INTRODUCTORY SPECIAL INTRODUCTORY ... - PHOTON Info

INTRODUCTORY SPECIAL INTRODUCTORY ... - PHOTON Info

INTRODUCTORY SPECIAL INTRODUCTORY ... - PHOTON Info

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Politics<br />

to federal income tax. Also, tax credits are<br />

received during the following tax year,<br />

or are spread out over a succession of tax<br />

years. Don’t fret if the cap on your state’s<br />

tax credit or rebate is smaller than other<br />

states. There may be additional incentives<br />

in your state or other factors – such as low<br />

electricity prices – that contribute to a bet-<br />

ter return on investment.<br />

30<br />

Homeowners in all 50 states also qual-<br />

ify for the Federal Investment Tax Credit,<br />

which pays 30 percent of system costs. Be-<br />

fore January 1, 2009, there was a $2,000<br />

cap on that tax credit, but that cap has<br />

been removed, providing homeowners<br />

with a major boost for their investment.<br />

A third incentive type common in the<br />

13 solar colonies is the use of solar renew-<br />

able energy credits (SRECs), a tradable<br />

environmental commodity on the open<br />

market. Many states have renewable port-<br />

folio standards (RPS), which mandate that<br />

utilities sell their customers a minimum<br />

amount of solar electricity in a certain<br />

timeframe. To comply with a state RPS,<br />

utilities build their own solar power plants,<br />

or purchase a required number of SRECs<br />

from homeowners or businesses with PV<br />

installations – or else pay a penalty called<br />

the Alternative Compliance Payment. Ho-<br />

meowners are credited with SRECs based<br />

on the amount of electricity that their PV<br />

systems produce over time. They can sell<br />

their SRECs on the open market, or bro-<br />

ker contracts with »aggregator« companies<br />

who in turn sell them to the utilities. By<br />

selling SRECs, customers accrue value over<br />

the lifetime of their PV system, helping to<br />

finance their long-term investment.<br />

New Jersey, New Mexico, Pennsylva-<br />

nia, Maryland, Delaware, Connecticut,<br />

and Massachusetts all have SREC markets<br />

associated with RPS compliance. SREC<br />

prices vary widely from state to state. Be-<br />

cause they are sold and traded on the open<br />

market, the prices adjust according to mar-<br />

ket conditions, and are difficult to predict<br />

over the long-term. That means that while<br />

SREC prices in some states are currently<br />

quite high, customers may not have the<br />

long-term guarantee of a revenue stream.<br />

Rapid growth in a state’s solar market could<br />

result in a glut of SRECs and a significant<br />

decline in prices. As part of our internal<br />

rate of return calculations for the 13 solar<br />

colonies, we made conservative assump-<br />

tions about long-term SREC prices. Keep<br />

in mind that the high price uncertainty<br />

means that the rate of return could signifi-<br />

cantly change in your state.<br />

Some utilities are beginning to offer<br />

SREC purchase programs that guarantee<br />

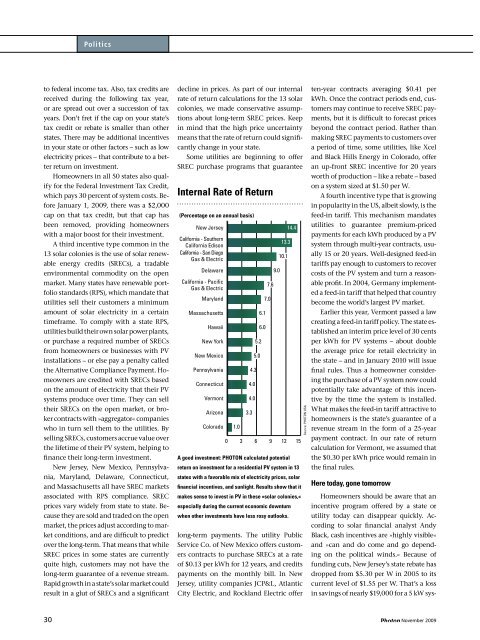

Internal Rate of Return<br />

(Percentage on an annual basis)<br />

New Jersey<br />

California - Southern<br />

California Edison<br />

California - San Diego<br />

Gas & Electric<br />

Delaware<br />

California - Pacific<br />

Gas & Electric<br />

Maryland<br />

Massachusetts<br />

Hawaii<br />

New York<br />

New Mexico<br />

Pennsylvania<br />

Connecticut<br />

Vermont<br />

Arizona<br />

Colorado<br />

1.0<br />

4.3<br />

4.0<br />

4.0<br />

3.3<br />

5.2<br />

5.0<br />

6.1<br />

6.0<br />

7.6<br />

7.0<br />

9.0<br />

13.3<br />

10.1<br />

0 3 6 9 12 15<br />

A good investment: <strong>PHOTON</strong> calculated potential<br />

14.4<br />

return on investment for a residential PV system in 13<br />

states with a favorable mix of electricity prices, solar<br />

financial incentives, and sunlight. Results show that it<br />

makes sense to invest in PV in these »solar colonies,«<br />

especially during the current economic downturn<br />

when other investments have less rosy outlooks.<br />

long-term payments. The utility Public<br />

Service Co. of New Mexico offers custom-<br />

ers contracts to purchase SRECs at a rate<br />

of $0.13 per kWh for 12 years, and credits<br />

payments on the monthly bill. In New<br />

Jersey, utility companies JCP&L, Atlantic<br />

City Electric, and Rockland Electric offer<br />

Source: <strong>PHOTON</strong> USA<br />

ten-year contracts averaging $0.41 per<br />

kWh. Once the contract periods end, cus-<br />

tomers may continue to receive SREC pay-<br />

ments, but it is difficult to forecast prices<br />

beyond the contract period. Rather than<br />

making SREC payments to customers over<br />

a period of time, some utilities, like Xcel<br />

and Black Hills Energy in Colorado, offer<br />

an up-front SREC incentive for 20 years<br />

worth of production – like a rebate – based<br />

on a system sized at $1.50 per W.<br />

A fourth incentive type that is growing<br />

in popularity in the US, albeit slowly, is the<br />

feed-in tariff. This mechanism mandates<br />

utilities to guarantee premium-priced<br />

payments for each kWh produced by a PV<br />

system through multi-year contracts, usu-<br />

ally 15 or 20 years. Well-designed feed-in<br />

tariffs pay enough to customers to recover<br />

costs of the PV system and turn a reason-<br />

able profit. In 2004, Germany implement-<br />

ed a feed-in tariff that helped that country<br />

become the world’s largest PV market.<br />

Earlier this year, Vermont passed a law<br />

creating a feed-in tariff policy. The state es-<br />

tablished an interim price level of 30 cents<br />

per kWh for PV systems – about double<br />

the average price for retail electricity in<br />

the state – and in January 2010 will issue<br />

final rules. Thus a homeowner consider-<br />

ing the purchase of a PV system now could<br />

potentially take advantage of this incen-<br />

tive by the time the system is installed.<br />

What makes the feed-in tariff attractive to<br />

homeowners is the state’s guarantee of a<br />

revenue stream in the form of a 25-year<br />

payment contract. In our rate of return<br />

calculation for Vermont, we assumed that<br />

the $0.30 per kWh price would remain in<br />

the final rules.<br />

Here today, gone tomorrow<br />

Homeowners should be aware that an<br />

incentive program offered by a state or<br />

utility today can disappear quickly. Ac-<br />

cording to solar financial analyst Andy<br />

Black, cash incentives are »highly visible«<br />

and »can and do come and go depend-<br />

ing on the political winds.« Because of<br />

funding cuts, New Jersey’s state rebate has<br />

dropped from $5.30 per W in 2005 to its<br />

current level of $1.55 per W. That’s a loss<br />

in savings of nearly $19,000 for a 5 kW sys-<br />

November 2009