Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

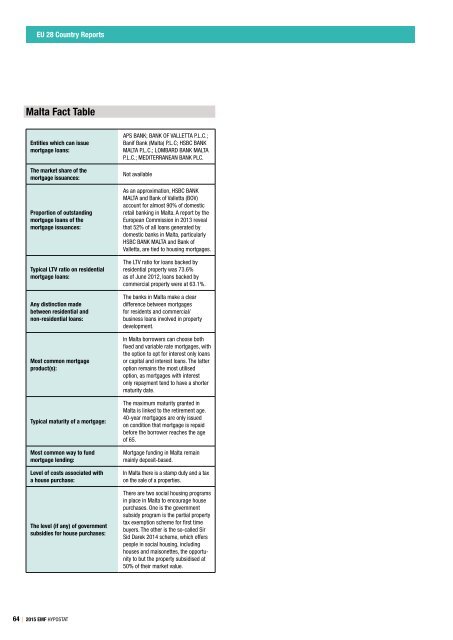

EU 28 Country Reports<br />

Malta Fact Table<br />

Entities which can issue<br />

mortgage loans:<br />

The market share of the<br />

mortgage issuances:<br />

Proportion of outstanding<br />

mortgage loans of the<br />

mortgage issuances:<br />

Typical LTV ratio on residential<br />

mortgage loans:<br />

Any distinction made<br />

between residential and<br />

non‐residential loans:<br />

Most common mortgage<br />

product(s):<br />

Typical maturity of a mortgage:<br />

Most common way to fund<br />

mortgage lending:<br />

Level of costs associated with<br />

a house purchase:<br />

The level (if any) of government<br />

subsidies for house purchases:<br />

APS BANK; BANK OF VALLETTA P.L.C.;<br />

Banif Bank (Malta) P.L.C; HSBC BANK<br />

MALTA P.L.C.; LOMBARD BANK MALTA<br />

P.L.C.; MEDITERRANEAN BANK PLC.<br />

Not available<br />

As an approximation, HSBC BANK<br />

MALTA and Bank of Valletta (BOV)<br />

account for almost 90% of domestic<br />

retail banking in Malta. A report by the<br />

European Commission in 2013 reveal<br />

that 52% of all loans generated by<br />

domestic banks in Malta, particularly<br />

HSBC BANK MALTA and Bank of<br />

Valletta, are tied to housing mortgages.<br />

The LTV ratio for loans backed by<br />

residential property was 73.6%<br />

as of June 2012, loans backed by<br />

commercial property were at 63.1%.<br />

The banks in Malta make a clear<br />

difference between mortgages<br />

for residents and commercial/<br />

business loans involved in property<br />

development.<br />

In Malta borrowers can choose both<br />

fixed and variable rate mortgages, with<br />

the option to opt for interest only loans<br />

or capital and interest loans. The latter<br />

option remains the most utilised<br />

option, as mortgages with interest<br />

only repayment tend to have a shorter<br />

maturity date.<br />

The maximum maturity granted in<br />

Malta is linked to the retirement age.<br />

40-year mortgages are only issued<br />

on condition that mortgage is repaid<br />

before the borrower reaches the age<br />

of 65.<br />

Mortgage funding in Malta remain<br />

mainly deposit-based.<br />

In Malta there is a stamp duty and a tax<br />

on the sale of a properties.<br />

There are two social housing programs<br />

in place in Malta to encourage house<br />

purchases. One is the government<br />

subsidy program is the partial property<br />

tax exemption scheme for first time<br />

buyers. The other is the so-called Sir<br />

Sid Darek 2014 scheme, which offers<br />

people in social housing, including<br />

houses and maisonettes, the opportunity<br />

to but the property subsidised at<br />

50% of their market value.<br />

64 | <strong>2015</strong> EMF HYPOSTAT