allocations

2018-2019GeneralFundlanguage

2018-2019GeneralFundlanguage

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

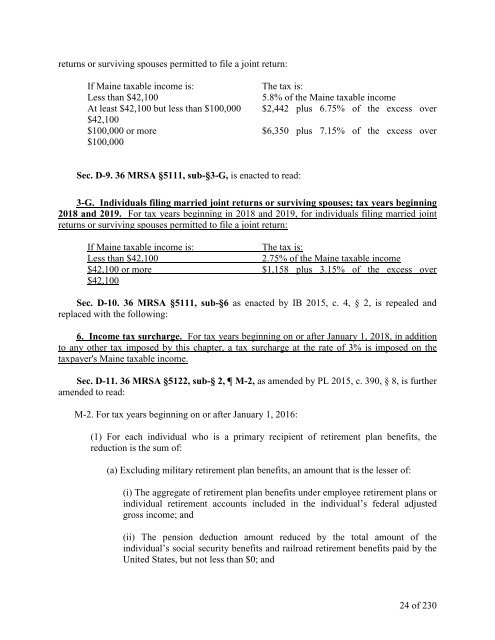

eturns or surviving spouses permitted to file a joint return:<br />

If Maine taxable income is:<br />

The tax is:<br />

Less than $42,100<br />

5.8% of the Maine taxable income<br />

At least $42,100 but less than $100,000 $2,442 plus 6.75% of the excess over<br />

$42,100<br />

$100,000 or more $6,350 plus 7.15% of the excess over<br />

$100,000<br />

Sec. D-9. 36 MRSA §5111, sub-§3-G, is enacted to read:<br />

3-G. Individuals filing married joint returns or surviving spouses; tax years beginning<br />

2018 and 2019. For tax years beginning in 2018 and 2019, for individuals filing married joint<br />

returns or surviving spouses permitted to file a joint return:<br />

If Maine taxable income is:<br />

The tax is:<br />

Less than $42,100<br />

2.75% of the Maine taxable income<br />

$42,100 or more $1,158 plus 3.15% of the excess over<br />

$42,100<br />

Sec. D-10. 36 MRSA §5111, sub-§6 as enacted by IB 2015, c. 4, § 2, is repealed and<br />

replaced with the following:<br />

6. Income tax surcharge. For tax years beginning on or after January 1, 2018, in addition<br />

to any other tax imposed by this chapter, a tax surcharge at the rate of 3% is imposed on the<br />

taxpayer's Maine taxable income.<br />

Sec. D-11. 36 MRSA §5122, sub-§ 2, M-2, as amended by PL 2015, c. 390, § 8, is further<br />

amended to read:<br />

M-2. For tax years beginning on or after January 1, 2016:<br />

(1) For each individual who is a primary recipient of retirement plan benefits, the<br />

reduction is the sum of:<br />

(a) Excluding military retirement plan benefits, an amount that is the lesser of:<br />

(i) The aggregate of retirement plan benefits under employee retirement plans or<br />

individual retirement accounts included in the individual’s federal adjusted<br />

gross income; and<br />

(ii) The pension deduction amount reduced by the total amount of the<br />

individual’s social security benefits and railroad retirement benefits paid by the<br />

United States, but not less than $0; and<br />

24 of 230