in the 21st Century

hTOE305aYVW

hTOE305aYVW

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Geography of F<strong>in</strong>ancial Services Providers <strong>in</strong> Kenya 81<br />

ATMs are <strong>the</strong> least excluded from <strong>the</strong> formal f<strong>in</strong>ancial system. 14 In contrast,<br />

MFIs also target f<strong>in</strong>ancially excluded clients. Taken toge<strong>the</strong>r, <strong>the</strong>se results<br />

confirm once aga<strong>in</strong> that ATMs are ma<strong>in</strong>ly concentrated <strong>in</strong> wealthier areas,<br />

while MFIs are much more dispersed (as also appears to be <strong>the</strong> case when<br />

look<strong>in</strong>g at <strong>the</strong> average distance of <strong>the</strong> population from <strong>the</strong> closest MFI) and<br />

reach out to less f<strong>in</strong>ancially <strong>in</strong>cluded populations.<br />

Surpris<strong>in</strong>gly, <strong>in</strong>dividuals with a bank branch as <strong>the</strong> closest f<strong>in</strong>ancial services<br />

provider are not characterised by very high rates of f<strong>in</strong>ancial access, on average.<br />

What may be beh<strong>in</strong>d this apparent contradiction is <strong>the</strong> presence of bank<br />

branches <strong>in</strong> areas where <strong>the</strong> level of f<strong>in</strong>ancial access of <strong>the</strong> population is<br />

relatively low. This effect is potentially driven by Equity Bank’s ‘deeper poverty<br />

outreach’ discussed <strong>in</strong> Section 4.2, which implies that Equity Bank’s f<strong>in</strong>ancial<br />

access po<strong>in</strong>ts are located at a greater distance from <strong>the</strong> ma<strong>in</strong> roads and –<br />

arguably – closer to poorer, less f<strong>in</strong>ancially <strong>in</strong>cluded populations.<br />

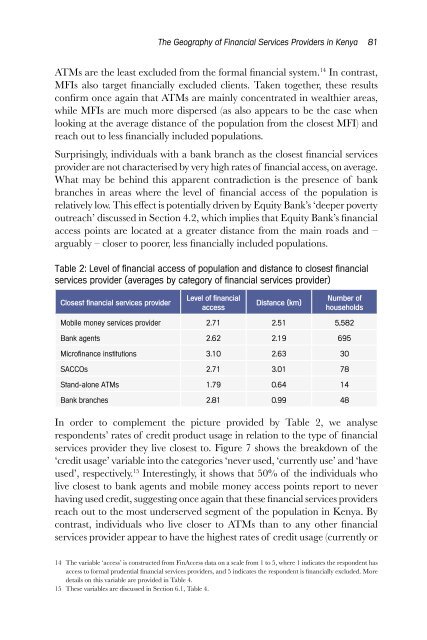

Table 2: Level of f<strong>in</strong>ancial access of population and distance to closest f<strong>in</strong>ancial<br />

services provider (averages by category of f<strong>in</strong>ancial services provider)<br />

Closest f<strong>in</strong>ancial services provider<br />

Level of f<strong>in</strong>ancial<br />

access<br />

Distance (km)<br />

Number of<br />

households<br />

Mobile money services provider 2.71 2.51 5,582<br />

Bank agents 2.62 2.19 695<br />

Microf<strong>in</strong>ance <strong>in</strong>stitutions 3.10 2.63 30<br />

SACCOs 2.71 3.01 78<br />

Stand-alone ATMs 1.79 0.64 14<br />

Bank branches 2.81 0.99 48<br />

In order to complement <strong>the</strong> picture provided by Table 2, we analyse<br />

respondents’ rates of credit product usage <strong>in</strong> relation to <strong>the</strong> type of f<strong>in</strong>ancial<br />

services provider <strong>the</strong>y live closest to. Figure 7 shows <strong>the</strong> breakdown of <strong>the</strong><br />

‘credit usage’ variable <strong>in</strong>to <strong>the</strong> categories ‘never used, ‘currently use’ and ‘have<br />

used’, respectively. 15 Interest<strong>in</strong>gly, it shows that 50% of <strong>the</strong> <strong>in</strong>dividuals who<br />

live closest to bank agents and mobile money access po<strong>in</strong>ts report to never<br />

hav<strong>in</strong>g used credit, suggest<strong>in</strong>g once aga<strong>in</strong> that <strong>the</strong>se f<strong>in</strong>ancial services providers<br />

reach out to <strong>the</strong> most underserved segment of <strong>the</strong> population <strong>in</strong> Kenya. By<br />

contrast, <strong>in</strong>dividuals who live closer to ATMs than to any o<strong>the</strong>r f<strong>in</strong>ancial<br />

services provider appear to have <strong>the</strong> highest rates of credit usage (currently or<br />

14 The variable ‘access’ is constructed from F<strong>in</strong>Access data on a scale from 1 to 5, where 1 <strong>in</strong>dicates <strong>the</strong> respondent has<br />

access to formal prudential f<strong>in</strong>ancial services providers, and 5 <strong>in</strong>dicates <strong>the</strong> respondent is f<strong>in</strong>ancially excluded. More<br />

details on this variable are provided <strong>in</strong> Table 4.<br />

15 These variables are discussed <strong>in</strong> Section 6.1, Table 4.