Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EU 28 Country Reports<br />

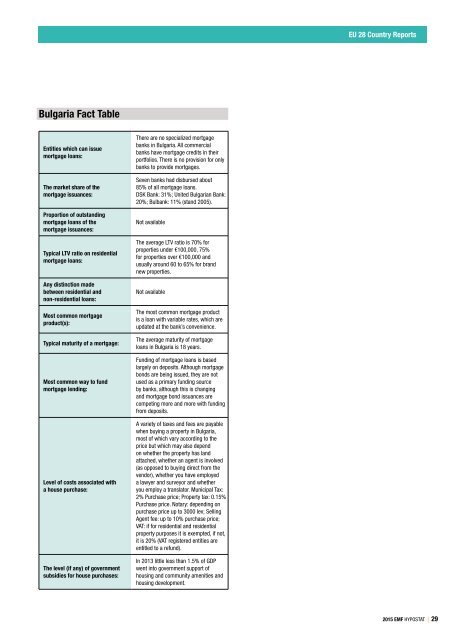

Bulgaria Fact Table<br />

Entities which can issue<br />

mortgage loans:<br />

The market share of the<br />

mortgage issuances:<br />

Proportion of outstanding<br />

mortgage loans of the<br />

mortgage issuances:<br />

Typical LTV ratio on residential<br />

mortgage loans:<br />

Any distinction made<br />

between residential and<br />

non‐residential loans:<br />

Most common mortgage<br />

product(s):<br />

Typical maturity of a mortgage:<br />

Most common way to fund<br />

mortgage lending:<br />

Level of costs associated with<br />

a house purchase:<br />

The level (if any) of government<br />

subsidies for house purchases:<br />

There are no specialized mortgage<br />

banks in Bulgaria. All commercial<br />

banks have mortgage credits in their<br />

portfolios. There is no provision for only<br />

banks to provide mortgages.<br />

Seven banks had disbursed about<br />

85% of all mortgage loans.<br />

DSK Bank: 31%; United Bulgarian Bank:<br />

20%; Bulbank: 11% (stand 2005).<br />

Not available<br />

The average LTV ratio is 70% for<br />

properties under €100,000, 75%<br />

for properties over €100,000 and<br />

usually around 60 to 65% for brand<br />

new properties.<br />

Not available<br />

The most common mortgage product<br />

is a loan with variable rates, which are<br />

updated at the bank’s convenience.<br />

The average maturity of mortgage<br />

loans in Bulgaria is 18 years.<br />

Funding of mortgage loans is based<br />

largely on deposits. Although mortgage<br />

bonds are being issued, they are not<br />

used as a primary funding source<br />

by banks, although this is changing<br />

and mortgage bond issuances are<br />

competing more and more with funding<br />

from deposits.<br />

A variety of taxes and fees are payable<br />

when buying a property in Bulgaria,<br />

most of which vary according to the<br />

price but which may also depend<br />

on whether the property has land<br />

attached, whether an agent is involved<br />

(as opposed to buying direct from the<br />

vendor), whether you have employed<br />

a lawyer and surveyor and whether<br />

you employ a translator. Municipal Tax:<br />

2% Purchase price; Property tax: 0.15%<br />

Purchase price. Notary: depending on<br />

purchase price up to 3000 lev; Selling<br />

Agent fee: up to 10% purchase price;<br />

VAT: if for residential and residential<br />

property purposes it is exempted, if not,<br />

it is 20% (VAT registered entities are<br />

entitled to a refund).<br />

In 2013 little less than 1.5% of GDP<br />

went into government support of<br />

housing and community amenities and<br />

housing development.<br />

<strong>2015</strong> EMF HYPOSTAT | 29