Hypostat 2015

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts. The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

On 30 September 2015, the EMF-ECBC published Hypostat 2015 , which is its main statistical report, encompassing data on recent developments in housing and mortgage markets in the EU28 and beyond. Hypostat is the result of a collaborative effort by the European Mortgage Federation’s national delegations and external experts.

The publication covers 33 countries – i.e. the EU28 plus Iceland, Norway, Russia, Turkey and the United States.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

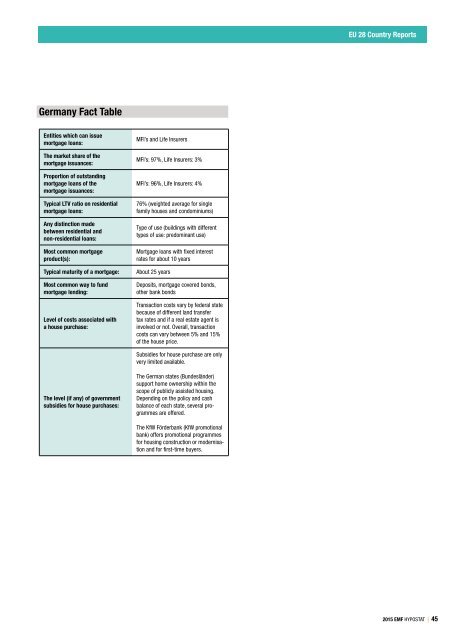

EU 28 Country Reports<br />

Germany Fact Table<br />

Entities which can issue<br />

mortgage loans:<br />

The market share of the<br />

mortgage issuances:<br />

Proportion of outstanding<br />

mortgage loans of the<br />

mortgage issuances:<br />

Typical LTV ratio on residential<br />

mortgage loans:<br />

Any distinction made<br />

between residential and<br />

non‐residential loans:<br />

Most common mortgage<br />

product(s):<br />

Typical maturity of a mortgage:<br />

Most common way to fund<br />

mortgage lending:<br />

Level of costs associated with<br />

a house purchase:<br />

MFI’s and Life Insurers<br />

MFI’s: 97%, Life Insurers: 3%<br />

MFI’s: 96%, Life Insurers: 4%<br />

76% (weighted average for single<br />

family houses and condominiums)<br />

Type of use (buildings with different<br />

types of use: predominant use)<br />

Mortgage loans with fixed interest<br />

rates for about 10 years<br />

About 25 years<br />

Deposits, mortgage covered bonds,<br />

other bank bonds<br />

Transaction costs vary by federal state<br />

because of different land transfer<br />

tax rates and if a real estate agent is<br />

involved or not. Overall, transaction<br />

costs can vary between 5% and 15%<br />

of the house price.<br />

Subsidies for house purchase are only<br />

very limited available.<br />

The level (if any) of government<br />

subsidies for house purchases:<br />

The German states (Bundesländer)<br />

support home ownership within the<br />

scope of publicly assisted housing.<br />

Depending on the policy and cash<br />

balance of each state, several programmes<br />

are offered.<br />

The KfW Förderbank (KfW promotional<br />

bank) offers promotional programmes<br />

for housing construction or modernisation<br />

and for first-time buyers.<br />

<strong>2015</strong> EMF HYPOSTAT | 45