Meeting everyday needs of people everywhere - Unilever

Meeting everyday needs of people everywhere - Unilever

Meeting everyday needs of people everywhere - Unilever

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Unilever</strong> Group Notes to the consolidated accounts<br />

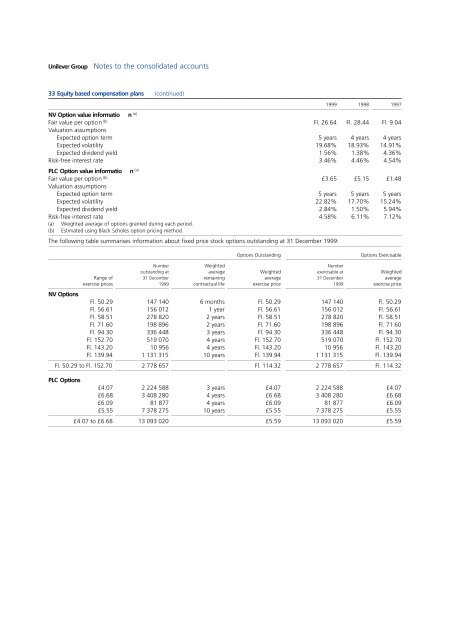

33 Equity based compensation plans (continued)<br />

00000000000000001111<br />

1999 1998 1997<br />

00000001111011111011111011111101111 01111 01111<br />

NV Option value informatio n (a)<br />

Fair value per option (b) Fl. 26.64 Fl. 28.44 Fl. 9.04<br />

Valuation assumptions<br />

Expected option term 5 years 4 years 4 years<br />

Expected volatility 19.68% 18.93% 14.91%<br />

Expected dividend yield 1.56% 1.38% 4.36%<br />

Risk-free interest rate 3.46% 4.46% 4.54%<br />

PLC Option value informatio n (a)<br />

Fair value per option (b) £3.65 £5.15 £1.48<br />

Valuation assumptions<br />

Expected option term 5 years 5 years 5 years<br />

Expected volatility 22.82% 17.70% 15.24%<br />

Expected dividend yield 2.84% 1.50% 5.94%<br />

Risk-free interest rate 4.58% 6.11% 7.12%<br />

(a) Weighted average <strong>of</strong> options granted during each period.<br />

(b) Estimated using Black Scholes option pricing method.<br />

00000001111011111011111011111101111101111101111<br />

The following table summarises information about fixed price stock options outstanding at 31 December 1999:<br />

00000001111011111011111011111101111101111101111<br />

Options Outstanding Options Exercisable<br />

00511110051100511005 1100511005<br />

Number Weighted Number<br />

outstanding at average Weighted exercisable at Weighted<br />

Range <strong>of</strong> 31 December remaining average 31 December average<br />

exercise prices 1999 contractual life exercise price 1999 exercise price<br />

00111511 1001111 1001111 1001111 11005 1005<br />

NV Options<br />

Fl. 50.29 147 140 6 months Fl. 50.29 147 140 Fl. 50.29<br />

Fl. 56.61 156 012 1 year Fl. 56.61 156 012 Fl. 56.61<br />

Fl. 58.51 278 820 2 years Fl. 58.51 278 820 Fl. 58.51<br />

Fl. 71.60 198 896 2 years Fl. 71.60 198 896 Fl. 71.60<br />

Fl. 94.30 336 448 3 years Fl. 94.30 336 448 Fl. 94.30<br />

Fl. 152.70 519 070 4 years Fl. 152.70 519 070 Fl. 152.70<br />

Fl. 143.20 10 956 4 years Fl. 143.20 10 956 Fl. 143.20<br />

Fl. 139.94 1 131 315 10 years Fl. 139.94 1 131 315 Fl. 139.94<br />

00111511 1001111 1001111 1001111 11005 1005<br />

Fl. 50.29 to Fl. 152.70 2 778 657 Fl. 114.32 2 778 657 Fl. 114.32<br />

00111511 1001111 1001111 1001111 11005 1005<br />

PLC Options<br />

£4.07 2 224 588 3 years £4.07 2 224 588 £4.07<br />

£6.68 3 408 280 4 years £6.68 3 408 280 £6.68<br />

£6.09 81 877 4 years £6.09 81 877 £6.09<br />

£5.55 7 378 275 10 years £5.55 7 378 275 £5.55<br />

00111511 1001111 1001111 1001111 11005 1005<br />

£4.07 to £6.68 13 093 020 £5.59 13 093 020 £5.59<br />

00000001111011111011111011111101111101111101111