Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EU 28 Country Reports<br />

Bulgaria<br />

By Maria Pavlova and Paolo Colonna, European Mortgage Federation – European Covered Bond Council<br />

Macroeconomic Overview<br />

2014 was a difficult and challenging year. Nevertheless, the Bulgarian economy<br />

continued to grow, on the back of domestic demand. Unfortunately, in 2014,<br />

Bulgarian consumers had to do most of the ‘heavy-lifting’ to compensate for<br />

lacklustre demand from EU partners. Nevertheless, a looser fiscal policy and an<br />

increased absorption of EU funds overshadowed sustained political uncertainty<br />

and the failure of a large bank. Thus domestic demand improved in 2014.<br />

While Bulgaria’s net external position has improved in recent years, the stock of<br />

liabilities remains high. In 2014 the net international investment position fetched<br />

76% of GDP at the end of the period, although a large proportion of this is due to<br />

cross-border intra-company financing. Nevertheless, the stock of liabilities could<br />

pose a risk for the financing of future investments and growth. However, a long<br />

series of current account deficits in the first decade of the 2000s has left Bulgaria<br />

a large external debt burden. Gross external debt stood at EUR 40 billion at end-<br />

2014, accounting for a worrisome 94% of GDP, largely by the private sector. The<br />

deflationary environment and growing government finance needs are putting<br />

pressure on the stock of liabilities.<br />

A deflationary trend has prevailed since the middle of 2013. Deflation has helped<br />

push up real wages but has hampered businesses and it is likely to have a net<br />

negative effect on the economy. On the one hand, debt servicing is likely to become<br />

more expensive, on the other declining prices will slash profitability, especially<br />

if wages and productivity do not rise in lockstep. Companies have been reacting<br />

to a stagnating economy by cutting costs (pay/benefit reductions and lay-offs)<br />

and perhaps more worryingly by curbing investments.<br />

From a labour standpoint, convergence to EU income levels will remain slow, with<br />

growth gradually reaching only 2.5% and unemployment declining to 11.4%.<br />

Housing and Mortgage Markets<br />

Bulgaria’s housing market is showing signs of recovery, despite the difficult years,<br />

and property transactions are starting to pick up.<br />

In 2014, the average price of existing flats in Bulgaria increased 1.15% to BGN<br />

874.49 (EUR 447.02) per square metre, the first year-on-year increase since<br />

2008. In Sofia, the capital, the average price of dwellings was up by 3.1% in<br />

2014 from a year earlier.<br />

Mortgage Funding<br />

In 2014, one mortgage bond was issued. The volume of issued mortgage-backed<br />

bonds totals EUR 273.3 million originated by 11 issuing banks (currently 10 banks<br />

after the merger of MKB Unionbank and First Investment Bank). As of the 31 st of<br />

December 2014, outstanding mortgage bonds amounted to EUR 5.0 million.<br />

Notes:<br />

Source: National Statistical Institute;<br />

Source: Bulgarian National Bank;<br />

Source: European Mortgage Federation-European Covered Bond Council.<br />

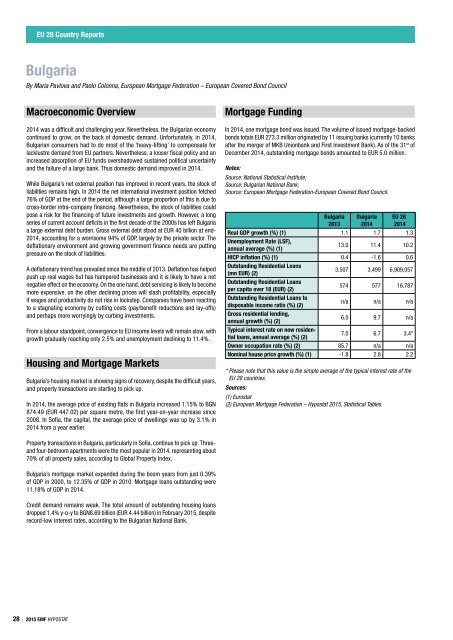

Bulgaria<br />

2013<br />

Bulgaria<br />

2014<br />

EU 28<br />

2014<br />

Real GDP growth (%) (1) 1.1 1.7 1.3<br />

Unemployment Rate (LSF),<br />

annual average (%) (1)<br />

13.0 11.4 10.2<br />

HICP inflation (%) (1) 0.4 -1.6 0.6<br />

Outstanding Residential Loans<br />

(mn EUR) (2)<br />

3,507 3,499 6,909,057<br />

Outstanding Residential Loans<br />

per capita over 18 (EUR) (2)<br />

574 577 16,787<br />

Outstanding Residential Loans to<br />

disposable income ratio (%) (2)<br />

n/a n/a n/a<br />

Gross residential lending,<br />

annual growth (%) (2)<br />

6.0 9.7 n/a<br />

Typical interest rate on new residential<br />

loans, annual average (%) (2)<br />

7.0 6.7 3.4*<br />

Owner occupation rate (%) (2) 85.7 n/a n/a<br />

Nominal house price growth (%) (1) -1.8 2.8 2.2<br />

* Please note that this value is the simple average of the typical interest rate of the<br />

EU 28 countries.<br />

Sources:<br />

(1) Eurostat<br />

(2) European Mortgage Federation – <strong>Hypostat</strong> <strong>2015</strong>, Statistical Tables.<br />

Property transactions in Bulgaria, particularly in Sofia, continue to pick up. Threeand<br />

four-bedroom apartments were the most popular in 2014, representing about<br />

70% of all property sales, according to Global Property Index.<br />

Bulgaria’s mortgage market expanded during the boom years from just 0.39%<br />

of GDP in 2000, to 12.35% of GDP in 2010. Mortgage loans outstanding were<br />

11.18% of GDP in 2014.<br />

Credit demand remains weak. The total amount of outstanding housing loans<br />

dropped 1.4% y-o-y to BGN8.69 billion (EUR 4.44 billion) in February <strong>2015</strong>, despite<br />

record-low interest rates, according to the Bulgarian National Bank.<br />

28 | <strong>2015</strong> EMF HYPOSTAT