allocations

2018-2019GeneralFundlanguage

2018-2019GeneralFundlanguage

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

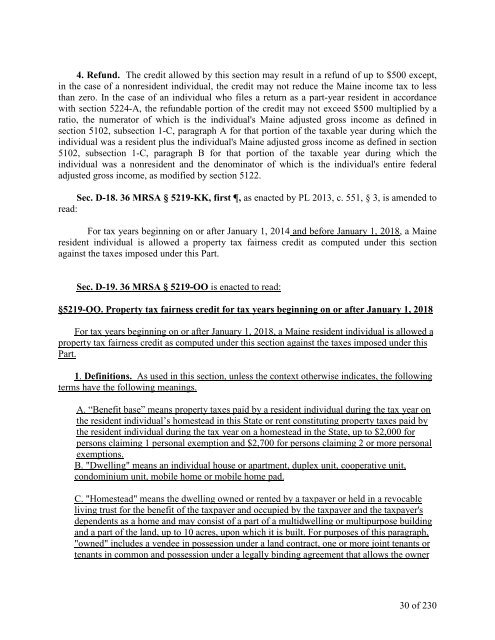

4. Refund. The credit allowed by this section may result in a refund of up to $500 except,<br />

in the case of a nonresident individual, the credit may not reduce the Maine income tax to less<br />

than zero. In the case of an individual who files a return as a part-year resident in accordance<br />

with section 5224-A, the refundable portion of the credit may not exceed $500 multiplied by a<br />

ratio, the numerator of which is the individual's Maine adjusted gross income as defined in<br />

section 5102, subsection 1-C, paragraph A for that portion of the taxable year during which the<br />

individual was a resident plus the individual's Maine adjusted gross income as defined in section<br />

5102, subsection 1-C, paragraph B for that portion of the taxable year during which the<br />

individual was a nonresident and the denominator of which is the individual's entire federal<br />

adjusted gross income, as modified by section 5122.<br />

Sec. D-18. 36 MRSA § 5219-KK, first , as enacted by PL 2013, c. 551, § 3, is amended to<br />

read:<br />

For tax years beginning on or after January 1, 2014 and before January 1, 2018, a Maine<br />

resident individual is allowed a property tax fairness credit as computed under this section<br />

against the taxes imposed under this Part.<br />

Sec. D-19. 36 MRSA § 5219-OO is enacted to read:<br />

§5219-OO. Property tax fairness credit for tax years beginning on or after January 1, 2018<br />

For tax years beginning on or after January 1, 2018, a Maine resident individual is allowed a<br />

property tax fairness credit as computed under this section against the taxes imposed under this<br />

Part.<br />

1. Definitions. As used in this section, unless the context otherwise indicates, the following<br />

terms have the following meanings.<br />

A. “Benefit base” means property taxes paid by a resident individual during the tax year on<br />

the resident individual’s homestead in this State or rent constituting property taxes paid by<br />

the resident individual during the tax year on a homestead in the State, up to $2,000 for<br />

persons claiming 1 personal exemption and $2,700 for persons claiming 2 or more personal<br />

exemptions.<br />

B. "Dwelling" means an individual house or apartment, duplex unit, cooperative unit,<br />

condominium unit, mobile home or mobile home pad.<br />

C. "Homestead" means the dwelling owned or rented by a taxpayer or held in a revocable<br />

living trust for the benefit of the taxpayer and occupied by the taxpayer and the taxpayer's<br />

dependents as a home and may consist of a part of a multidwelling or multipurpose building<br />

and a part of the land, up to 10 acres, upon which it is built. For purposes of this paragraph,<br />

"owned" includes a vendee in possession under a land contract, one or more joint tenants or<br />

tenants in common and possession under a legally binding agreement that allows the owner<br />

30 of 230