide a measure of<br />

housing affordability. However, this index is partially biased since it does not<br />

integrate financing costs: mortgage interest rate, taxes, notary costs, etc.<br />

C. Funding of the Mortgage Market<br />

19. Total Covered Bonds Outstanding,<br />

Backed by Mortgages<br />

EUR million<br />

Covered bonds are a dual recourse debt instruments issued by credit<br />

institutions and secured by a cover pool of financial assets, typically composed<br />

of mortgage loans, public-sector debt or ship mortgage. Three different models<br />

of covered bonds co-exist in Europe:<br />

Direct/on-balance issuance (German model): the originator issues the covered<br />

bonds and the assets are ring-fenced on the balance sheet of the originator.<br />

Specialist issuer (French model): an originator establishes a credit institution<br />

subsidiary which issues the covered bonds and holds the collateral.<br />

Direct issuance with guarantee (UK model): the originator issues the covered<br />

bonds, which are guaranteed by a special purpose entity of the originator,<br />

which holds the cover pool assets.<br />

22. Total Residential Mortgage-Backed Securities<br />

(RMBS) Outstanding<br />

EUR million<br />

A RMBS is a derivative whose value is derived from home equity loans and<br />

residential mortgages. In line with the other mortgage-backed securities, the<br />

owner is entitled to a claim on the principal and interest payments on the<br />

residential loans underpinning the security.<br />

D. Macroeconomic Indicators<br />

24. GDP at Current Market Prices<br />

EUR million<br />

Within the approach of GDP at current prices, the fundamental principle is that<br />

output and intermediate consumption is valued at the prices current at the time<br />

the production takes place. This implies that goods withdrawn from inventories<br />

by producers must be valued at the prices prevailing at the times the goods<br />

are withdrawn, and consumption of fixed capital in the system is calculated<br />

on the basis of the estimated opportunity costs of using the assets at the time<br />

they are used, as distinct from the prices at which the assets were acquired.<br />

25. Gross Disposable Income of Households<br />

EUR million<br />

According to the “1993 SNA”, Gross Disposable Income of Households is the<br />

sum of household final consumption expenditures and savings (minus the<br />

change in net equity of households in pension funds). It also corresponds to the<br />

sum of wages and salaries, mixed income, net property income, net current<br />

transfers and social benefits other than social transfers in kind, less taxes<br />

on income and wealth and social security contributions paid by employees,<br />

the self-employed and the unemployed.<br />

The indicator for the household sector includes the disposable income of<br />

non-profit institutions serving households (NPISH).<br />

114 | <strong>2015</strong> EMF HYPOSTAT