Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

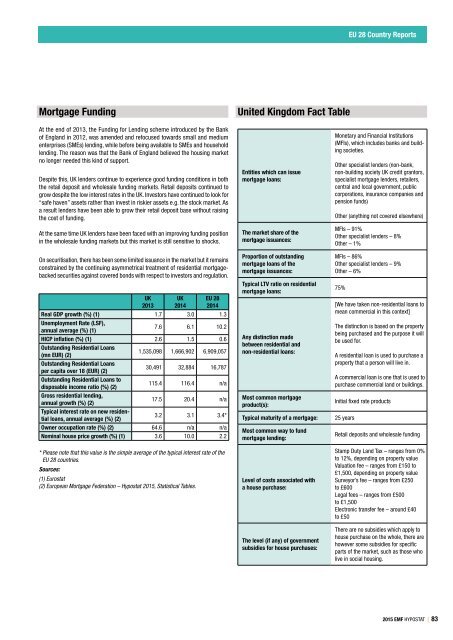

EU 28 Country Reports<br />

Mortgage Funding<br />

United Kingdom Fact Table<br />

At the end of 2013, the Funding for Lending scheme introduced by the Bank<br />

of England in 2012, was amended and refocused towards small and medium<br />

enterprises (SMEs) lending, while before being available to SMEs and household<br />

lending. The reason was that the Bank of England believed the housing market<br />

no longer needed this kind of support.<br />

Despite this, UK lenders continue to experience good funding conditions in both<br />

the retail deposit and wholesale funding markets. Retail deposits continued to<br />

grow despite the low interest rates in the UK. Investors have continued to look for<br />

“safe haven” assets rather than invest in riskier assets e.g. the stock market. As<br />

a result lenders have been able to grow their retail deposit base without raising<br />

the cost of funding.<br />

At the same time UK lenders have been faced with an improving funding position<br />

in the wholesale funding markets but this market is still sensitive to shocks.<br />

On securitisation, there has been some limited issuance in the market but it remains<br />

constrained by the continuing asymmetrical treatment of residential mortgagebacked<br />

securities against covered bonds with respect to investors and regulation.<br />

UK<br />

2013<br />

UK<br />

2014<br />

EU 28<br />

2014<br />

Real GDP growth (%) (1) 1.7 3.0 1.3<br />

Unemployment Rate (LSF),<br />

annual average (%) (1)<br />

7.6 6.1 10.2<br />

HICP inflation (%) (1) 2.6 1.5 0.6<br />

Outstanding Residential Loans<br />

(mn EUR) (2)<br />

1,535,098 1,666,902 6,909,057<br />

Outstanding Residential Loans<br />

per capita over 18 (EUR) (2)<br />

30,491 32,884 16,787<br />

Outstanding Residential Loans to<br />

disposable income ratio (%) (2)<br />

115.4 116.4 n/a<br />

Gross residential lending,<br />

annual growth (%) (2)<br />

17.5 20.4 n/a<br />

Typical interest rate on new residential<br />

loans, annual average (%) (2)<br />

3.2 3.1 3.4*<br />

Owner occupation rate (%) (2) 64.6 n/a n/a<br />

Nominal house price growth (%) (1) 3.6 10.0 2.2<br />

* Please note that this value is the simple average of the typical interest rate of the<br />

EU 28 countries.<br />

Sources:<br />

(1) Eurostat<br />

(2) European Mortgage Federation – <strong>Hypostat</strong> <strong>2015</strong>, Statistical Tables.<br />

Entities which can issue<br />

mortgage loans:<br />

The market share of the<br />

mortgage issuances:<br />

Proportion of outstanding<br />

mortgage loans of the<br />

mortgage issuances:<br />

Typical LTV ratio on residential<br />

mortgage loans:<br />

Any distinction made<br />

between residential and<br />

non‐residential loans:<br />

Most common mortgage<br />

product(s):<br />

Typical maturity of a mortgage:<br />

Most common way to fund<br />

mortgage lending:<br />

Level of costs associated with<br />

a house purchase:<br />

The level (if any) of government<br />

subsidies for house purchases:<br />

Monetary and Financial Institutions<br />

(MFIs), which includes banks and building<br />

societies.<br />

Other specialist lenders (non-bank,<br />

non-building society UK credit grantors,<br />

specialist mortgage lenders, retailers,<br />

central and local government, public<br />

corporations, insurance companies and<br />

pension funds)<br />

Other (anything not covered elsewhere)<br />

MFIs – 91%<br />

Other specialist lenders – 8%<br />

Other – 1%<br />

MFIs – 86%<br />

Other specialist lenders – 9%<br />

Other – 6%<br />

75%<br />

[We have taken non-residential loans to<br />

mean commercial in this context]<br />

The distinction is based on the property<br />

being purchased and the purpose it will<br />

be used for.<br />

A residential loan is used to purchase a<br />

property that a person will live in.<br />

A commercial loan is one that is used to<br />

purchase commercial land or buildings.<br />

Initial fixed rate products<br />

25 years<br />

Retail deposits and wholesale funding<br />

Stamp Duty Land Tax – ranges from 0%<br />

to 12%, depending on property value<br />

Valuation fee – ranges from £150 to<br />

£1,500, depending on property value<br />

Surveyor’s fee – ranges from £250<br />

to £600<br />

Legal fees – ranges from £500<br />

to £1,500<br />

Electronic transfer fee – around £40<br />

to £50<br />

There are no subsidies which apply to<br />

house purchase on the whole, there are<br />

however some subsidies for specific<br />

parts of the market, such as those who<br />

live in social housing.<br />

<strong>2015</strong> EMF HYPOSTAT | 83