Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EU 28 Country Reports<br />

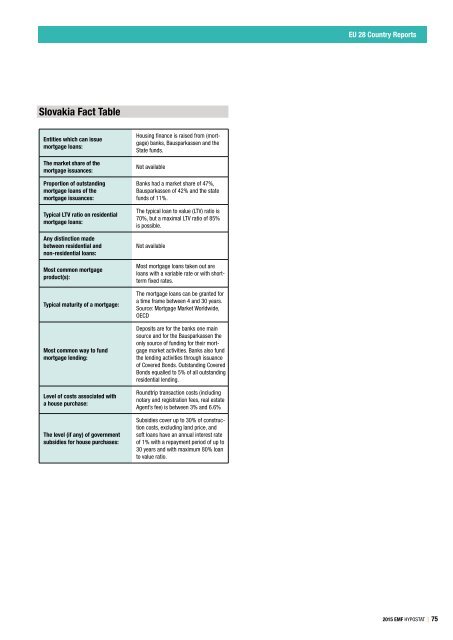

Slovakia Fact Table<br />

Entities which can issue<br />

mortgage loans:<br />

The market share of the<br />

mortgage issuances:<br />

Proportion of outstanding<br />

mortgage loans of the<br />

mortgage issuances:<br />

Typical LTV ratio on residential<br />

mortgage loans:<br />

Any distinction made<br />

between residential and<br />

non‐residential loans:<br />

Most common mortgage<br />

product(s):<br />

Typical maturity of a mortgage:<br />

Most common way to fund<br />

mortgage lending:<br />

Level of costs associated with<br />

a house purchase:<br />

The level (if any) of government<br />

subsidies for house purchases:<br />

Housing finance is raised from (mortgage)<br />

banks, Bausparkassen and the<br />

State funds.<br />

Not available<br />

Banks had a market share of 47%,<br />

Bausparkassen of 42% and the state<br />

funds of 11%.<br />

The typical loan to value (LTV) ratio is<br />

70%, but a maximal LTV ratio of 85%<br />

is possible.<br />

Not available<br />

Most mortgage loans taken out are<br />

loans with a variable rate or with shortterm<br />

fixed rates.<br />

The mortgage loans can be granted for<br />

a time frame between 4 and 30 years.<br />

Source: Mortgage Market Worldwide,<br />

OECD<br />

Deposits are for the banks one main<br />

source and for the Bausparkassen the<br />

only source of funding for their mortgage<br />

market activities. Banks also fund<br />

the lending activities through issuance<br />

of Covered Bonds. Outstanding Covered<br />

Bonds equalled to 5% of all outstanding<br />

residential lending.<br />

Roundtrip transaction costs (including<br />

notary and registration fees, real estate<br />

Agent’s fee) is between 3% and 6.6%<br />

Subsidies cover up to 30% of construction<br />

costs, excluding land price, and<br />

soft loans have an annual interest rate<br />

of 1% with a repayment period of up to<br />

30 years and with maximum 80% loan<br />

to value ratio.<br />

<strong>2015</strong> EMF HYPOSTAT | 75