Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Housing and Mortgage Markets in 2014<br />

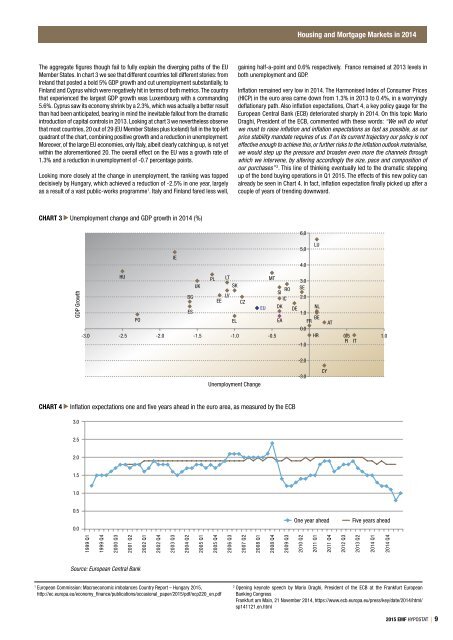

The aggregate figures though fail to fully explain the diverging paths of the EU<br />

Member States. In chart 3 we see that different countries tell different stories: from<br />

Ireland that posted a bold 5% GDP growth and cut unemployment substantially, to<br />

Finland and Cyprus which were negatively hit in terms of both metrics. The country<br />

that experienced the largest GDP growth was Luxembourg with a commanding<br />

5.6%. Cyprus saw its economy shrink by a 2.3%, which was actually a better result<br />

than had been anticipated, bearing in mind the inevitable fallout from the dramatic<br />

introduction of capital controls in 2013. Looking at chart 3 we nevertheless observe<br />

that most countries, 20 out of 29 (EU Member States plus Iceland) fall in the top left<br />

quadrant of the chart, combining positive growth and a reduction in unemployment.<br />

Moreover, of the large EU economies, only Italy, albeit clearly catching up, is not yet<br />

within the aforementioned 20. The overall effect on the EU was a growth rate of<br />

1.3% and a reduction in unemployment of -0.7 percentage points.<br />

Looking more closely at the change in unemployment, the ranking was topped<br />

decisively by Hungary, which achieved a reduction of -2.5% in one year, largely<br />

as a result of a vast public-works programme 1 . Italy and Finland fared less well,<br />

gaining half-a-point and 0.6% respectively. France remained at 2013 levels in<br />

both unemployment and GDP.<br />

Inflation remained very low in 2014. The Harmonised Index of Consumer Prices<br />

(HICP) in the euro area came down from 1.3% in 2013 to 0.4%, in a worryingly<br />

deflationary path. Also inflation expectations, Chart 4, a key policy gauge for the<br />

European Central Bank (ECB) deteriorated sharply in 2014. On this topic Mario<br />

Draghi, President of the ECB, commented with these words: “We will do what<br />

we must to raise inflation and inflation expectations as fast as possible, as our<br />

price stability mandate requires of us. If on its current trajectory our policy is not<br />

effective enough to achieve this, or further risks to the inflation outlook materialise,<br />

we would step up the pressure and broaden even more the channels through<br />

which we intervene, by altering accordingly the size, pace and composition of<br />

our purchases” 2 . This line of thinking eventually led to the dramatic stepping<br />

up of the bond buying operations in Q1 <strong>2015</strong>. The effects of this new policy can<br />

already be seen in Chart 4. In fact, inflation expectation finally picked up after a<br />

couple of years of trending downward.<br />

CHART 3 Unemployment change and GDP growth in 2014 (%)<br />

ie<br />

6,0<br />

5,0<br />

4.0<br />

lu<br />

GDP Growth<br />

HU<br />

PL lt<br />

mt<br />

3.0<br />

UK<br />

sk<br />

ro se<br />

bG<br />

ee lv<br />

si<br />

ic 2.0<br />

cz<br />

eu dk<br />

de<br />

nl<br />

es<br />

1.0<br />

PO<br />

be<br />

EL<br />

ea fr at<br />

0.0<br />

-3.0 -2.5 -2.0 -1.5 -1.0 -0.5 Hr 0.5 1.0<br />

fi it<br />

-1.0<br />

-2.0<br />

Unemployment Change<br />

-3.0<br />

cy<br />

CHART 4<br />

Inflation expectations one and five years ahead in the euro area, as measured by the ECB<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

One year ahead<br />

Five years ahead<br />

1999 Q1<br />

1999 Q4<br />

2000 Q3<br />

2001 Q2<br />

2002 Q1<br />

2002 Q4<br />

2003 Q3<br />

2004 Q2<br />

2005 Q1<br />

2005 Q4<br />

2006 Q3<br />

2007 Q2<br />

2008 Q1<br />

2008 Q4<br />

2009 Q3<br />

2010 Q2<br />

2011 Q1<br />

2011 Q4<br />

2012 Q3<br />

2013 Q2<br />

2014 Q1<br />

2014 Q4<br />

Source: European Central Bank<br />

1<br />

European Commission: Macroeconomic imbalances Country Report – Hungary <strong>2015</strong>,<br />

http://ec.europa.eu/economy_finance/publications/occasional_paper/<strong>2015</strong>/pdf/ocp220_en.pdf<br />

2<br />

Opening keynote speech by Mario Draghi, President of the ECB at the Frankfurt European<br />

Banking Congress<br />

Frankfurt am Main, 21 November 2014, https://www.ecb.europa.eu/press/key/date/2014/html/<br />

sp141121.en.html<br />

<strong>2015</strong> EMF HYPOSTAT | 9