Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

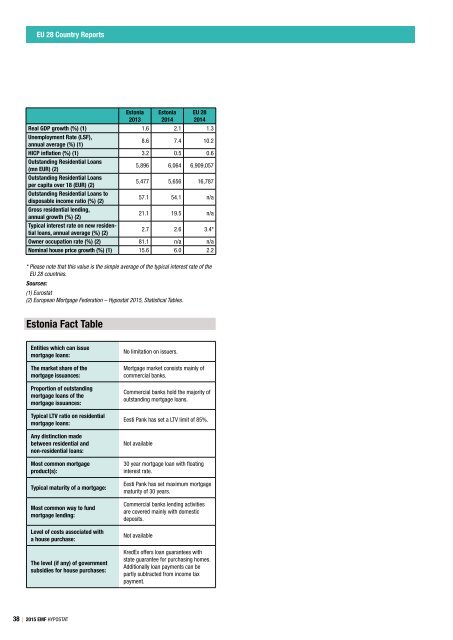

EU 28 Country Reports<br />

Estonia<br />

2013<br />

Estonia<br />

2014<br />

EU 28<br />

2014<br />

Real GDP growth (%) (1) 1.6 2.1 1.3<br />

Unemployment Rate (LSF),<br />

annual average (%) (1)<br />

8.6 7.4 10.2<br />

HICP inflation (%) (1) 3.2 0.5 0.6<br />

Outstanding Residential Loans<br />

(mn EUR) (2)<br />

5,896 6,064 6,909,057<br />

Outstanding Residential Loans<br />

per capita over 18 (EUR) (2)<br />

5,477 5,656 16,787<br />

Outstanding Residential Loans to<br />

disposable income ratio (%) (2)<br />

57.1 54.1 n/a<br />

Gross residential lending,<br />

annual growth (%) (2)<br />

21.1 19.5 n/a<br />

Typical interest rate on new residential<br />

loans, annual average (%) (2)<br />

2.7 2.6 3.4*<br />

Owner occupation rate (%) (2) 81.1 n/a n/a<br />

Nominal house price growth (%) (1) 15.6 6.0 2.2<br />

* Please note that this value is the simple average of the typical interest rate of the<br />

EU 28 countries.<br />

Sources:<br />

(1) Eurostat<br />

(2) European Mortgage Federation – <strong>Hypostat</strong> <strong>2015</strong>, Statistical Tables.<br />

Estonia Fact Table<br />

Entities which can issue<br />

mortgage loans:<br />

The market share of the<br />

mortgage issuances:<br />

Proportion of outstanding<br />

mortgage loans of the<br />

mortgage issuances:<br />

Typical LTV ratio on residential<br />

mortgage loans:<br />

Any distinction made<br />

between residential and<br />

non‐residential loans:<br />

Most common mortgage<br />

product(s):<br />

Typical maturity of a mortgage:<br />

Most common way to fund<br />

mortgage lending:<br />

Level of costs associated with<br />

a house purchase:<br />

The level (if any) of government<br />

subsidies for house purchases:<br />

No limitation on issuers.<br />

Mortgage market consists mainly of<br />

commercial banks.<br />

Commercial banks hold the majority of<br />

outstanding mortgage loans.<br />

Eesti Pank has set a LTV limit of 85%.<br />

Not available<br />

30 year mortgage loan with floating<br />

interest rate.<br />

Eesti Pank has set maximum mortgage<br />

maturity of 30 years.<br />

Commercial banks lending activities<br />

are covered mainly with domestic<br />

deposits.<br />

Not available<br />

KredEx offers loan guarantees with<br />

state guarantee for purchasing homes.<br />

Additionally loan payments can be<br />

partly subtracted from income tax<br />

payment.<br />

38 | <strong>2015</strong> EMF HYPOSTAT